Fine Art Funds A Beautiful Investment

Post on: 15 Май, 2015 No Comment

Have you ever admired a piece of art and wished you had the money to own it? Are you the type of person who would rather invest in the arts than in traditional Wall Street firms? Then you’ll want to check out this relatively new investment vehicle — art investment funds. In recent years, these funds have become a very enticing alternative investment tool, and may even make owning a stake in fine art accessible for the non-wealthy. (For background reading, see Fine Art Can Be A Fine Investment .)

In Pictures: 6 Biggest Millionaire Flops

It’s a Beautiful Thing

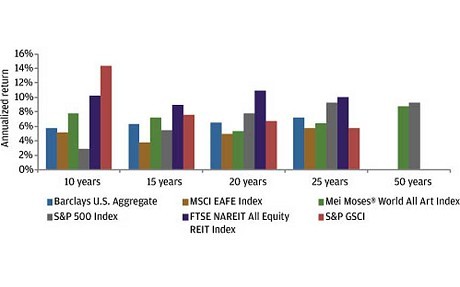

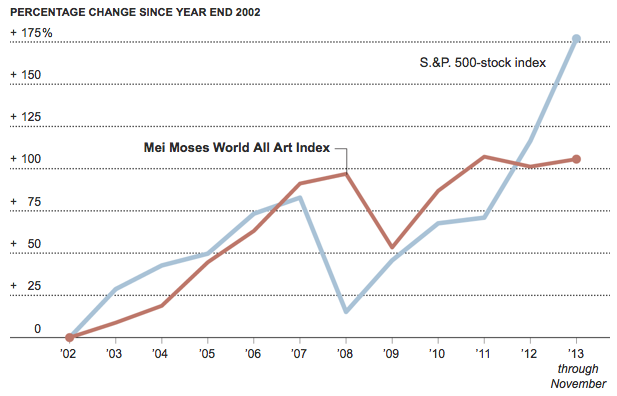

Stocks plunged during the recent recession, but the economic downturn’s impact on the art market was minimal. At the height of the recession in 2008, the art market fell a slight 4.5%, according to the Mei/Moses All Art Index, which tracks the long-term performance of fine art. This isn’t the first time the art market fared well in a poor economic climate — it also out-performed the stock market during the 2001 recession.

So far, art market has enjoyed seven years of price appreciation. According to Bloomberg, the average compound annual return has been 33% since 2004. The high historical performance has attracted the attention of hedge fund managers. endowments and foundations, and ultra-high-net-worth individuals.

Even financiers noticed the trend. They eventually gathered together to form art investment funds with assets ranging from the tens of thousands of dollars, to more than $100 million. These funds leverage purchasing power to buy art. Generally, the minimum entry into these funds for an investor has been $250,000. Investors typically receive a diversified portfolio of art, annual statements and appraisals for the artwork.

As the funds emerged, some had trouble raising funds, and struggled with the costs of buying, storing and insuring the art work, such as ABN AMRO, which closed a year after it launched. Most funds are still in their formative years and are developing a track record of success. Here are a few that have prevailed or recently launched with funds in the millions:

1. Anthea 1 Contemporary Art Investment Fund

The closed art fund’s target is the uber-rich. It’s overseen by the Irish Financial Services Regulatory Authority. The period of the artwork is from 1945 to present day. Target artists include Frank Stella and Jeff Kochs. The fund plans to raise 80 million in euros, or about $110 million dollars.

The renowned investment house started in 2001. The fund claims it’s the first of its type to invest in art as an asset class worldwide. It holds assets of $100 million under management and consists of four unregulated funds: the Chinese Fine Art Fund, the Middle Eastern Fine Art Fund, the Fine Art Fund and Fine Art Fund II.

3. Artemundi Global Fund

Artemundi is a private investment fund that allows its investor to display the artwork on a revolving basis in their homes or offices. Its collection includes Old Masters, Post-War and Contemporary Art. Artists include Claude Monet, and Frida Kahlo and Diego Rivera.

Conclusion

Art investments are considered risky because it’s hard to gauge what type of art will be in favor in the future. Generally, art is considered an alternative investment and should make up no more than 5% of an overall portfolio. Also keep in mind that many of these funds are unregulated. This will mean embarking on intense research. Increase your knowledge by reading art magazines and journals and learning about the artists whose work is included in the funds you’re considering.