Five Best ETF Themes For Investors In 2015 SPY DIA HEWJ

Post on: 1 Апрель, 2015 No Comment

ETFs proved a winner in 2014, with assets in U.S. funds topping $2 trillion on Dec. 22. That confirmed the popularity of exchange traded funds, as well as a successful year for the stock market.

The start to 2014 was rocky, with a stock market slowdown induced by the polar vortex. In the second quarter, the Fed’s signals on ending its bond purchase program created volatility. Then things calmed down. As the year wore on, investors adjusted well to the rate policy moves. Various economic indicators showed resilience on the home front even as the global outlook weakened.

The U.S. economy continues to provide leadership to the rest of the world, Omar Aguilar, Charles Schwab’s CIO of equities, said in a Dec. 19 media conference call.

SPDR S&P 500 (ARCA:SPY ) rose 13.5% in 2014, booking its sixth straight year of positive returns.

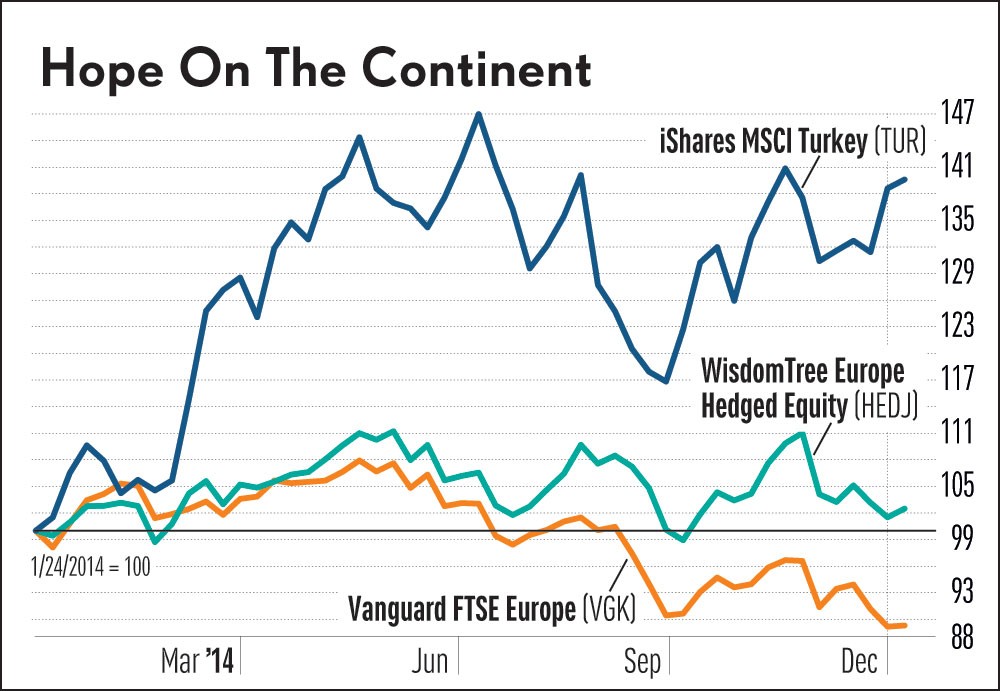

SPDR Dow Jones Industrial Average (ARCA:DIA )gained 9.8%. Meanwhile, iShares MSCI EAFE (ARCA:EFA ), tracking stocks in developed international markets, tumbled 6.2%.

At the sector level, real estate was the most sought after as interest rates declined, contrary to investor expectations, David Mazza, head of research for SPDR ETFs, wrote in State Street’s 2015 ETF and Investment Outlook report.

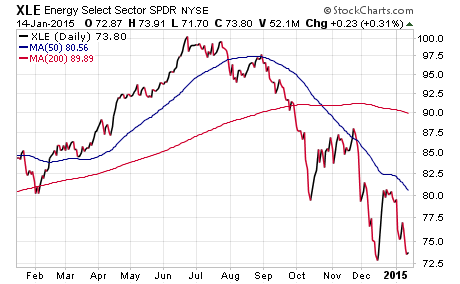

Energy and health care stock ETFs also ranked highly in inflow, the report noted.

Equities saw more inflow than any other asset class, according to data from TrimTabs Investment Research in Sausalito, Calif. Faced with anemic global growth and geopolitical tensions, ETF investors showed a strong domestic bias.

Investors put $143.3 billion into U.S. equity ETFs in 2014, beating the record $138.1 billion inflow in 2013. Global equity ETFs absorbed $40.1 billion in 2014 vs. $57.9 billion the previous year.

Putting the taper tantrum behind, bond ETFs bounced back with $52 billion flowing in. That marked a reversal from 2013 when $5.2 billion trickled in.

Investors pulled $300 million out of commodity ETFs vs. a $30.2 billion outflow in 2013. The asset class got slammed by a supply glut, slowing worldwide demand and a strong U.S. dollar.

The greenback rose 13% against a basket of six major world currencies. It was one of the year’s standout economic trends and boosted the appeal of hedged ETFs. The $282 million iShares Currency Hedged MSCI Japan (ARCA:HEWJ ) rose 17.9% in 2014 after its Feb. 5 launch. Its nonhedged counterpart, the $14.5 billion iShares MSCI Japan (ARCA:EWJ ), tumbled 6.2%.