Foreign direct investment in Latin America hit record highs in 2011

Post on: 16 Март, 2015 No Comment

An employee works at the assembly line of Ford Automotive in Hermosillo, Sonora, Mexico. (Photo/ Sonora Gov)

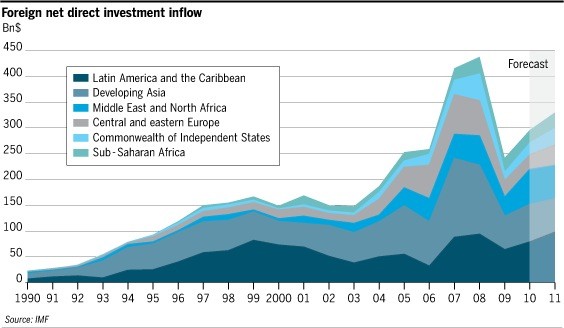

Last year foreign direct investment (FDI) in Latin America continued its surge, topping $150 billion, an all time high for the region.

According to the Economic Commission for Latin America and the Caribbean’s report “Foreign Direct Investment in Latin America and the Caribbean ,” the inflows climbed 31 percent—the most of any region and three times Asia’s growth rate—and now represent just over 10 percent of total global investment (breaking into the double digits for the first time as well).

While nearly all countries gained, the largest recipient, unsurprisingly, was Brazil.

There, investments rose by 37 percent, and in a change from the past, flowed mostly into the manufacturing and service sectors (the largest single investment coming from the German conglomerate ThyssenKrupp’s construction of a $7 billion steel exporting plant).

Inflows to Mexico and Central America were also led by manufacturing and services (including tourism, banking, and the automotive sectors).

Only in South America (excluding Brazil), did most of the investment remain in commodities and natural resources.

Despite tough times at home, Europe led with some $35 billion in investment. Anecdotes suggest that the profitability of Latin American subsidiaries and operations have helped keep some European companies afloat (for instance the Spanish banks Santander and BBVA).

Read related: Brilla Group: Colombia a growing opportunity for tourists, investors

Following in total inflows was the United States, and, if taken in the aggregate, other Latin American states (which invested nearly $23 billion). Interestingly, these countries, Japan, and Canada all outpaced China’s involvement.

The report also touches on the quality of FDI flows, and its potential to transform Latin America’s economies for the better through job creation, technology transfers, capacity building, and the like.

Here the story is better than in the past, but still cautionary. More investment (now over one-third) went into what can be considered medium-high tech sectors, such as chemicals, autos, and machinery.

Most of this uptick occurred in Latin America ’s largest economies, Brazil and Mexico. The study also shows that investment in high end technology and research and development remains small (less than 5 percent) and concentrated in Brazil.

Foreign direct investment is a useful gauge of investor confidence and, indirectly, potential economic growth.

Here Latin America’s decade of macroeconomic stability, natural resource endowments, and expanding domestic markets (due to a growing regional middle class) have drawn increased attention and dollars.

The challenge for the region is to funnel the growing investment to benefit its citizens alongside these international companies and investors, creating jobs, enhancing learning, and increasing productivity in ways that will let Latin America compete globally in the longer term.