Finding Undervalued Stocks The Graham s Number Technique

Post on: 16 Март, 2015 No Comment

B enjamin Graham (1894-1976) is considered by many to be the architect of Fundamental Analysis and Value Investing. Graham liked to find discrepancies between a stocks price and its value and would buy large portfolios of undervalued stocks, holding them until they became fully valued. In his 1949 book The Intelligent Investor, Graham describes a stock selection technique that identifies stocks that are trading at a deep discount to a calculated value termed the Net Current Asset Value or NCAV.

It is important to note that Graham would consider the NCAV to be a first step in further analysis of the stock. A sensible investor would investigate the balance sheet further to check for a sound business with other desirable factors such as good earnings,revenue growth, low debt-to-equity, and good operational cash flow per share.

Stocks trading at such a deep discount are few and far between, and have usually been beaten down by a combination of bad news and emotional reactions from the investing public. These stocks were Grahams bread and butter. He repeatedly insisted that the time to buy stocks was when everyone else was selling and the time to sell was when everyone else was buying. Had he been alive, he certainly would have been out of stocks before the dot com bubble burst and would surely have been picking up bargains soon after. It is no secret that one of Grahams most famous disciples is Warren Buffett who has consistently beaten the market by a large margin with his investments.

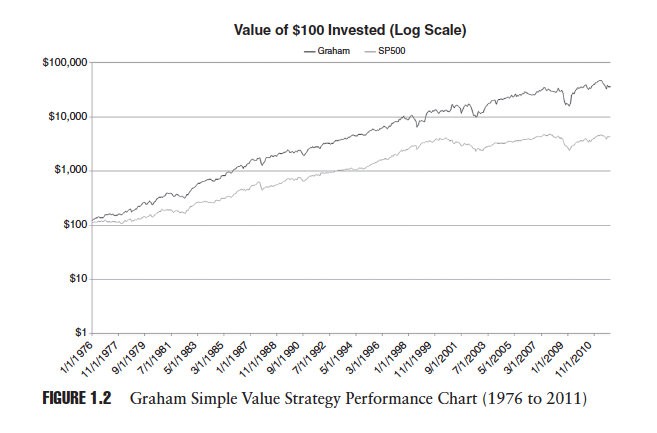

One study has shown that Grahams NCAV strategy works well; in this particular study, portfolios picked using the strategy at the beginning of each year between 1970 and 1983 would have returned an average annual gain of over 29% when held for only the duration of each year in this 13 year period.

Van Tharp mentions an actual investing strategy based on the NCAV or Grahams Number as it is sometimes called, in his book Safe Strategies for Financial Freedom. The strategy as mentioned by Tharp involves buying stocks at two-thirds of their NCAV, and selling a third of your holding when a 50% profit is achieved. If the price continues upwards to 100% profit, you sell a number of shares to make up half your original holding.

You now have your original investment back and have a holding of free shares. This strategy can be performed in an IRA using a large portfolio of perhaps 30 similarly undervalued stocks. If the market has been declining for several months, there will be several such stocks to choose from. In an up trending market, however, it will be much harder to find good value candidates but diligent investors who do their homework will more often than not be well rewarded for their efforts.