Foreign Tax Credits for Dividend Stocks

Post on: 20 Май, 2015 No Comment

Jeffrey Hamilton/ Digital Vision/ Getty Images

Dividend stocks are very popular in the United States, because they provide investors with a steady stream of income over time. But before diving into international dividend stocks, you may want to do some homework first. Many countries withhold taxes out of the dividends distributed by a foreign company, which can impact your effective dividend yields .

Dividend Tax Withholdings

Investing in U.S. dividend stocks is a fairly straightforward process. After receiving dividends from the stocks you own, you include them on your tax return and pay income tax. If they are held in a tax-favored account. like an IRA, then you don’t pay any tax on them. Unfortunately, foreign dividend stocks are a bit more complicated.

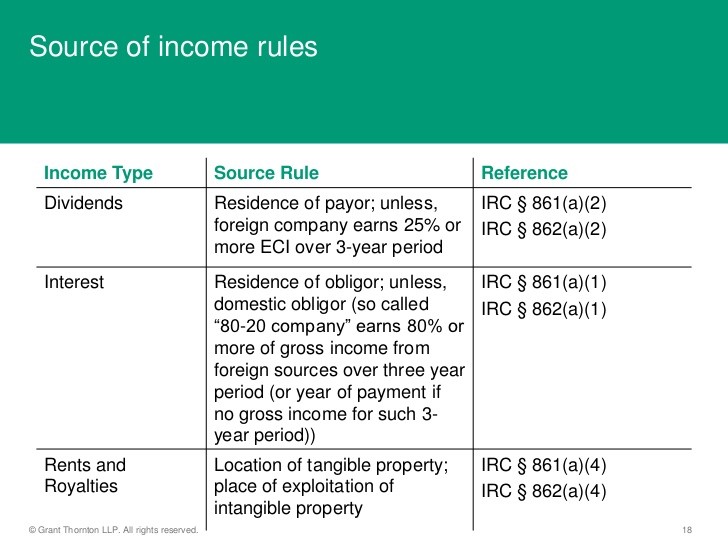

The difference is that dividends paid by a foreign corporation may be subject to tax by that corporation’s home country. In theory, this means that you may have to file separate tax returns for each country in which you receive dividends. The dividend tax rates themselves also differ from country to country, which means you should ask your broker for the exact rates.

Using Foreign Tax Credits

The U.S. Internal Revenue Service (IRS) offers either a foreign tax credit or an itemized deduction for taxes accrued in a foreign country on a foreign source of income that are subject to U.S. tax on the same income, such as stock dividends. Notably, these tax credits are only applicable to offset taxes paid in the U.S. so some retirees may not benefit.

Normally, investors receiving less than $300 in foreign tax credits can file for the credits directly on Form 1040, if the shares in question are held in a traditional brokerage account and a Form 1099-DIV was received listing the foreign taxes paid. Otherwise, it may be necessary to file Form 1116 in order to apply for the tax credit and attach it to Form 1040.

Finally, the foreign tax credit is not applicable in some circumstances. First, the credit cannot exceed your foreign sources of income divided by your worldwide total taxable income. And second, certain countries that are not on good terms with the United States may be ineligible for the foreign tax credit, including countries that the U.S. is at war with, for instance.

Retirement Account Issues

Those with retirement accounts. such as 401(k)s, IRAs and Roth IRAs. should pay special attention to these issues. Since there is no income tax owed in the U.S. on the dividends, any foreign taxes withheld on dividend stocks in these accounts are lost forever. In countries where dividend taxes can be higher than 20%, this can significantly reduce effective dividend yields .

There are a few countries either do not withhold any taxes on dividends or have special provisions for U.S. investors. As a result, investors with tax-advantaged accounts may want to limit their foreign dividend stock investments to these countries.

Tax Treaties & Final Notes

Most countries have tax treaties with the U.S. which may help bring down the tax rates for investors in foreign dividend stocks. But in some cases, the tax rates may differ from broker to broker, since each broker must file paperwork with foreign authorities. In some cases, individual investors can also choose to take this route to receive a discounted rate .

In the end, foreign dividend stocks can be tricky business for investors. But in general, it’s important to remember a few key points when investing in foreign dividend stocks :

- The U.S. offers a foreign tax credit for investors who are at risk of double-taxation by paying dividend taxes to both a foreign country and the U.S.

- Retirement accounts are not eligible for the foreign tax credit. since they would not have otherwise owed the taxes in the U.S.

- Investors should ask their brokers to learn about dividend tax rates in different countries, since the rates vary between country and even financial institution.