FLCSX Analysis Fidelity Large Cap Stock Fund

Post on: 12 Апрель, 2015 No Comment

- Fidelity Large Cap Stock Fund is a diversified domestic equity strategy with a large-cap core orientation.

- Our investment approach is to find companies that we believe have attractive earnings and dividend yield potential over the next two to three years, and where our view is different than market consensus.

- We believe securities can become mispriced relative to their true long-term value when investors become increasingly focused on the short term, and our process seeks to exploit these discrepancies to drive performance.

- We strive to uncover these companies through in-depth bottom-up, fundamental analysis, working in concert with Fidelity’s global research team.

Performance Review

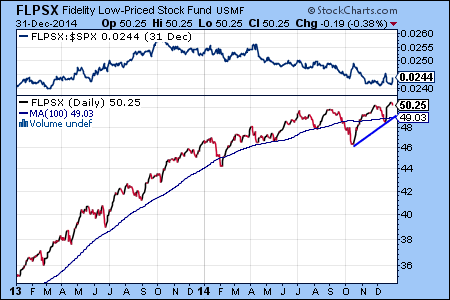

The fund’s underperformance of the S&P 500 Index in the fourth quarter was mostly due to our positioning in the energy and health care sectors, as well as security selection in financials.

The fund was modestly overweight in energy, which hurt because the sector sold off sharply amid falling oil prices. In addition, the stocks we held the biggest positions in underperformed the energy sector overall, including our two largest overweights in the sector: out-of-benchmark positions in Suncor Energy, Canada’s largest energy firm, and U.K.-based large-cap exploration & production firm BG Group.

Both stocks stumbled during the period, as a steep pullback in crude oil prices that escalated in November after the Organization of the Petroleum Exporting Countries (OPEC) said it would maintain current production levels in an oversupplied market. Despite the news, we continued to favor both stocks and added to the fund’s positions on weakness in their share prices.

We think the supply/demand dynamics in the oil market will eventually adjust and buoy the price of crude oil, but it is uncertain how long this will take to occur. We are positioned in companies (like Suncor and BG Group) that we feel can survive in a sustained environment of low oil prices. Both firms sport solid balance sheets and management teams focused on keeping capital expenditures under control — a trait we have admired in them since before the oil price collapsed.

While we continued to maintain the fund’s position squarely in the large-cap blend style box, we opportunistically invest down the market-capitalization spectrum when we feel the risk/reward is in our favor. One of our small-cap positions hurt in the quarter: biotechnology firm Intercept Pharmaceuticals.

The non-index stock was a leading contributor to the fund’s performance for the full year, but shares saw downward volatility in the fourth quarter after an editorial in a well-respected medical journal challenged the company’s phase 3 trial of its therapy to treat nonalcoholic steatohepatitis to meet loftier goals. This opinion caused some negative sentiment related to the stock, but we remained bullish on its prospects because we think the market continued to underestimate demand for Intercept’s lead drug.

Conversely, security selection in consumer discretionary was the largest contributor to relative performance for the quarter, led by one of the fund’s largest overweights: Target. The stock outperformed and served as a top contributor for the quarter and the full calendar year. Target shares gained 22% for the quarter, as the U.S.-based retailer showed signs of recovery from last year’s wide-scale data breach and troubles with its expansion into Canada. Just ahead of the holiday shopping season, the company posted better-than-expected third-quarter earnings and sales, driven by increased customer visits attributed to lower gasoline prices and effective advertising. We maintained our position in the stock because we thought the core U.S.-based business was well positioned to grow at a pace greater than the market’s valuation implied.

Underweighting some high-growth index constituents dampened relative performance for much of 2014, but it helped in the quarter. As an example, we avoided biotechnology company Gilead Sciences due to valuation concerns. After hitting record prices in November, shares of Gilead tumbled mid-December on approval of a potentially cheaper alternative to the company’s breakthrough drug to treat hepatitis C, Harvoni . Gilead returned about -11% for the quarter. We continued to avoid the stock, as we thought there was a significant risk that the company’s long-term earnings would not meet expectations.

LARGEST CONTRIBUTORS VS. BENCHMARK