Forex v Comparation Review

Post on: 17 Май, 2015 No Comment

Share this forex article:

Trading is the act of buying something and selling something. With Foreign Exchange trading, Forex in the short form, the commodity that is being traded is currency. With Stock Exchange trading, the commodity that is being traded is stocks. This is only the basic definition and with that, every property that defines the commodity affects the markets as well. Every market earns the characteristics of the commodity that is being traded in it. A furniture market would have its own unique way of behaving, helping traders make money and lose money. An apple market would have its own rules.

Similarly, there are a lot of differences between Forex and Stock markets. Some traders like to think that they can excel in both of these two markets. Being active in both markets might look like an amazing feat, but it comes with its own collection of risks. Being active in either one of these markets is a risky thing already. If active in both markets, the potential profits can be amazing. At the same time, the amount of losses would be incredible too.

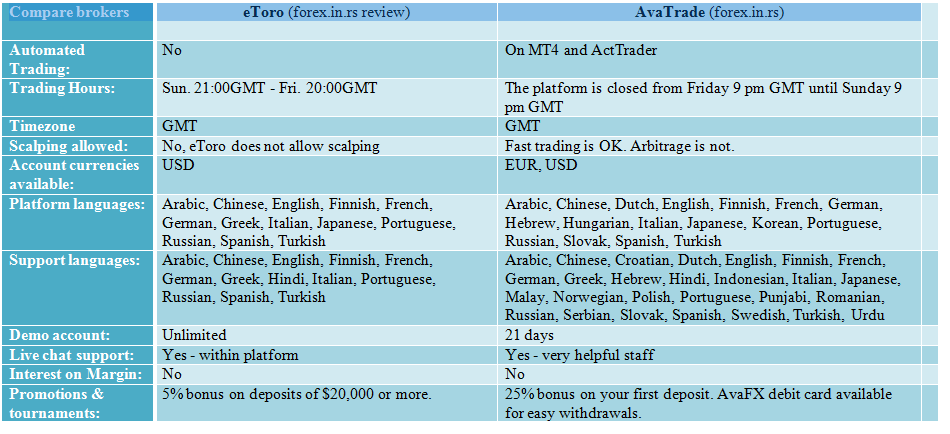

Here we can see full Forex vs. Stocks (forex vs. equities) comparation table.

The only way to excel in any market is to gain expertise about that market. Learn about the way other traders are behaving, how the economy is running and not running. There are simply too many things to do. One mistake here and another one there, the trader who is active in both the markets will end up losing everything. That is precisely why, even if someone is showing tendencies to play in both the markets, should not do so. That is also the reason why, one should pick one of these markets. Decide to become good at either Forex Trading or Stock Trading.

There are some common misconceptions that one has to stay clear from, before a choice is made. One of the more popular suggestions that is almost impossible to escape, is that forex trading is far more amazing than stock trading. Other impressions that will be made on a newcomer, thanks mostly to the fake ads on the internet, is that forex trading has literally no limits on the amount of gains to be made. If these ads were to be believed, the world would be filled with millionaires who happened to be so, overnight. That is why; these ads are easily considered as scams. If becoming rich was so easy, everybody and their mother would be walking off with thousands of dollars after each session of trading.

Forex Trading And Flexibility

One of the major reasons that these ads can become convincing, is the time advantage. Let’s look at conventional stock trading. A trader can only take part in trading during the working hours of the exchange of the traded stocks. This could be considered inflexible, if the preferred stock exchange does not match up with the local trading hours. For instance, if someone is on European time and wants to trade on the American stock exchange, they would have to adjust their work hours. The same goes to anybody who is trading on any stock exchange. They will have to adjust their working hours to that of the stock exchange.

With Forex trading, there are no such time restrictions. One can trade round the clock. There are time restrictions of any kind because the market is open all the time. If there is a trader, and he likes to trade early morning, he can do so. If someone wants to trade round the clock, take advantage of a particularly good run? That is possible too. Many forex trading ads, particularly training institutes and software sellers, try to use this as their selling pitch. The truth is, just because trading can be done round the clock, it does not mean there is more money to be made. It just does not work that day.

Lower Initial Investment

Another property that gets advertised a whole lot about forex trading is that, the initial investment is very less. In all fairness, it is true that forex trading can be done with as little as five dollars or ten dollars. If all you have is a dollar, that is just enough for a trader to begin trading. The stock market really does not work like that. There are very few companies listed on any stock exchange that are trading at low levels of a few dollars. Even if some stocks are trading at a very low level, they will eventually fold up or be merged or delisted. A lot of things can happen with stock trading. The stock market is definitely more volatile than the Forex market. In other words, forex trading is simplified. It is important to note that this, is relative simplicity when compared to the stock market. It is not absolute simplicity. The online ads that brag about forex trading, conveniently forget to mention this.

There are some things about the stock market which actually are better than forex market. With trading, one of the concepts that outsiders will also know about is risk. Risk is always inherent in any business related activity. With stock trading the risk is immediate, just as it is with forex trading. There is a minor difference and that makes for a huge impact in the long term. With forex trading, your risk is connected to every currency that is being traded. It is money. Since, money is money, no matter which currency is being traded; the collective risk is actually higher.

Stock Trading and Stocks

With stock trading, things are slightly better. The risk of the trader is confined to the stocks in which the trader is currently busy in. Let us suppose that we have a trader, T. T has put money in two stocks, A and B. T currently owns about a hundred shares of A and B. On the next day of trading, it so happens that the stock value of A has gone to almost zero. That means, all the money that was put into those stocks are gone. If the stock value never picks up, that money is as good as gone. On the surface, this is a bad thing.

The bright side is that, only the money that was invested in that particular stock is gone. The money that is invested in other stocks is still intact. If it so happens that the stock B went up proportional to the value by which stock A went down, the trader has lost nothing. There is another aspect of stock trading that makes for an interesting observation. Depending on the prospects of the company, the stock value can always rise. A smart investor who has seen this coming, can make a lot of money by buying the stocks on the cheap. When the value recovers, technically, the trader can make a lot of money.

With currencies, it just does not work that way. Currencies don’t drop to zero or minimal value. In some ways, they never behave like stocks. Currencies are tied to the countries that use them, and there are only five currencies that are available for trading right now. The way the world economy is going, it is highly unlikely that any of these currencies will be removed or new ones will be added. In other words, the choice of commodities to trade is very limited. That means, when things go bad with the world economy, the trader stands to lose everything despite his exposure being limited to a single currency.

Forex versus Stock

All things considered, there are certain circumstances where jumping into forex trading are a lot more interesting than stock trading. With stock trading, the only way to make gains is to buy them in bulk. Suppose there is a stock S which is currently trading at 10 dollars. A week later, the same stock gains 40 dollars. If the trader had bought one stock, he or she is richer by 40 dollars. If the same trader had bought a thousand shares, then he or she is sitting on a potential cash pile of 40000 dollars. It is a numbers game. For any meaningful profits to be made, the initial investment has to be high.

With forex trading, such a huge initial investment is not required. Even if the trader only has a few hundred dollars to trade with, and the currency gains by a few percentage points, there is some profits to be pocketed. Just like stock trading, a high initial investment will guarantee large profits. With forex trading, though, even small time traders can make the most of it, climb their way up the investment ladder, so to speak.

There are some advantages of sticking with forex trading. Low initial investment and less commodities to trade in are the top two reasons. Forex trading is much simpler than stock trading. With stock trading, there are any numbers of options. There are many exchanges around the world and there are so many stocks that are trading within each exchange. Those who are limited by time should opt to go with forex trading. Those who are able to align their trading hours with that of the stock exchange, stock trading is a lot more amiable.

Personal suggestion

If you have large amount of money and you are not good in technical analysis I can suggest you stocks trading. In other way, I can suggest you forex trading.