Flash Crash

Post on: 2 Июль, 2015 No Comment

QE Caused Crash to Negate its Benefits: Independent Financial Advice

QE risks of a fatal error could affect stocks

The risks of unlimited, unending Quantitative Easing are greater than assumed. The Federal Reserve may be tempted to think that all that matters in risk mitigation is to be able to stop inflation caused by QE by simply raising interest rates high enough to shut down the economy. So the Fed assumes it has future QE risks under control. The problem is not simply the risk of inflation, rather the real problem with QE is that it creates market distortions which will result in “innocent”, naïve investors getting hurt as they try to play the carry trade in an attempt to earn a reasonable yield. Remember when Orange County experienced losses during the 1994 bond market rout?

The fundamental problem with QE is that it is a radical, untested, and therefore unknown and potentially unmanageably technique. It is like a mountain climber going up very high where no one has ever gone before. The risk is great that the climber who ascends by facing into the wall (to avoid looking down) may eventually look down and get scarred of just how high he is and how risky his situation is. Then he may panic and come down suddenly, possibly making a fatal mistake.

When interest rates return to normal then lots of carry trade programs will be shut down causing losses for some investors. Some of these programs could be embedded inside of major corporations and government agencies looking to earn extra money by playing interest arbitrage. They borrow at rates of less than 1% and lend at 3% and lever it up several times during the current market. However, when rates return to normal these arbitrageurs may find their assets default or go down in value and their carrying costs exceed the portfolio’s yield. If they are leveraged five times then a 10 to 20% portfolio asset loss could result in a 50 to 100% loss of equity. Lehman was leveraged 30 times.

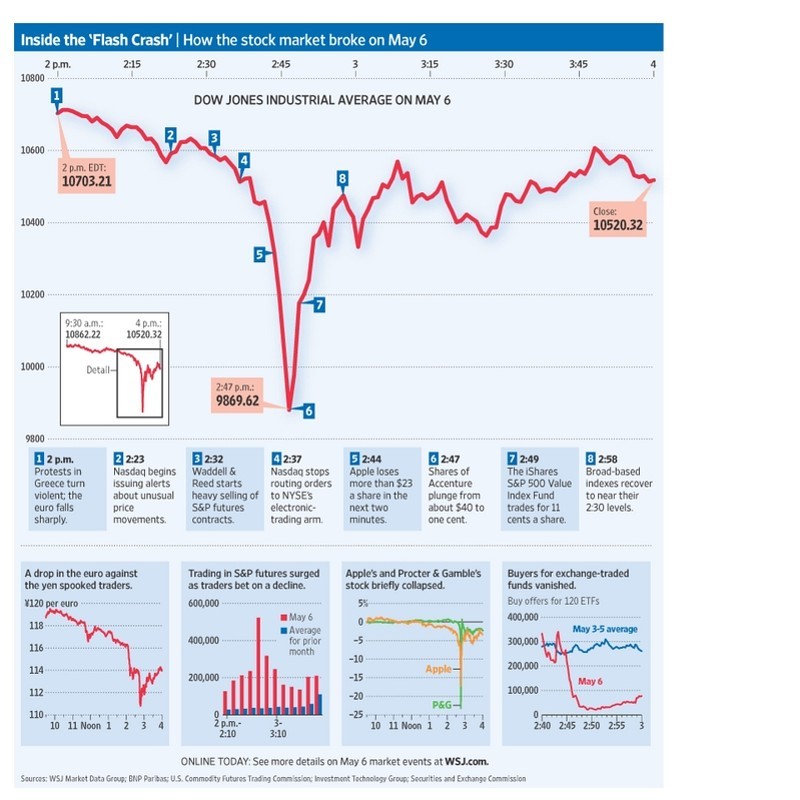

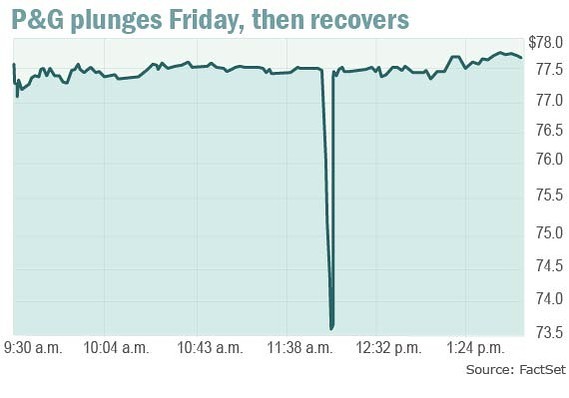

The expectation of QE is that the “wealth affect” will make consumers buy more things. But for every affluent consumer who made some money in stocks there may be another consumer who suffered a severe drop in interest income. Thus the wealth affect is minimal. QE incurs the hidden risk of a future economic blowup which will do worse damage than the alleged benefits of the wealth affect. The recent bond market rate increase in the week of May 28-30 was the worst in two years. It hurt the high yield alternatives to bonds more than it hurt bonds. My concern is that naïve retail investors may seek yield by buying high risk junk bonds, oil MLP’s, mortgage REIT’s and when the truth comes out these assets will have only panicked sellers and no buyers leading to “Flash Crash” price drops. But unlike a Flash Crash, when these drop in price and cut their dividends after QE ends they won’t recover.

Another problem with QE is that it is supposed to motive allegedly wimpy overcautious savers (who are actually brave enough to withstand Wall Street bubble propaganda and instead keep their funds in bonds and CD’s) to switch to investing in equities. An analogy would be if the government closed down Social Security for a few years and told the beneficiaries to earn money by starting a small business. The problem is that if everyone starts a small business at the same time there won’t be enough demand for the goods and services produced and the business may lose money. So an attempt to nudge savers into equity ownership won’t create sustainable jobs because there has to be demand for the services of the corporations. If I buy a share of stock in GM that doesn’t mean a car buyer will decide to buy a car and that the company will then hire a worker. All QE does is encourage more aggressive, overleveraged forms of speculation in non-productive things like mortgage REIT’s rather than encourage funds to be put into new businesses that may create jobs. Today the Barclays Aggregate bond index yields 1.75% if bought in the form of an ETF. Several years ago the yield was around 6%, which is a decline of 71%. The opportunity loss incurred by savers has resulted in some people over age 55 returning to the work force thus making it harder for young workers to find a job, thus defeating the forecasted benefits of QE to reduce unemployment.

When there is a Flash Crash caused by QE’s end that will hurt traditional high quality non-speculative stocks, as they are moderately overpriced and should only be bought at good, low prices.

Investors should seek independent financial advice.