FRM Monte carlo simulation Brownian motion

Post on: 3 Июль, 2015 No Comment

Автор Hao Zheng (3 месяца)

Your drift daily is wrong. It’s divided by 25 instead of 252. Very

confusing, please correct.

Автор solongsucka (3 месяца)

+Bionic Turtle 4:22 — You actually messed up the Drift(daily) formula. You

changed the 252 to 25 while playing around with the cell.

Автор George Iolas (11 месяцев)

Can someone here help me simulate commodity prices (like gold for example)

for 50 years in a probabilistic way? thanks

Автор Meher Khémiri (1 год)

how can i stop a Brownian motion. with least square. HELP PLZ

Автор Niels Hoogeveen (1 год)

Can you just take the average lognormal difference of the stocks to

calculate the drift?

Автор Niels Hoogeveen (1 год)

how do you calculate the (annual) drift? I dont get it. please help me

Автор brunetto345 (5 лет)

bravissimo, complimenti

Автор Mike Di Ciero (4 года)

Hi David— Aren’y you using a median (geometric) return? Mike

Автор caetans (4 года)

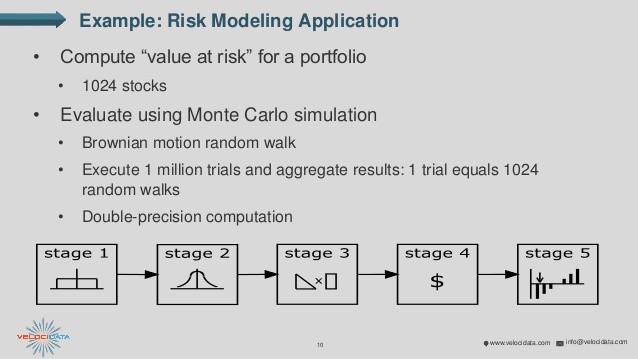

nice video. how can I get Value at rik from your example?

Автор Bionic Turtle (4 года)

@dicieromike great observation. I think i did mislabel but it should be:

drift (return). You are totally correct that under the GBM, the use of the

return (mu) as an INPUT gets to the distributional median with (mu -

Автор jokermant (4 года)

Hi @bionicturtledotcom, is this the same approach to simulate Monte Caro

VaR for a portfolio?

Автор Walter Zelhofer (3 года)

I also have Hull’s Book found where you got the formula. However, I don’t

understand why we subtract 1/2 the variance from the mean log return: The

arithmetic average of discrete, single period returns with a compounding

frequency of one is greater than the geometric average by approx 1/2 the

variance, true. BUT we’re using continuously compounded returns! The

expected return should just be mu no? I would like to send you a

spreadsheet where I demonstrate this, please advise.

Автор Mike Di Ciero (4 года)

Hi David— Aren’t you using median (geometric) dirft? Your cell is labeled

‘mean’. Thanks, Mike

Автор Kevin Lin (2 года)

in daily drift E2/252, you did E2/25, typo, it then should be 0.04%

Автор pgthanki (3 года)

This is a great Video. Thanks so much David Harper.

Автор Walter Zelhofer (3 года)

Here are my 2 cents: First, GBM, as shown in the video (and the formula

used) assumes constant volatility. With GARCH, volatility changes with time

and tends to revert to a long-run average volatility. See Market Risk

Analysis V 2 by Alexander. Second, the expected return you calculate from

CAPM isn’t the same as the mean of the distribution of log returns on the

asset: it is, in theory, the required return on the stock for an investor

who plans on holding a large diversified portfolio.

Автор Dharmz Jams (3 года)

great video! Even though I studied this in uni, I was a bit shaky in

answering this question in an interview but now feel more confident about

it! thanks a lot ![]()

Автор Walter Zelhofer (3 года)

@bionicturtledotcom Hi David, I’m emailing you the spreadsheet right now.

It’s a little large due to all the random numbers that were generated, but

I think it proves my point/confusion? haha

Автор Bionic Turtle (6 лет)

yes, thank you for noting that, I did mistakenly change the 252 to 25. I

appreciate your help on that point. David

Автор LondonBoy2006 (4 года)

@nahaymath No they are not, just memorize the book to get a 2.1 or 1st.

(UCL University Of London).

Автор dudeman209 (2 года)

I was wondering how you would modify this if you wanted to use fractional

brownian motion or if you were to use some sort of distribution with fat

tails like a Levy-stable distribution. The problems I’ve had with

fat-tailed distributions like Levy-stable distributions are that there are

4 different parameters to estimate.

Автор Luis Olano (4 года)

Very good video explanation, all the formulas match with the ones I have on

my notes. We can use the Drift value (Expected return) from CAPM model and

Stock Volatility calculated using GARCH.

Автор Nguyễn Thanh Vũ (3 года)

How can I compute Var with changing price in Monte Carlo method. it is easy

to calculate var in Historical

Автор nahaymath (3 года)

@bionicturtledotcom LOL! Great explanation. It’s amazing how strongly those

who do applied simulations get wed to their favorite probability

distribution functions, because THOSE were the ones they were taught in

school. No shame! I am just as easily attached to the distributions I

learned studying for my actuarial exams. The great value of doing research

is it forces one to be creative and to consider all conceivable probability

functions.

Автор Longpan898 (2 года)

Great one. Thanks David.

Автор nahaymath (4 года)

Just curious: as an undergraduate in chemical engineering at the University

of Delaware in the 1980s, I got a VERY rigorous education in mathematical

modelling — i.e. in coming up with one’s OWN models (of the physical

world). That training completely altered my way of thinking and inspired my

passion for inventing new models of events. I assume and hope that students

today are still taught in math and engineering classes to invent models, in

addition to studying the work of others.

Автор WarrenEdwardBuffet (4 года)

Is there a way I could let excel do this monte carlo simulation 100 times

in a row with all the results simultaneously displayed on a single chart?

Автор Bionic Turtle (4 года)

Автор quacka101 (5 лет)

this be for nerds and geeks me thinks.

Автор Jeremy Jukes (4 года)

Do you have any examples with correlated variables using choleski

ordering.

Автор Bionic Turtle (4 года)

@777wt honestly you should blame the copula not MCS, IMO. If folks ran more

simulations, it might have helped

Автор nahaymath (4 года)

@nahaymath. or, more specifically, deliberately misapplying models with

tons of wrong assumptions, the number one assumption being that all players

act honestly and keep their promises.

Автор TommyMarxable (3 года)

@ids180genius Fantastic regurgitation. If you read the thread, I was saying

most people in the finance world who use Black Scholes have no idea how it

works (of course they’ll have read the finance 301 textbook, case in

point). I wasn’t knocking the model itself. In engineering and physics

fields there is no pre-packaged excel spreadsheet you can buy on the

internet to solve the problems you find there.

Автор Bionic Turtle (4 года)

@remo1200 as slipknotpsychoman noticed, I made a mistake in the drift.

First, the annual drift of 10% is merely an input assumption (nothing

necessary about that). Second, the daily drift should be = (10% -

40%^2/2)/252 = 0.0079%. Or, daily mu = 10%/252 = 0.04%. Daily vol = 40% *

SQRT(1/252) = 2.52%. And daily drift = 0.04% — 2.52%^2/2 = 0.0079%. (by

inadvertently deleting the extra 2 in 252, i implicitly assumed an annual

drift of 101%)

Автор Bionic Turtle (3 года)

@WalterZelhofer Hi Walter, sure my email is davidh(at)bionicturtle(dot)com,

but feel free to also post in our forum at bionicturtle(dot)com/forum. I

frankly have the same intuition as you do on this, yet (eg) McDonald uses

the above also. I’d love to see your XLS, thanks!

Автор ids180genius (3 года)

@TommyMarxable Actually, the GBM process is considered a random walk

which is actually the most appropriate model for the market without getting

into agent based modelling. So, in finance, YES. The Black Scholes option

pricing formula was also derived from a geometric Brownian Motion

assumption and through the use of Ito’s lemma fwi.

Автор slipknotpsychoman (6 лет)

you deleted the end 2 of the 252 drift daily on accident

Автор Bo Mølgaard Nielsen (3 года)

Автор Riverdale270 (6 лет)

this really comes in handy for my masterthesis, thanks a bunch!

Автор Bionic Turtle (4 года)

@pzedful it’s normal just by definition of GBM. MCS can use any

distributional assumption. Why? physics envy, of course. Exactly why?

because i wanted to share and it’s the first MCS I learned. Caveat emptor.

I am not defending it. Models simplify, that’s what they do. A toy train is

not a train, but it may still have something to offer about the train-ness

of trains.

Автор Fullperson (3 года)

I have downloaded S&P prices, how do I find annual drift?

Автор MrFbeaupre (2 года)

Actually, he erased it while doing is presentation.

Автор Bionic Turtle (4 года)

@dicieromike it just occurred to me, unless i have confused myself, that

what is typically called a geometric mean is equivalent to the

distributional median (i.e. ex ante lognormal). if you know better or

agree, i’d love to hear how i could have that wrong?