Fundamental Analysis Profitability Analysis

Post on: 16 Март, 2015 No Comment

In this project, you will learn:

a) How to analyze the profitability of a company

b) How to compare the profitability of a company to others

The conceptual material for this project is in Chapter 3 of the Valuation Tutor textbook: Financial Statement Analysis: Business Ratios.

To motivate profitability analysis, we start with a key ratio: ROE (“Return on Equity”) defined by

ROE = Net Income / Shareholders Equity.

Intuitively, ROE it measures the return generated by the investment made by shareholders. Put another way, it also determines the company’s “fundamental growth rate,” which is the rate at which the company is growing shareholders equity (defined as ROE times the Retention Ratio).

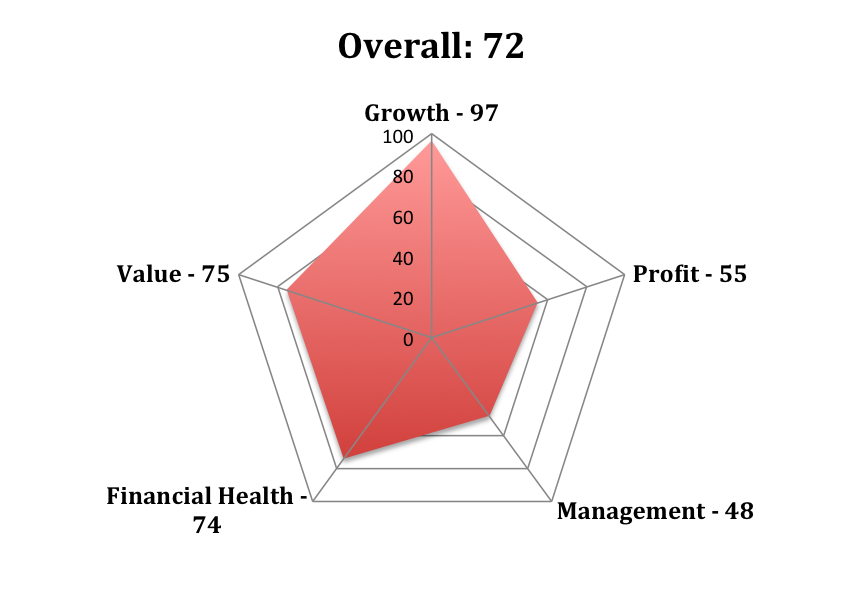

ROE is affected by the firm’s investment and financing decisions. This is illustrated in the flow chart below. The upper part of the flow chart depicts the DuPont decomposition of fundamental growth. ROE is decomposed into ROA (“Return on Assets”) and Financial Leverage, and so reflects the firm’s investment and financing decisions. Profitability analysis focuses upon ROA, which results from the firm’s investment decision.

This of course sits on top of four major accounting statements:

The objective of this project is to analyze and understand the drivers of profitability for stocks you select and to compare this performance with their industry, sector and market as a whole, to answer two fundamental questions

Is each stock’s ROA above or below average for the industry?

Is this result driven by the profit margin, efficiency or both?

Answering these questions requires drilling down further into the financial statements. In the flow chart, these are the two terms captured by the decomposition of ROA into the product of Profit Margin and Asset Turnover or Efficiency. An analyst can drill down further beyond Net Income to strip out the effects from taxes and financing expenses. EBIT (Earnings Before Interest and Taxes) focuses sharply upon the investment decision by separating out the effects of financing costs and taxes. Similarly, efficiency can further decompose into Working Capital Management and fixed asset management/activity analysis, as shown in the flow chart. Combined, this finer analysis will provide a comprehensive analysis of the drivers of profitability for your stocks and let you understand why your selected firms are above or below averages of other companies, whether in their sector or industry or relative to companies in a broad market index.

Operational Details

Remark: To learn how to reconcile each of the numbers in the steps below refer to Chapter 3 which provides a complete reconciliation of each ratio for Proctor and Gamble from their 10-K financial statements.

Step 1: Stock Selection

First, choose two stocks from the large available set of stocks provided in the Valuation Tutor datasets, covering both US Public Companies plus a comprehensive set of ADR’s (Level 2 and 3). You should select one “old economy” stock that belongs to a relatively stable industry and one stock that belongs to an industry driven by technological innovations.

Step 2: ROA Analysis

The objective of this step is to decompose ROA for your stocks and then compare them to the market as a whole by running a decile analysis on all stocks. You will then decompose ROA into Profitability and Efficiency to understand broadly what is driving ROA.

For example, suppose you were working with IBM.

In this DuPont decomposition, the relevant component for profitability analysis is ROA.

IBM’s ROA is 0.1307 or 13%. Is that good?

You can only answer this question by comparing this to other stocks.

By clicking on Calculate for All (circled above) you see a screen that performs the DuPont decomposition for all stocks in the Current FTS Dataset (of about 1600 stocks). On this screen, the button Calculate Deciles (circled below) does the decile analysis.

The decile analysis reveals that IBM currently has a very strong ROA (it belongs to the second highest decile).

In the next step, we ask: what drives IBM’s strong ROA – Profitability or Efficiency? You should perform this analysis for the stocks you chose.

Step 3: Burden Analysis

The objective of this step is to refine the analysis in Step 2 further by running a DuPont Burden Analysis which further separates out the effects of taxes and debt when analyzing profitability. It works directly with Earnings Before Interest and Taxes (EBIT). The following screen shows you how:

Repeating the decile analysis to assess IBM’s Operating Margin provides a refined assessment of profitability by eliminating the impact of interest and taxes upon net income.

Step 4: Analyzing Profitability

Now you are ready to drill further into the investment decision. Recall that Operating Margin and Asset Turnover provide immediate insight into Efficiency and Profitability relative to how this impacts ROA. In this step we first explore the profitability question further by selecting Analyzing Profitability – see the screen below for IBM:

This lets you drill down deeper into the driver of Profitability by looking at the components of EBIT – Sales, COGS and SG&A.

How can we interpret these numbers?

The above calculator provides the numbers on a per share basis. This may be informative but her you probably want to engage in some “Common Size Analysis” and compare this against the market as a whole. To do this select the topic Common Size Analysis, select Sales. This will express the COGS as a percent of sales which provides a more meaningful comparison with the market as a whole for a decile analysis:

This reveals that IBM’s COGS are 53.9% of Sales which you can then compare to the market as a whole in a decile analysis by clicking on “Calculate for All” or you can compare it IBM’s competitors by choosing the industry subset and then Calculate for All. Here you need to apply some judgment relative to their stocks when evaluating the drivers of profitability at this level and performing Common Size Analysis.

Step 5: Analyzing Efficiency I: Working Capital

Now you are ready to drill further into the investment decision from an efficiency perspective. We start with Working Capital as illustrated for IBM:

A rich amount of material is provided in the above screen. First, the key components are Inventory Turnover, Receivables Turnover, Payables Turnover and combined these turnovers drive the Cash Conversion Cycle. A more intuitive presentation of the turnovers is n days and so the additional depiction of the three turnover ratios is also provided in terms of days to sell inventory etc.

How do we interpret these numbers?

Again a starting place is to conduct a decile analysis relative to the market as a whole by Calculating for All and then performing a decile analysis as before.

If your stocks have an efficiency problem you will want to closely scrutinize their working capital ratios. For example, in the book industry the inventory turnover ratios for “bricks and mortar” sellers such as Barnes and Noble (and earlier the now failed Borders) was poor compared to internet sellers. So inventory turnover ratio comparison is one of those key ratios to analyze further by comparing it to the market as well as immediate competitors.

Step 6: Analyzing Efficiency II: Degree of Operating Leverage

The second important dimension for analyzing the Efficiency dimension of ROA is to consider the utilization of the firm’s assets. For this dimension we compute the Degree of Operating Leverage by running a Cost Volume Profit Analysis. The degree of Operating Leverage (DOL) is important because it provides a measure of sensitivity of EBIT to changes or growth in Sales Revenue. Using Valuation Tutor you can reach this analysis from the following:

This analysis starts with the standard Gross Margin or Absorption Cost Accounting Income Statement form. You can override the above default %’s for the Fixed/Variable cost breakdowns by clicking on the Edit Data button circled above. This brings up the following screen:

The colored parts you can edit directly.

Aside: You can also edit Sales Revenue here which lets you work with either the data from the statements or Sales Revenue forecasts from analysts. We will return to this aside shortly.

How do you assess the % Variable COGS?

If you have studied Management Accounting then you would have been introduced to techniques such as High-Low, Regression and Professional Judgment. If you have not studied Management Accounting don’t worry we will illustrate how to conduct the simple, but still very powerful techniques because they use current information, which is the high-low technique combined with judgment.

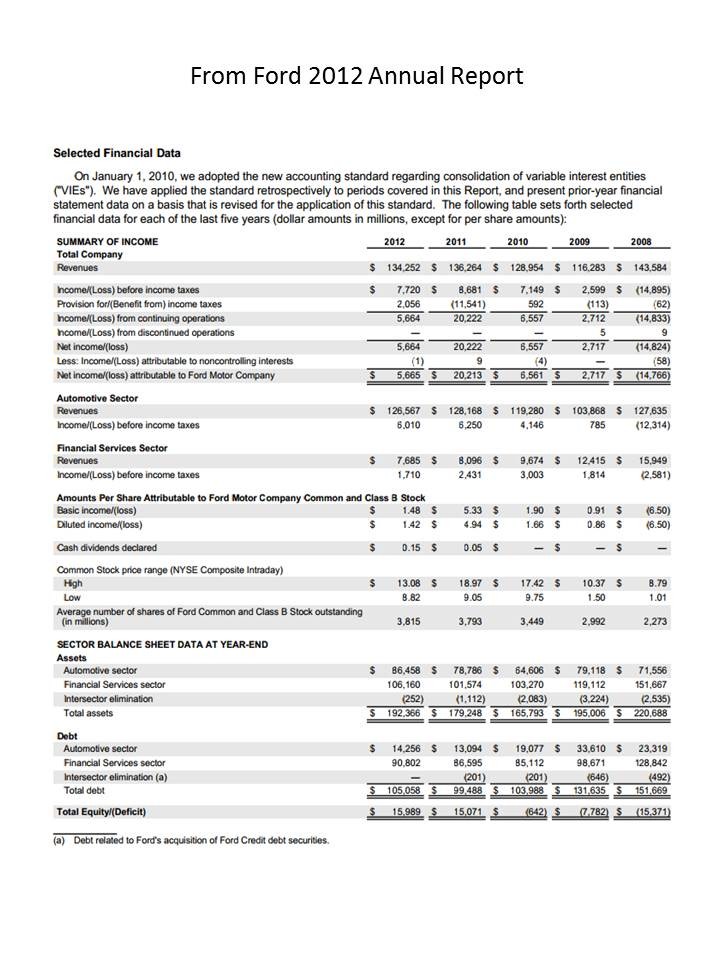

We will first bring up IBM’s financials from a 10-K. Valuation Tutor provides you with access to all interactive filings which are now required for Public US companies by the SEC:

Select SEC Filing Viewers at Bottom as circled above. The bottom part of the screen provides you immediate access to these interactive filings and now you can enter the ticker for IBM followed by Enter or Return key. This is circled below.

In addition, select the latest 10-K filing to gain access to the annual audited financial statements. In particular we want to refer to the last three years of Income Statements for IBM. For convenience we provide the income statement in both the bottom part of the screen as follows:

Now you can see how the numbers hang together – the default numbers in the calculator come form the latest 10-K. The above provides the source data for IBM’s Total Sales and COGS.

The High-Low technique to estimate the % variable COGS is described in Problem 8, to Chapter 3 of Valuation Tutor:

So applying this to IBM (note you can export the interactive data immediately to Excel to make your calculations even easier to perform.

The high low technique reveals that IBM’s COGS is very sensitive to Sales and Hi Low is greater than 1 which provides a first pass estimate of 100% for IBM for the % variable COGS, similarly for SG&A 41% and for Other 8%. These numbers can be entered into IBM and the DOL is re-estimated as follows:

This results in a re-estimation of Cost Volume Profit as follows:

This refines the DOL for IBM to be 2.0317 which provides a measure of the % sensitivity of EBIT growth to Sales Revenue growth. Again in this step this can be interpreted in relation to the market as a whole by Calculating for All.

An additional way of exploiting this information is to apply current consensus forecasts for Sales Revenue. Again in Valuation Tutor you can immediately check this consensus as follows:

Re-select Information Browser at Bottom by selecting View Filings:

Here the current forecasts for IBM’s Sales Revenues are 107.69 and 111.85 billion. This can be combined with DOL to make forecasts about EBIT.

Step 7: Conclusions

After completing the previous six steps for your two stocks you will have developed sharp insight into the drivers of ROA and how this compares with the industry and market in general. Recall that ROA results from the following:

ROA = Profitability times Efficiency

Each step in this project drilled down further into this broad relationship.