From the financial crisis to the economic downturn OECD Observer

Post on: 19 Сентябрь, 2015 No Comment

From the financial crisis to the economic downturn

Secretary-General of the OECD

The financial crisis sweeping world markets is the worst since the Great Depression. While the crisis is biting into the real economy, hard lessons are being learned. How should policymakers move forward, particularly as room for manoeuvre is being squeezed?

The size and duration of the crisis remain uncertain, but the cost is immense, in subprime losses, wiped-out stocks, rescue packages and more.

The OECD has from the outset welcomed the systemic rescue plans in the US and Europe. By injecting liquidity, providing guarantees, dealing with troubled assets and recapitalising the banking system, these actions should help relaunch bank lending and get the economy going again.

We have seen boom and bust cycles before, but these are exceptional circumstances. This time the financial system–the conveyor belt through which the economy works–has been blocked. Governments had no choice but to take action.

We have welcomed the strong leadership shown by several countries which has helped restore the functioning of the markets. We must now tackle the underlying causes. Moreover, as markets remain volatile, the crisis has placed serious doubt in people’s minds about the reliability of their banks and financial services and indeed, about the credibility of the market system itself. How can governments restore confidence and get the markets back on their feet?

Understanding causalities is a pre-condition for good policymaking, since bubbles and crises will occur again if the sources are not addressed directly. There is wide agreement that markets need more effective monitoring and regulation, and stronger corporate governance. After all, from Wall Street to Main Street and across world financial centres, the market’s invisible hand had gone astray. Excessive lending at cheap interest rates fed an insatiable demand for high-risk financial products, backed by flawed approvals from rating agencies. An already complex market became unreadable. What eventually transpired while asset prices dropped was a market excessively loaded with so-called “toxic” debt.

The reaction was sudden, and the deleveraging brutal, but while the crisis itself was not forecast, no-one can say it came completely out of the blue. Over the past year some OECD members expressed concerns about lightly regulated, highly-leveraged financial products, and several months ago we wrote about the gaps in regulatory and accounting standards, and highlighted failures in corporate governance.

True, there may have been ignorance about the amount of debt outstanding and who was exposed, but clearly the regulatory structure was simply unable to deal with the likes of mortgage-based securities, derivatives and credit-default swaps.

Now, we must ensure that the rescue packages work, so that lending resumes and payments systems are secured. For this, markets must recover some normality, while avoiding excessive volatility.

We must also think about the long term, and OECD is working alongside governments, central banks and international institutions in advancing the reforms in regulatory and accounting standards, lending practices and corporate governance needed to address the crisis. We should also respond to the call of political leaders to rethink the global economic governance infrastructure, in order to increase its effectiveness and legitimacy.

Overall, a more holistic culture of risk management, compensation issues and responsible, ethical and accountable management must be forged, grounded in better regulatory structures and stronger implementation of agreed standards, such as the OECD Principles of Corporate Governance, as well as improved financial education and risk awareness among all users of financial markets. Other policies too must be improved, not just concerning banking, but also related to housing, for instance, so that low-income families are not unfairly exposed to risky mortgages.

After all, what really matters is the economic welfare of people, their homes, businesses and jobs. The ultimate goal of our actions is to avoid a wide, protracted global economic downturn, restore the conditions for growth and ensure this crisis cannot be repeated. Already before the crisis, OECD had forecast a slowdown in some countries, and now the outlook seems dimmer as we prepare our next OECD Economic Outlook for late November. It is as yet unclear to what extent government intervention will affect budget deficits and aggregate demand, but clearly sound fiscal management will be needed. Also, the degree to which lower inflation will allow for a more accommodating monetary policy remains uncertain.

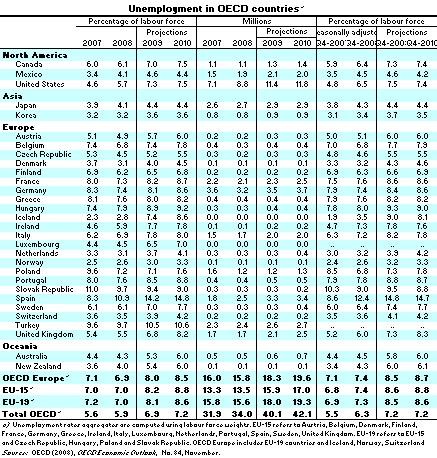

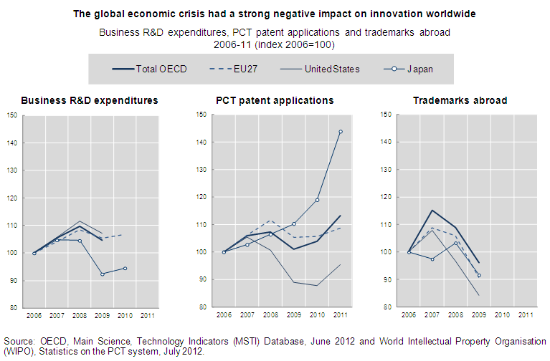

Policy measures to restore economic growth are therefore essential. We should look at the underlying trends and policy levers that will allow a new era of increased productivity and growth. But to do so, we also need to deal with issues such as competition, education, and the required reforms. Social measures will also have to be reinforced to address the expected rise in unemployment. And we must not neglect other challenges either, such as meeting development aid targets and tackling climate change.

These exceptional circumstances may reshape priorities and policy frameworks in several OECD countries. The crisis casts a shadow, but there is a bright side, as lower commodity prices create precious wiggle room for policy, and robust emerging economies inject some balance to the world economy.

The market system is in crisis, and governments are in the driver’s seat. Our leaders must solve the financial crisis together. As a hub for dialogue on global challenges, our new, more plural and relevant OECD is helping to chart the way forward. Times are uncertain, but our commitment will not be found wanting.

©OECD Observer No 269 October 2008

For more on the crisis, see here .

UPDATE January 2009: see OECD’s strategic response to the economic crisis.