Forex Trading Software The ECO Histogram

Post on: 25 Май, 2015 No Comment

The MFE is valuable because you can develop a target strategy for partial profits. No one likes to see a good trade turn into a mediocre trade, so by having a set target based on the average MFE for a series of trades you increase your opportunity to consistently make profits.

Finally, all of this information is generated by the combination of the attributes of the system and how it matches the rhythm of the markets. There is no guesswork of arbitrary influence from the trader’s emotions.

Let’s say that you trade a stock that is around $100/share and every time you enter into the market via your signals, long and short, the market goes at least $10 your way for every trade, and you have no losers (please call me at once!). A $10 move is a 10% return if the original price of the stock is $100. I point out using percentages because in today’s stock market some of these high tech stocks can double in price or lose 50% in a matter of days, so using percentages gives you a more accurate representation. Plus you can then compare different trading methods on different stocks. Figure 2 is our table of the trades for America Online we discussed from Figure 1. We have set it up by trade number, long or short entries, the entry price, the maximum favorable excursion (both the extreme price and open dollar profit), the maximum adverse excursion (both the price and open dollar loss) and the price the trade was reversed as there were no trades that did not have confirmation.

By reviewing the MFE we can see that five of the seven trades exceeded a profit of more than eight dollars, and most of the traders were near $100 so we could set a target for partial or total profit of 8%. You can look to the MAE of each trade and determine what the typical open loss or heat you have to cope with while you are in a trade. If you reviewed, say some thirty or more trades, you probably will be able to determine a cutoff point or point of no return for a trade. That would be a typical open loss that never recovers to be a gain. The fact is most trades do go against you somewhat, but hopefully recover and go onto a profit. However, some are bad from the beginning, and you can use MAE analysis to exit a trade before the system does. Plus MAE analysis gives you a better idea of your risk of each trade when you actually place the trade, and avoid having to wait for an indicator to reverse the trade.

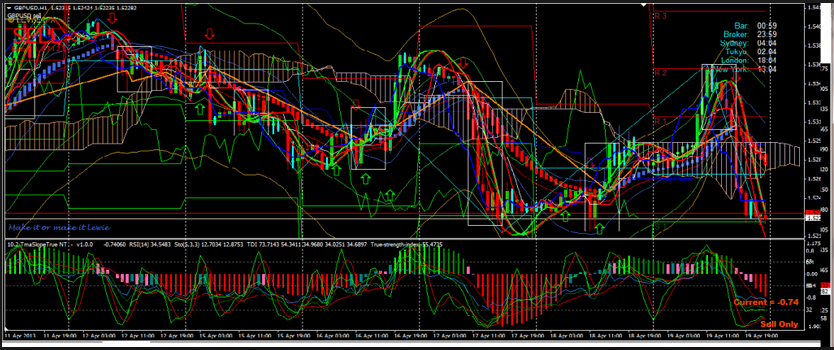

f you would like to have a somewhat faster entry system then the HiLo Activator then work with the Balance Point Step “Own” set to five periods. Use the same criteria that a close past the Balance Point Step must be confirmed by the ECO Histogram. Figure 3 shows the same chart as Figure 1, except we have added theBalance Point Step Own (Daily on the Daily) for your perusal.