FOREXDollar firms on concerns euro falls

Post on: 11 Июнь, 2015 No Comment

Analysis & Opinion

* Focus on U.S. budget talks on year’s last day of trading

* Highly liquid dollar favoured as investors shun risk

* Drastic currency sell-off unlikely if no deal by Wednesday

* Dollar/yen down from highest since Aug 2010 set on Friday

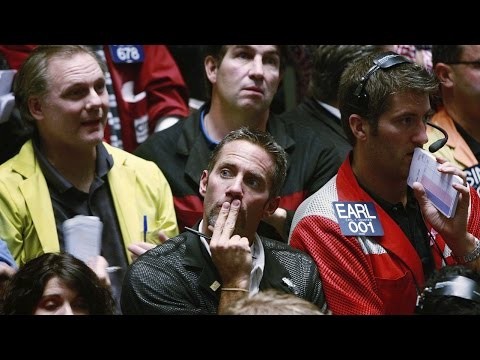

LONDON, Dec 31 (Reuters) — The euro fell against the dollar on Monday as growing concern U.S. lawmakers would not reach a deal in last-minute budget talks prompted investors to seek refuge in the more liquid U.S. currency.

The euro was down 0.2 percent on the day at $1.3187, with near-term support seen around $1.3144, the Dec. 17 low. Any euro gains would be capped at $1.33085, the 8-1/2 month high hit on Dec. 19, traders said.

The U.S. Congress is scheduled to meet on Monday in a last- minute attempt to avert the fiscal cliff — $600 billion worth of tax hikes and spending cuts due to kick in from Jan. 1, that could gradually tip the world’s largest economy into recession.

On Sunday, Democratic and Republican leaders in the Senate remained at loggerheads, holding their positions, and this soured market sentiment and buoyed the dollar.

The markets have presumed now there will be some sort of a agreement around the middle route, said Neil Mellor, currency strategist at Bank of New York Mellon.

Mellor said a major sell-off in growth-linked currencies on Wednesday, when trading resumes after the New Year’s holiday, was unlikely as it would take a few days before volumes rose to normal and investors return with fresh annual allocations.

Many investors say the impact of the fiscal measures will only be felt gradually and that the U.S. economy does not face immediate catastrophe if no deal is reached.

Strategists also said that with budget talks dragging on for months, the lack of a deal by year-end had already been priced in by many investors, limiting the impact of such an outcome.

The market seems to have almost taken into account the U.S. fiscal cliff discussions will go into the new year and investors seem to have taken off any risk-on positions before the holiday period, said Michael Sneyd, FX strategist at BNP Paribas.

The safety of the dollar is favoured in times of financial uncertainty and deadlock in budget talks is likely to keep it firm against most major currencies. Any progress in talks would, however, be positive for stocks and riskier currencies such as the euro and Australian dollar.

The euro has gained 2 percent against the dollar this year, overcoming worries about a euro zone break-up and a sovereign debt default.

Sentiment towards the euro zone improved after the European Central Bank pledged to buy bonds of indebted peripheral countries. Positioning data on Friday showed speculators sharply reduced bets against the euro in the week ending Dec. 24.

The euro was flat at 113.65 yen, below a 17-month high of 114.675 yen set on Friday. The euro has risen roughly 14 percent against the yen in 2012, putting it on track for its biggest yearly percentage gain since it was launched in 1999.

YEN WEAKNESS

The yen held above a two-year low versus the dollar on Monday but remained on track for its largest annual drop in seven years, pressured by expectations of more monetary easing by the Bank of Japan.

The dollar was up 0.2 percent on the day at 86.16 yen. but below Friday’s high of 86.64 yen, which was the dollar’s strongest level versus the Japanese currency since August 2010.

As 2012 draws to a close, the dollar is up 11.9 percent against the yen for 2012 and there was little respite in store for the Japanese currency.

With a new Japanese government led by Prime Minister Shinzo Abe expected to pursue a policy mix of aggressive monetary easing and heavy fiscal spending to beat deflation, analysts see the yen staying under pressure in 2013 and any drop in the dollar against the yen likely to be limited.

Some analysts however said the yen may be due a near-term bounce, especially since currency speculators have already ramped up bets against the Japanese currency.

BNP’s Sneyd also said that not all in Abe’s Liberal Democratic Party shared his views and it was likely his rhetoric would become less dovish before the BOJ meeting on Jan. 21-22.

Then people will likely start to take profits on their short yen positions and we could see dollar/yen retracing lower, Sneyd added.