Forex Market EUR_1

Post on: 16 Март, 2015 No Comment

August 29, 2014 7:46 am

Yesterday’s trading session saw EUR/USD hold in the range of 1.3220 1.3160. The pair closed at 1.3184, losing 0.06% on a daily basis, having declined 1.20% last week.

At 7:43 GMT today EUR/USD was down 0.06% for the day to trade at 1.3174. The pair fell to a daily low of 1.3160, close to Wednesday’s trough of 1.3153 which was the lowest since September 6th, 2013, while day’s high stood at 1.3186.

Fundamental view

Eurozone

Unemployment within the Eurozone probably remained unchanged at 11.5% in July, Eurostat will report at 09:00 GMT.

Meanwhile, consumer prices likely rose by an annualized 0.3% in August, according to preliminary data, compared to 0.4% in July. If confirmed, this would be the lowest gain since October 2009.

Core consumer prices, which exclude the more volatile food, energy, alcohol and tobacco products, are expected to have risen by 0.8%, the same as in July.

Germany

Destatis reported that Germany’s retail sales Tracks the changes in retail sales’ volumes. Information is gathered through a research including big retailers and an excerpt for the smaller ones. Higher volumes mean higher consumer demand, increased production and economic growth. Calculated both on a monthly and annual basis. rose by an annualized 0.7% in July from 0.1% in June, underperforming analysts’ projections for a 1.5% jump. Month-on-month, purchases at retail stores slid by 1.4% following a downward-revised 1.0% rise a month earlier. Economists had projected a 0.1% increase.

Spain

Purchases at retail stores in Spain contracted in July. Data by Spain’s National Institute of Statistics showed that retail sales Tracks the changes in retail sales’ volumes. Information is gathered through a research including big retailers and an excerpt for the smaller ones. Higher volumes mean higher consumer demand, increased production and economic growth. Calculated both on a monthly and annual basis. slid 0.5% in July, following a 0.2% jump in June. Economists had projected a 0.1% jump growth.

Additionally, Bank of Spain is expected to report at 08:00 GMT that the nation’s current account Represents the difference between a nation’s total exports and imports of goods, services and transfers in the current period. Excludes transactions in financial assets and liabilities. If exports exceed imports we have a Current Account Surplus. If imports are higher than exports we have a Current Account Deficit. Both government and private payments are included in the calculation. deficit widened to $1.1 billion in June from $0.584 billion in May.

A separate report by the Ministry of Industry, Tourism and Trade is likely to show that Business Confidence in the Eurozone’s fourth-biggest economy remained unchanged in August.

Italy

A slate of economic data from Italy is due today.

Italy’s National Institute of Statistics is expected to report at 08:00 GMT that unemployment in the Eurozone’s third-largest economy remained unchanged in July at 12.3%.

Later, at 09:00 GMT, Istat will release its preliminary consumer prices report. The annualized preliminary consumer price index probably marked a 0.2% contraction in August, after a month ago the final CPI Consumer Price Index. Examines the weighted average of prices of a basket of consumer goods and services. It is calculated by taking price changes for each item in the basket and averaging them, weighting them according to its importance. CPI is sometimes referred to as headline inflation. Calculated on both annual and monthly basis. stood at 0.1%. Month-on-month, consumer inflation is projected at 0.1% after declining 0.l% in July.

The nation’s annualized preliminary CPI Consumer Price Index. Examines the weighted average of prices of a basket of consumer goods and services. It is calculated by taking price changes for each item in the basket and averaging them, weighting them according to its importance. CPI is sometimes referred to as headline inflation. Calculated on both annual and monthly basis. for August, evaluated in accordance with the harmonized methodology, probably contracted 0.1%, compared to remaining flat in July. Month-on-month, Italy’s HICP Harmonized Index of Consumer Prices. A list of the final costs paid by European consumers for the items in a basket of common goods such as coffee, meat, fruit, tobacco, electricity, cars and other widely used products. It is used for measuring and comparing inflation rates between the different members of the EU. It’s calculation is based on international harmonized standards and is the percentage change compared to the same month of the previous year. probably declined by 0.1% after a 2.1% contraction a month earlier.

Due at 10:00 GMT, Istat will report on Italy’s second-quarter economic expansion. The statistics agency’s data is likely to show that the Italian economy contracted by an annualized 0.3% in the three months through June, after declining 0.4% in Q1. Quarter-on-quarter, the Italian economy is projected to have shrunk by 0.2%, from -0.1% in the first quarter.

United States

The Commerce Departments Bureau of Economic Analysis is expected to report that its Core Personal Consumption Expenditure (PCE) Price Index rose by 0.1% in July on a monthly basis after gaining 0.1% in June. Year-on-year, Core PCE added 1.5% in June.

The general PCE Price Index added 0.2% in June on a monthly basis, while year-on-year it was up 1.6% in June.

Personal spending is projected to have jumped by 0.2% in July from a month earlier, when the index registered 0.4% growth. Personal income likely gained 0.3% in July, down from 0.3% during the preceding month.

A separate report prepared by MNI Deutsche Börse Group may show that manufacturing activity in the Chicago region expanded in August for the 16th straight month. The respective Chicago PMI Purchasing Managers’ Index. Economic indicators, based on monthly surveys among private sector companies. Conducted by the Institute of Supply Management in the U.S. and by Markit Group in over 30 other countries worldwide. Gives information about the economic health of the manufacturing sector. It is based on five major indicators — 1. new orders, 2. production, 3. employment environment, 4. inventory levels, 5. supplier deliveries. Base level is 50. Values above the neutral level indicate an improvement and below 50 — a worsening in the current state of the manufacturing sector. It is calculated every month and compared to the preceding. Based on a monthly survey, which provides preliminary information about the activity in the private and public sectors of the U.S. economy. Includes the whole international business activity of the surveyed companies. Consists of seven components: 1. manufacturing, 2. inventories, 3. employment, 4. new orders, 5. uncompleted orders, 6. prices, 7. deliveries. Published on every last working day of the month. Calculated on a monthly basis on a scale of 1 to 100. The neutral level is 50. Values above 50 indicate economic expansion and below 50 — contraction. index is projected to come in at 56.0 after sliding to 52.6 in July from 62.6 in June.

The monthly survey by Thomson Reuters and the University of Michigan may show that consumer confidence in the United States worsened in August. The corresponding index probably slid to 81.0 during the current month from 81.8 in July. A preliminary reading earlier in the month pointed to a decline to 79.2.

The survey encompasses about 500 respondents throughout the country. The index is comprised by two major components, a gauge of current conditions and a gauge of expectations. The current conditions index is based on the answers to two standard questions, while the index of expectations is based on three standard questions. All five questions have an equal weight in determining the value of the overall index. In case the gauge of consumer sentiment showed a larger improvement than projected, this would boost demand for the dollar. The official reading is due out at 13:55 GMT.

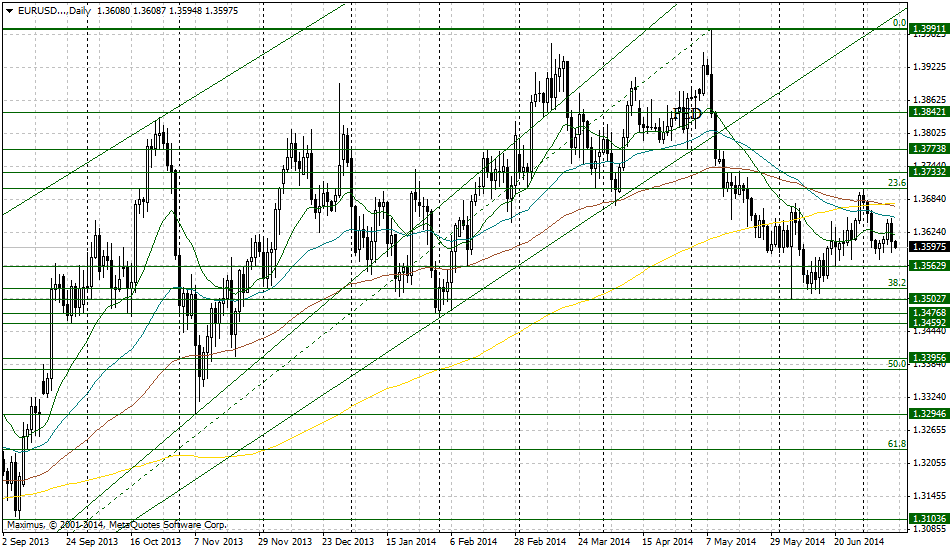

Technical view

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 1.3188. In case EUR/USD manages to breach the first resistance level at 1.3216, it will probably continue up to test 1.3248. In case the second key resistance is broken, the pair will probably attempt to advance to 1.3276.

If EUR/USD manages to breach the first key support at 1.3156, it will probably continue to slide and test 1.3128. With this second key support broken, movement to the downside will probably continue to 1.3096.

The mid-Pivot levels for today are as follows: M1 – 1.3112, M2 – 1.3142, M3 – 1.3172, M4 – 1.3202, M5 – 1.3232, M6 – 1.3262.

In weekly terms, the central pivot point is at 1.3287. The three key resistance levels are as follows: R1 – 1.3353, R2 – 1.3466, R3 – 1.3532. The three key support levels are: S1 – 1.3174, S2 – 1.3108, S3 – 1.2995.

- Tweet