For 2015 Economy Strong but Markets Unstable

Post on: 16 Март, 2015 No Comment

Strong Economic Data Points to Growth in 2015?

As 2014 winds down, many investors are wondering what the economic outlook for 2015 will be. If you look at the U.S. economic data that’s been trickling in, 2015 looks like it could be a very strong year.

The U.S. announced strong third-quarter gross domestic product (GDP) growth of 3.9%. This extends the recent trend of strong quarter-over-quarter GDP growth; in the fourth quarter of 2013, real GDP growth came in at 2.4%; GDP in the first quarter of 2014 contracted 2.9%—though this was primarily seen as a result of the brutal winter; and in the second quarter, real GDP increased 4.6%.

Gloss over the winter of 2014, and the U.S. economy is showing signs of sustained growth. Not only is GDP growth up, but the U.S. jobs market is also improving with unemployment at 5.8%, consumer confidence is up, and so, too, is retail spending.

The U.S. Census Bureau announced recently that November retail sales increased 0.7% month-over-month to $449.3 billion—the largest monthly gain since March 2014. Economists were expecting November sales to climb just 0.4%. On a year-over-year basis, November retail sales were up a whopping 5.1%.(1 )

The momentum could continue well into 2015. And it is excellent news for a country that gets 70% of its GDP from consumer spending. This may be why the U.S. economy is forecast to grow by 3.1% in 2015. That would represent the strongest annual GDP growth since 2005, when the economy grew 3.3%.

In fact, thanks to an improving job market and falling oil prices, the U.S. could enjoy the fastest economic growth in a decade. The optimism and boost in consumer spending can be attributed, in large part, to slumping oil prices.

Special: Guaranteed Oil Pension Checks

Oil Pension Checks could pay you up to eight-times more than Social Security and have no income or maximum age restrictions. The monthly checks can outlive you and continue to generate steady income for your heirs five, ten, even twenty years out. Oil companies do not advertise them; that’s why most investors have never heard of the Oil Pension Check program. To activate your account and to get your own Oil Pension Checks coming in monthly. Click here now to learn more.

Oil prices have been in retreat since the summer due to an increased supply of North American shale oil and weak global economic data. Oil prices faced additional pressure in mid-November, when OPEC (the Organization of the Petroleum Exporting Countries) announced it would not reduce its output.

On Thursday, December 11, the price of West Texas Intermediate oil dipped below $60.00 per barrel, the lowest price since July 2009. Some analysts predict oil could stay around $60.00 per barrel for the next five years.

What could go wrong?

U.S. Economy Strong but Markets Unstable

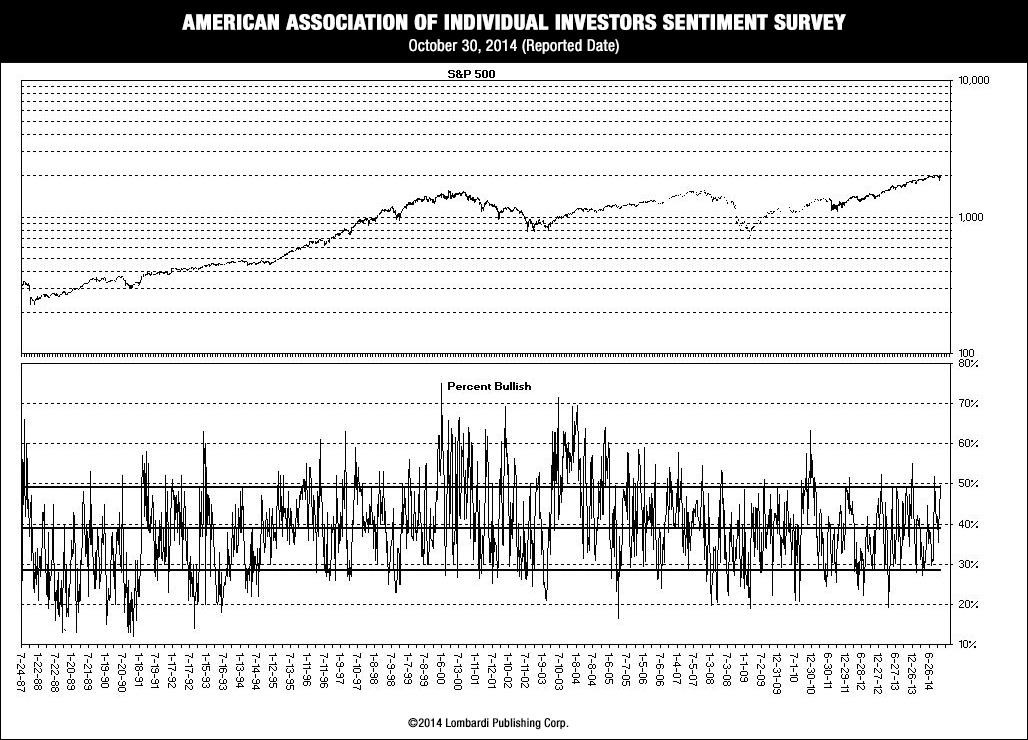

Despite all the optimism surrounding the U.S. economy, there is reason for concern. The stock markets may be near their all-time highs, but they are beginning to shows signs of weakness.

Just because the U.S. is doing well does not mean stocks will run in step. Remember, the stock market is only as strong as the companies that go into making up the exchanges. The U.S. is finally showing signs of strength, but the global economythat’s another issue entirely.

Why? Because roughly half of all U.S. companies get some of their revenue from outside the country. A slowing global economy could translate into slowing global sales and fears of a stock market correction in the U.S.

The fact of the matter is that the biggest economies in the world are in trouble and it is only going to get worse.

China, the world’s second-largest national economy, is cooling. The country reported third-quarter GDP growth of 7.3%, down from 7.5% in the previous three quarters. This also marks the slowest pace since 2009. The fourth quarter is expected to slow even further. For fiscal 2014, China has set bottom-line economic growth in 2015 at seven percent. Growth in 2015 could be even more subdued.(2 )

The eurozone, the biggest economic region in the world, is on the brink of a recession. Germany, the region’s biggest economy, recently staved off a recession when it announced third-quarter GDP growth of 0.1%. In the previous quarter, the economy contracted 0.1%.(3 )

France, the region’s second-biggest economy, announced anemic third-quarter GDP growth of 0.3%; it’s the fastest pace in more than a year—but still, nothing to really celebrate. The country’s unemployment rate is still near 10%, twice that of Germany’s. As in any major economy, high unemployment cuts into consumption and economic growth.

Italy, the third-largest economy in the eurozone, returned to a recession in the third quarter after its economy fell 0.1%—the 13th consecutive quarter that it has failed to grow.

Japan, the world’s third-largest economy, fell more deeply into a recession in the third quarter at an annual rate of 1.9%.(4 )

Russia, a country that derives 16% of its GDP from oil and gas, is being hit especially hard by falling oil pricesand political sanctions. Lower oil prices have erased tens of billions of dollars in market cap from Russia’s biggest oil and gas companies.

Inflation is on the rise and Russia’s central bank has raised its key interest five times this year, from 5.5% at the beginning of 2014 to 10.5% today. And the ruble has plummeted 40% against the U.S. dollar since the start of 2014. Perhaps not surprisingly, Russia is expected to slip into a recession in 2015, as the economy contracts by 0.7%.(5 )

There’s only so much the U.S. consumer can do to support or carry the global economy. That’s why predictions about the country’s economic outlook in 2015 might be a little more gruesome than rosy.