For Maximum Market Returns Get Creative With Hedges

Post on: 16 Май, 2015 No Comment

For Maximum Market Returns, Get Creative With Hedges

Most individual investors make very simple decisions when investing — they either buy or sell a stock based on its perceived value. By contrast, professional investors formulate broad investment ideas and then design specific strategies to maximize profit and minimize risk. Individual investors can employ these same strategies by adhering to a simple set of rules and guidelines.

An Introduction to Hedging

Hedges are designed to mitigate risk and isolate opportunity in an investment thesis. For example, an investor who is bullish on a retailer due to its real estate’s value, but bearish on the retail sector as a whole, may want to hedge out the risk of a decline in retailers overall and isolate the real estate portfolio’s opportunity. Or perhaps an investor wants to buy a stock ahead of earnings, but would like to minimize losses in the event of a dramatic decline. (For more, see Hedging In Layman’s Terms .)

Let’s take a closer look at the first example. A hedge fund believes that the value of a retailer’s real estate assets is not reflected in the share price. However, the hedge fund isn’t certain that the retail sector will recover yet amid a declining economy. As a result, the hedge fund decides to take a long position in the retailer, but establish a short position in an ETF that tracks the retail sector.

Assuming that the retailer is trading at $50 per share and the retail ETF is trading at $100 per share, the hedge fund decides to purchase 1,000 shares of the retailer while simultaneously shorting 500 shares of the retail ETF as a hedge. This way, any percentage decline in the retailer relative to the sector is offset dollar-for-dollar.

The result is a position whereby the hedge fund gains from any improvement in the retailer versus its sector, but doesn’t stand to lose anything from further declines in the overall retail sector. Meanwhile, the hedge fund can also adjust the position over time as sentiment about the sector or the opportunity changes. (To learn more, read Exchange-Traded Funds: ETF Investment Strategies .)

The Building Blocks of a Hedge

Hedges can be designed using a variety of different types of securities, ranging from options to futures. All that really matters is the hedge’s value and its relation to the underlying position, which combine to form the investment strategy. However, there are many types of securities that are very useful for individuals to keep in mind when devising creative hedges:

These various securities can be employed in a number of different ways to hedge against:

How to Design Hedges

The actual design of a hedging strategy boils down to a simple, three-step process:

A good hedge often uses the cheapest possible security that offers the protection needed. For example, in the retail situation above, using put options on the retail ETF may be cheaper than purchasing a full short position, while offering the same benefits as the more expensive alternative.

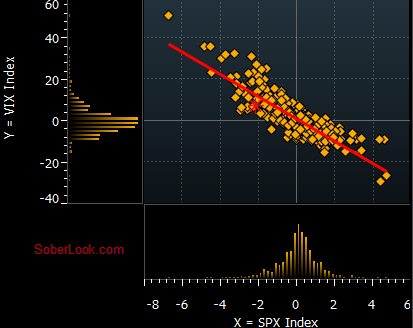

Correlation is very important to consider, as any variance equates to additional unmitigated risk. For example, using gold as an inflation hedge may be less correlated to inflation than using a TIPS ETF or other similar securities. After all, any movement in gold that’s not tied to inflation could mean additional downside.

A hedge’s total value must always match the value of the underlying position in order to completely isolate an investment idea. Going back to our retail example, the total value of the retail ETF short position matched that of the long position in the retailer in order to completely offset any decline in the retail sector. However, the positions can be adjusted as needed, depending on situation and sentiment.

Important Considerations

Effective hedging strategies can help individual investors mitigate risk and isolate opportunity in much the same way that professional investors protect their investments. However, it is important to double-check these hedges and think through the strategy in order to ensure that they will function as expected and help enhance returns in your portfolio. (For more ideas, read Practical And Affordable Hedging Strategies .)