Fly Your Way Into A Profitable Butterfly Options Spread

Post on: 8 Апрель, 2015 No Comment

Im not all that wild about butterfly spreads at least not establishing one as an initial options trade. But if you can turn a vertical spread into a butterfly spread with a guaranteed profit, well, then Im all for it.

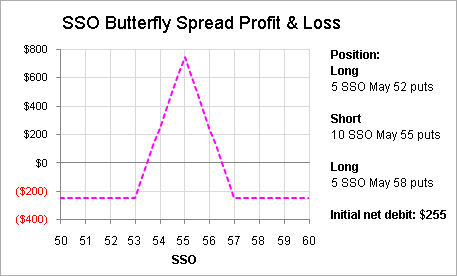

The butterfly spread involves three options using either calls or puts selling two options at one strike while simultaneously buying one option at a lower strike and one at a higher strike.

Heres an example. Lets say that on November 8 you set up the following trade on Netflix (NASDAQ:NFLX ) options with Netflix trading at $90.47.

Your risk is limited to the debit paid. The most you can make is the distance between the strikes (10 points or $1000) less the debit paid in this case $74.

The problem is that the maximum value of the spread lies exactly at the short strike. And you wont see anything close to the maximum value until very late in the expiration cycle.

By the way, all charts in this article assume constant volatility. Thats not the best assumption to make about NFLX, but I dont want to get too complex here. Just remember that higher volatility does not usually help a spread like this. You want implied volatility to ease off so the short options decay more quickly.

Ill bet a bunch of people can trade these butterfly spreads successfully, but you have to be very precise with a gift for knowing not only where a stock will trade, but when. And Im just not that gifted.

Turning Vertical Spread Into A Butterfly

Sometimes you can turn a simple vertical spread into a butterfly spread.

Heres an example. Lets say that on October 3, with Netflix at 113.25, you had set up the following vertical put spread.

Your maximum risk is the $435 debit paid. Assuming the stock goes down, you could make about $1,065 the difference between the strikes ($1500) less the $435 debit paid.

Heres the theoretical profit of that spread at various times to expiration.

But lets say that on October 25 when Netflix fell to 77.37, you looked at the option prices at the close. One choice would be to close your position for a net profit of $785.

Or you could have adjusted your position to fly yourself into butterfly spread with a guaranteed profit.

One way to do this would have been to sell another 85 put and buy a 70 put as shown here.

Youre already long a 100 put and short an 85 put, so doing this creates a 70-85-100 butterfly spread.

But this spread guarantees you a profit. Combined with your initial net debit of $435, you now have a net credit of $300, which is yours to keep regardless of what happens, as shown on the chart below.

Gaining More Profit, Or Breaking A Wing

If you wanted to do something a bit more complex, you could have exchanged your long 100 put for a 90 put. Then you might have bought back your short 85 put, sold two 80 puts and buy a 60 put.

Heres what transaction that creates, a 70-80-90 butterfly spread.

Combined with your initial net debit of $435, you now have a net credit of $520 a bit more than in the example above with a profitability profile as shown below.

Finally, you might have considered breaking one of the butterflies wings, say by doing the following:

Combined with your initial net debit of $435, you would still have a net debit of $340, which would be your maximum risk in a 70/80/100 spread. But as you can see below, the spread would only lose money if the stock rose sharply.

At a price of under $90 or so, the spread would certainly be profitable, and would gain in value over time if the stock stayed in the spreads sweet spot, near about $80.

So while I dont like butterfly spreads as initial positions, they can be a good way to lock in some gains and still benefit from time decay.

As I noted above, simply closing a position at a profit might be the more logical thing to do, but flying your way into a butterfly spread with a guaranteed profit could be something to consider.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.