Fundamental Analysis For Traders

Post on: 19 Май, 2015 No Comment

- Page Title:

- Page URL:

This page has been successfully added into your Bookmark.

1 followers

Follow

Having written about technical analysis for fundamental investors, it seems only fair that I pay credence to how a trader can user fundamental analysis. Unfortunately, I’m not sure it’s quite as instructive to use fundamental analysis for trading.

The principles of valuation and balance sheet analysis do not lend themselves naturally to trading. The goal of fundamental analysis is to find companies trading below their fair values and be patient as the broader market catches on. It’s hard to predict if or when market movers will pile into an undervalued stock. Look at the track record of one of the most famous fundamental traders, Jim Cramer. His many flip flops are well chronicled on Youtube. And, this is a man who supposedly eats, breathes, and sleeps the markets. For more on the argument for technicals over fundamentals, I’d direct you to this video by a technical analysis educator which documents the fallacies of trying to trade off of fundamentals over technicals. Most importantly, the inability to determine proper stop losses. After all, when trading fundamentals your focus is determining upside.

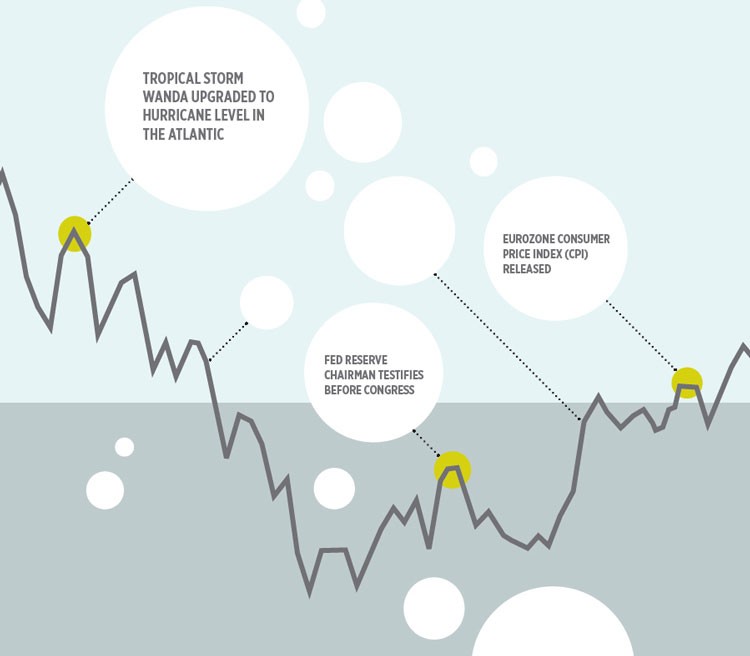

There are, however, a few situations (events) where an investor using fundamental knowledge can extract quick profits. Fundamental trading is probably more accurately described as event driven or “special situations” trading.

Earnings Releases

As we saw with Apple’s recent earnings release, some bloggers like Andy Zaky performed intense analysis of Apple’s performance last quarter and determined that Wall Street expectations were much too low. As earnings announcements are highly publicized and catch the eye of many investors, you can expect large scale movements in a stock as material information comes public. Here, a trader with fundamental knowledge can have a leg up on the broader market. This often works best with growth companies where mainstream projections are rarely in consensus. About a year ago, I documented a potential fundamental strategy for targeting potential earnings beats in high growth stocks.

Analyst Upgrades and Downgrades

It isn’t just earnings expectations which are highly driven by analyst recommendations. A stock’s short term direction can often be affected by unanticipated analyst upgrades or downgrades. With the rise in the popularity of main stream stock prognosticators, we’ve even seen this phenomena extend beyond analysts to the “Cramer effect” or “Barrons pop” after a positive or negative affirmation from our beloved media prognosticators. Linn Energy (LINE ) just happened to be the recipient of both a Cramer rally and a Barrons pop over the last quarter months. The reaction to these upgrades and downgrades is easy to anticipate and for trader with a quick trigger finger, possible to take advantage of. Even after a quick rally, these reports often attract irrational over buying or over selling and a trader with a fundamental knowledge of the business in question can continue to take advantage of any retracement.

Stock Splits

Some believe that stock splits create short term buying pressure because a split typically lowers the price per share thus allowing a broader swath of retail investors to invest when they otherwise couldn’t have. For example, if Google were to split it’s stock from $300 to $150, it may look more attractive for retail investors to pick up a few shares of the stock even if it doesn’t ultimately change the fundamentals of the Company.

Another situation some people have found profitable is the spinoff of an operating business. The basic premise of a spinoff is to allow investors to better understand a business which management might believe is being masked by being part of a larger corporation. There’s a whole host of other reasons why spinoffs typically create valuation mismatches and they’re best described by Joel Greenblatt in his book, You can be a Stock Market Genius (Read my review ).

Mergers and Acquisitions

Merger arbitrage is likely the single most popular form of true fundamental trading. When M&A activity was plentiful, this strategy became so popular that even retail funds (The Arb Fund ) popped up to allow at-home investors an opportunity to take advantage. Whenever a Company attempts to buy out another company (i.e. Pfizer and Wyeth), the shares of the target will usually move dramatically towards the buyout price depending on how serious the offer seems. After the announcement, the possibility of the offer falling through, a higher bid, or emergence of new bidders creates a plethora of opportunities to trade the volatility for a fundamental trader.

All in all, it is likely more difficult to be a fundamental trader than it is to be a technical trader as knowledge of one Company is not necessarily broadly applicable to many different stocks. I, personally, have shied away from it in recent months. But, with valuations as depressed as they are and outlook so negative, someone who’s bold enough may be able to find some terrific fundamental trades during this earnings season.