Forex Gann Indicator

Post on: 10 Июнь, 2015 No Comment

Forex GANN Indicator — SQUARE nine

Forex Gann indicator mql4 Download

Forex Gann2 indicator mql4 Download

In 1909, WD Gann a now famous interview with Richard D. Wyckoff the Ticker and Investment Digest. In that interview Gann said: With my method you can determine the vibration of any kind, and also by taking certain time values ​​into consideration, can in most cases, tell exactly what the stock will be under the circumstances. Read the interview and see if you can figure out where the terms of WD Gann Law of Vibration is coming from.

WD Gann remains controversial and influential to this day. Some Wall Street insiders deep, men whose views are presumed credibility, insist that markets can turn to steam, as other insiders know the right time to change the trend without the need to communicate among themselves. The real price levels and time are easy to calculate angles and Forex Gann Indicator levels. Others believe that his book Through Tunnel air astrological secrets of Gann numbers and how they can be used to predict the stock and commodity prices. You can spend thousands of modern futures trading software that tries to combine astrology Gann and Elliott wave theory.

Are Insider story is true or not we will never know. But. If it is true. If deep Insiders know when to change the trend. know their game. The decision rules of the game on this web site. Most in plain site if you can see them. Square Nine principles are outside the mainstream of conventional technical analysis. A theory in which the price each time makes no sense at all to the outsider. WD Gann spent 10 years researching ancient and contemporary knowledge of how the universe works before you make your first trades. Fame and fortune followed. We believe that the basic principles underlying the Square of Nine historical basis for all Gann Theory and understanding that no 360 degree framework that equates price and time, WD Gann is forever an enigma. See the video on the square of nine concepts.

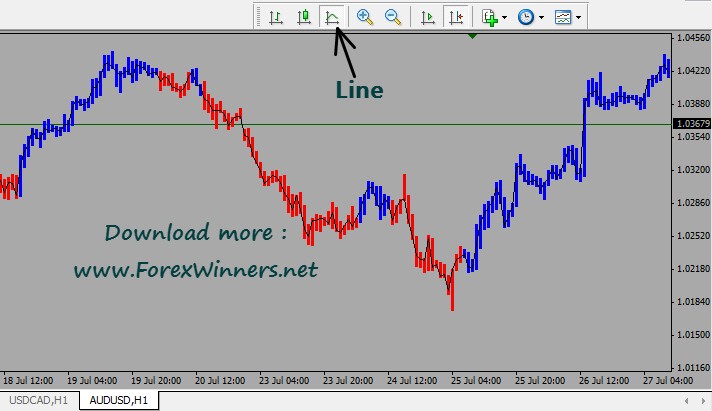

Map graphics are visible demonstration of the square root theory in action, and show how even a simple component of mathematical principles to the square of nine can be employed to identify, in advance, the potential cost and time turning points and support and resistance levels in stocks, commodities and forex. This knowledge is essential to swing trading strategy. Map charts are self-assessment. They provide clear and objective evidence of the direction and strength of the trend, or they can tell immediately when you can trade trend is present.

Gann studies are used by active traders for decades and, although the futures and stock markets changed considerably, they remain a popular method of analyzing the direction of the asset. New shopping areas such as foreign exchange market and finding the exchange traded funds (ETFs) have also been necessary to revise some rules of construction and application concepts. Although the basic construction of Gann angles remains the same, this article will explain why changes in prices and volatility is considered necessary to adjust a few key components. (For background reading, see the discussion of forex Gann indicator or studies)

Basic elements of Gann Indicator Theory

Gann angles are popular trading and analysis tool used to measure the key elements, such as model, price and time. Often debated topic of discussion among technical analysts that past, present and future are all at the same time the angle Gann. When analyzing and trading during a market analyst or trader is trying to get an idea of ​​where the market is, where on the former bottom or top, and how to use the information to predict future price action .

Gann Angles vs. Trendlines

All WD Gann trading techniques available, drawing angles and trade forecast is probably the most popular analysis tool used by traders. Many traders still draw charts by hand, and even more use computerized technical analysis package to put the screens. Due to the relatively easy day traders have set Gann angles of the charts, many traders feel no need to actually explore when, how and why to use them. These angles are often compared with trendlines, but many people are unaware that they are not the same thing. (To learn about trendlines, see Track stock prices With Trendlines.)

Gann angle A is diagonal line that moves in a uniform rate of speed. A trendline is created by connecting the bottom of the bottom in case the uptrend and tops on top in case of a downtrend. The benefit of drawing Gann angles compared with trendline is that it moves in a uniform rate of speed. This allows the analyst to predict where price will be at a certain date in the future. This is not to say that Gann angle which always predicts the market will be, but the analyst will know where Gann angle will be, which will help measure the strength and direction of this trend. A trendline, on the other hand, has some prognostic value, but because of the constant adjustments that normally take place, it is unreliable for making long term forecasts.

Forex Gann indicator Past, Present and Future

As mentioned earlier, a key concept to grasp when dealing with Gann angles that past, present and future are all at the same time the corners. This being said, the Gann angle can be used to predict support and resistance, under the direction and timing of tops and bottoms.

Gann Angles provide support and resistance

Using Gann angles to predict support and resistance is probably the most popular way they are used. Once the analyst determines the time period he or she is going to trade (monthly, weekly, daily) and properly scales the chart, the merchant simply Gann draws three main angles: the 1X2, 1×1 and 2X1 major tops and bottoms. This technique within the market, allowing the analyst to read the movement of the market in this framework.

Uptrending angles provide support and downtrending angles provide resistance. Because the analyst knows where angle is the table, he or she is able to determine whether to buy support or sell resistance.

Traders also need to note as the market rotated by an angle corner. This is known as government at all angles. This rule says that when the market breaks a corner, will move to the next.

Another way to determine support and resistance is to combine horizontal angles and lines. For example, often downtrending Gann angle will cross the 50% level violations. This combination will then set a key resistance point. The same can be said for uptrending angles crossing the 50% level. This area is becoming a key support point. If you have long-term pattern, sometimes you will see many corners clustering at or near the same price. They are called cost clusters. The more angles in zone grouping, the more important support or resistance. (For related reading, see Support and Resistance Basics.)

Forex Gann Indicator Angles determine the strength and weakness

Gann angles are primary 1X2, 1×1, and the 2X1. The mean angle 1X2 move one unit of price for every two units of time. The 1×1 moves one unit of price by one unit of time. Finally, 2X1 move two units of price by one unit time. Using the same formula, angles, can also be 1X8, 1X4, 4X1 and 8X1.

A proper scheme scale is important for this type of analysis. Gann wanted to have markets and appropriate square on the chart paper, and the corresponding pattern scale is important to his prediction technique. On his list were square the 1×1 angle is often referred to as 45-degree angle. But using degrees to prepare the angle will only work if the table is properly reduced.

Not only the angles show support and resistance, but they also give the analyst a clue about the power market. Trading at or slightly above uptrending 1×1 angle means that the market is balanced. When the market is trading at or slightly above uptrending 2X1 corner, the market is in a strong uptrend. Trading in or near a 1X2 mean trend is not so strong. The strength of the free market when the market sees the top down. Something under the 1×1’s in a weak position. (For more insight, read the study on the strength of the market move.)

Gann angles can be used for timing

Finally, Gann angles are also used to predict important tops, bottoms and changes in trend. This is a mathematical technique known as quadrature, which is used to determine times when the market is likely to change direction. The basic concept is expected to change direction when the market has reached the same unit of time and price up or down. This timing works better indicator of longer term charts, such as monthly or weekly charts, it is because daily charts are often very tops, bottoms and move on to analyze. As price action, this time tools tend to work better when the clustered with other time indicators.

Conclusion

Gann angles can be a valuable tool to the analyst or trader if used properly. Have an open mind and grasping a key concept that the past, present and future are all at the same time the Gann angle can help you analyze and trade the market with more accuracy. Learning the characteristics of different markets in terms of volatility, price range and how markets are moving in the corner Gann framework will help improve your analytical skills.

Forex Gann indicator levels

Calculation of support and resistance levels with the Gann indicator becomes very simple task.

Forex Gann level indicator

In the thirties of the twentieth century, American merchant and investor Gan, stock trading, I found many interesting models that appear in the price movement. Based on mathematical calculations, he concluded that the angle of 45 degrees (or the angle of 00:59) is an important support for the uptrend and resistance for the downtrend.

Thus, calculating the trends he looked, that if the price drops at an angle of 45 degrees, then it is a downtrend, if price is increased to a higher angle of 45 degrees, then the market’s uptrend.

Forex Gann Indicator Calculator Explanation

Introduction: Gann calculator in the early days of its introduction was a very good response from traders and investors. Many experienced the benefit of this calculator and expressed their experience and difficulties. I am going to describe all these aspects in this manual. It is an authentic tool and base-building formulas can be obtained from books Gann’s Method. As I told all my readers and seminarians before it is secreted tool. It is a simple mathematical formula as given by WDGann and I just simplified it and used to develop this application. I think it is the need of the time to explain how to use this calculator with some examples.

Swing Trading: Swing Trading and the mother is the basis of this calculator. In my own words the definition of swing trading is trade in the direction of price movement. Price movement of shares as described by Gann and Elliott followed harmonic motion. One step forward I would say follow the random Brownian motion. Who found this movement? The traders or investors to determine. The behavior of a trader or investor is again driven by fear and confidence. I will not use the word greed in this context. As a swing trader to learn the price points that generate fear or confidence. These are points I can name as swing turning points or resistance and support points. Although this is a complex thing, but now the day it is getting easier by the use of tools S / W. Gann Calculator is not calculating the work of these swing turning points we have named as resistance, support, buy in, sell entry points.

Gann Calculator: swing 2 supports and resistance point that I believe as a decisive moment for the purchase or sale of entry, are named as input Buy and sell in the calculator input, respectively. In gann calculator I used is the square root formula and the extent to factor formula to calculate the various supports and resistances. I took 180 degree factor as 1 and based on this every 15 degrees and more have calculated resistance and supports.

You have to ask me why 15 degrees and multiples? Given a day, 24 hours and a 360 degree cycle as found in any one hour a day is 15 degrees. My second argument is the basic math says 1 degree as 4 minutes to an hour it is 15 degrees.

You have to ask me why should I believe the last hours of swing high and low for predicting future price? In many statistical tools such as MACD, Bollinger band or finding chart patterns will be used over many data points. Even in the daily chart, also if you use these tools without your knowledge to use many past data points. So it is nothing wrong with using only two dynamic swings high and low data point in this calculator.

How to use? Take an hour past high and low swing as input to calculate the resistance, and key support and key resistance levels of support. Buy and sell entry input prices calculated by Gann Calculator are nothing but the two swing resistance and support points. In less volatile day can encounter congestion. Congestion is nothing but a Buy and Sell input input prices will be set very close together say with RS2 RS 3 difference. You can also encounter the resistance and support. In this case change the swing high and low points of a general or make entry Buy or sell the entry above or below 1 point or target trade between the band means between any two resistances, supports, and stop loss points. Make a practice swing to change the high and low points in time and again every hour. If your position works in profit then use the technique trailing stoploss to maximize profits.

This calculator works and have hundreds and thousands to prove it. If you feel that because I’m sharing this great tool with you then I have a simple answer that knowledge is God gifted and I want to share with you. It is up to you to accept or not. Critics never stop sharing my knowledge with someone. I would advise anyone if it pained me to act better exchange then stop to think about this calculator.

My way to identify the swing high and low:

You can follow any way of identifying high and swing low.

High and low price within a certain time frame. Minimum time must be taken for observation is one hour.

Take last hour earlier days high and low for the next 1 hour days provided global trade sentiment must be neutral during non trading hours of our market.

If the current price action of the script is trending then take the low or high trend monitor high or low.

If you encounter congestion then take the high and low in larger time interval.

Now let’s see some examples that I’ll hype. I also will explain how to enter the trade.

Example 1: Consider a nifty place 10-11 o’clock hour data 2008.Its 12 August 4634 is the high and low was the 4598th

Using these data in the calculator I found that day my key supports are 4600-4566-4498 and 4631-4666-4735 resistance. You can use these data in the calculator and test its accuracy.

At 11:05 she fell and found support at 4565, 11:30 4599 high touch and fell. So it is confirmed in the next half hour was very nifty within the group of my calculated support 1 and support the second

From trading point of view if you miss the chance to enter a short trade in 4611 better then this node will wait or change my data points. Second observation is the low bounce of 4565 failed to level 1 support 4600th So now the support turns into resistance, as the basic technical analysis concept for the next half hour. At this junction, also, I can go with my initial short stoploss as 4611 and 4631 as second stoploss and target as the 4565th See the next half hour nifty create new low of 4557 at 11:52

In this example I used an hour past high and low points of my observation and calculated all the support and resistance values ​​for the next hour. It is not guaranteed to achieve my goal or stop losses in the next hour. It’s just a mathematical assumption based on my observation. I would suggest everyone to treat this as an alternative calculator software tool such as caring for all other indicators and tools.

Example 2: consider the suspension industry high and low in the period 10:00 to 12:00 August 13, 2008. It was trending day suspension because it is creating a higher high and higher low. My swing high and swing low for two hours period in 2353 and 2315, respectively.

Using these two values ​​gann calculator get the following values:

Long entry price is: 2331 goal 2339-2347-2363-2412

Short entry price is: 2337 goal 2329-2320-2304-2256

Because the market was trending RIL and it is creating a higher high and higher low and the current price is well above my second target point and trending upwards. I will use this action to swing into the store Trade Buy me a stoploss as 2339 which is my key resistance, which in turn support and my goal will be 2363rd I will come out of trade in 2363 or slightly below that because this is the 3rd level of the target and important resistance point.

Again I have noticed that after touching a high of 2373.65 price started thinking back. Now I will change my swing low and high. At low as 2339 and as high as 2373.65. The share price is low in 2339 that stock has done just prior to the adoption of this high 2373.65. You could say this is high at low. Note carefully not taken the time high or low, and got the latest low-high.

Why this deviation in principle? If the current price action is contrary to the trending nature of the previous price, then you need to make this deviation. In the second case scenario if the price continues its trending behavior then this deviation in principle will come into focus.

Using these two values ​​received in 2339 and 2373.65

Short entry price is: 2358

Long entry price is: 2355

This is a mess because the difference is only RS 3 / — and will now shift my focus on 1 target level for both long and short. As per my calculation 1 short and long goals in 2363 and the 2349th These two prices will act as my new long entry and short entry points. Specifically suspension will buy over 2363 and sold under the 2349th My stoploss sales 2358-2374-2398 entry will be buying and trading stoploss would be 2355-2339-2314

Watch the second part of the calculator which flags significant support and resistance points. my entry points also coincides with 1 level of resistance and support.

As can be observed in the table 12:35 Mon-level float shares in 2362 has little bounce in 2366 and more downward action began after she has broken the level of the 2349th My goal level in the short article is 2342-2326-2277. You can tell how fit or mathematical miracle.

At 01:30 shares in 2341 and rejected reach back to 2349 levels.

At 02:20 shares touch day low of 2326 level.

Although Gann other method is to calculate the time action, but it is beyond the scope of this calculator. You can read all these methods in my book Gann Method

Read the following section on white paper evidence:

# 1: 10:20 download Nifty future high as 4302 and 4279 low as the calculator Gann. We identify swing turning points as follows. Buy above 4301 for the purpose 4312-4323-4345, stop loss 4279-4246 and sold under the 4280 stop loss order 4269-4258-4237 and 4335. At 10:20 Nifty future trading in 4283

Using current and past price action while squaring away goals loss is expected to be activated before 02:00. In fact, after the turning point of the swing entry was triggered selling a 4269 target was reached within 15 minutes, followed by 2 The purpose and intraday low of 2.30 to 4256.65

# 2: 11:05 to take RIL future high as 4156.4 and low as the calculator 4120 Gann. We identify swing turning points as follows. Buy above 2135 stop loss order 2143-2151-2166 and 2120-2097 and in 2141 sold under the stop loss order 2133-2126-2110-2065 2156-2180. Although the stock was quoting at 2125 at the time, but I will make a brief entry because my short 2 Purpose of entry is almost reached. Around 11:30 we got swing Buy price cause the table 2135th As per the current price and time spent squaring action of the 1st order to purchase entry must occur within one hour and 30 minutes from time caused a buy entry. At 12:08 I scored 1 target in 2143 and retraced back to the 2147 level and touched a short entry trigger price lower than 2140 at 12:20. 1 goal and achieved around 01 o’clock.

One can master the quadrature gann price action is just a simple little practice and analytical knowledge and use the free calculator available on my web site www.smartfinance.in

2009 I feel the need to change this calculator and used a price decession process. This chnage has produced a very good result for the daily operations decission. Please read the manual with him associted intraday Gann Calculator page to learn more to use.

Conclusion: This is a mathematical calculator Gann application. It was developed using the cost price of the Area Action Gann’s method. That is my advice to all traders / investors to treat this application as informative and educational tool.