Foreign Income Tax Reclamation Claim It or Lose It

Post on: 16 Март, 2015 No Comment

NEW YORK — Tax withholding, or the pay-as-you-go system that has been in place in America since President Franklin D. Roosevelt and World War II, is not merely a domestic experience, it is an international issue that crosses all borders.

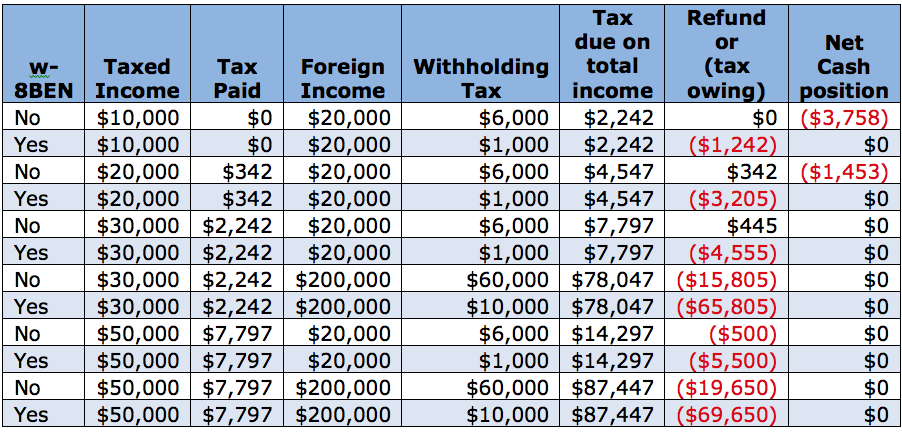

If your clients receive income from international investments, they may be taxed at high foreign withholding rates. However, they may be eligible under Double Tax Treaties to be taxed at a lower rate. In this case, your client may be eligible to reclaim the difference in tax paid between what was already paid (withheld) and the lower treaty tax rate. This difference, in most cases, is held in abeyance by the foreign tax authority, but will generally be lost after some arbitrary statute of limitations expires. Clients who have overpaid (or have been over-withheld) may not be aware that there are taxes to reclaim.

The Reclamation Process

Many factors may affect the success of a recovery, such as the amount being requested for recovery, the timeliness of the claim, who the clients are, how the foreign tax authorities view them, the type of income, the country from which the income originated and the applicable tax rates. The administrative procedures involve a complex network of custodians, withholding agents, brokers, depositaries, depositories and in-country agent banks.

The tax reclaim applications are often difficult to complete. Clients or service providers must procure the forms or have software to re-create them. Interpreting the treaties is a Herculean job, as is keeping up-to-date with ever-changing tax laws and procedures. The forms must be printed, signed and sent to the correct authorities. Frequently, erroneous reclaims are rejected without by the foreign taxing authority as to the disqualifying deficiency.

As a result of complications involved in reclaiming foreign taxes, many claimants do not recover their tax at all, said Martin S. Foont, president of Globe Tax Services. For investors it is a loss and for custodians, funds and intermediaries it is a potential risk and liability.

At stake is whether or not investors can recover their withholdings due to treaties between the United States and the country in which the investment was made. Foreign governments generally impose high statutory withholding rates (often between 25 percent and 35 percent), and investors receive only a fraction of the gross income to which they are entitled.

Foreign taxing authorities do not know who your clients are or where in the world they are based, Foont said. Claims for refunds for hedge funds and partnerships must be filed on behalf of the individual owners and partners. Reclaims are filed by applying the correct treaty based on the status of the beneficial owner. Foreign taxing authorities have varying rules regarding the documentation required to file a claim, Foont explained, and most require proof of residency for the beneficial owner and proof of dividend or interest payment from the custodian.

Special Considerations

American Depositary Receipts (ADR) also present a challenge to investors who are often completely unaware that they have an entitlement because they did not buy the shares in a foreign market (they bought shares on the New York Stock Exchange or NASDAQ). However, investors who buy ADRs (which are foreign shares that trade on a US exchange) have the same issue of withholding at source and the need to file a tax reclaim application. The only difference is that because these shares are depositary receipts they represent the underlying ordinary shares at a specified ratio. Because the shares are owned by a depositary who has issued depositary receipts, the reclaim must be filed through the institution that issued the ADRs so that they can file a claim with the foreign tax authority for the issue. Banks and brokerages perform this function for their clients to varying degrees.

Hedge funds find themselves in a position regarding tax reclamation in which they need to address this issue themselves because their custodians (usually a prime broker) cannot perform it for them. There are two primary reasons for this: First, the claims must be filed on behalf of the beneficial owner of the shares (e.g. individual partners in the fund) and virtually no hedge funds share the identity of their partners with the prime brokers, and second, prime brokers do not have the knowledge or experience necessary to file and follow foreign tax reclaims in a meaningful way. If a hedge fund does not use an outside service provider to file tax reclaims not only will they suffer statutory withholding rates in virtually all markets but they will likely never receive the full amount entitled to them and their partners.

IRS Compliance Issues

Foont said that a common question on foreign tax reclamation is whether an investor can simply take a Foreign Tax Credit for the excess withholding on a cross-border income payment. The instructions for taking a foreign tax credit, IRS Form 1116, clearly states: You cannot take a credit for the following foreign taxes. 1. Taxes paid to a foreign country that you do not legally owe, including amounts eligible for refund by the foreign country. If you do not exercise your available remedies to reduce the amount of foreign tax to what you legally owe, a credit for the excess amount is not allowed.

In other words, a foreign tax credit is only allowed for the non-recoverable portion of the withholding. Taking an additional foreign tax credit for withholdings that could have been recovered had the investor filed a reclaim are not allowable by law.

Statutes of Limitation

Keep in mind that there are varying statutes of limitations on tax reclaims that provide investors with a limited amount of time in which to initiate a recovery of excess withholding.

Due to the complexities, tax reclamation may not be a service you provide directly to your clients, but it may be an important issue to raise in certain instances, and you may want to acquaint yourself with the issues in case you receive inquiries from clients. For technical queries on foreign tax reclamation, please contact Martin S. Foont at info@GlobeTax.com.