Finding the Right Withdrawal Rate One Key to Portfolio Sustainability

Post on: 22 Июль, 2015 No Comment

by Maria Crawford Scott

Like all investors, individuals who are living off of their retirement savings need a blueprint to construct a successful portfolio.

But the blueprint that works for the typical investor who is saving for retirement wont work for those who are living off of their retirement savings.

Thats because the goals of these two types of investors are not quite the same.

All investors want maximum returns on their savings. But those living off of their retirement savings are also savings consumers who use their savings to support themselves. These investors typically have two goals:

- Goal OneSavings That Last: One goal is that your savings need to provide you with your living needs throughout your entire lifetime. In other words, your savings need to last at least as long as you do, through all kinds of market conditionsboth bull and bear.

- Goal TwoSavings That Provide Large Annual Paychecks: The other goal is that your savings should provide you with enough financial resources so you can do the things you want to do during retirement. In other words, you want your retirement savings to provide you with as large an annual paycheck as possible.

Unfortunately, this presents individuals living off of their retirement savings with a dilemma: Their two savings goals are actually working against each other.

If you are living off of your savings, how do you balance those goals? To be more specific: How do you find the point at which you can spend the maximum amount of your retirement savings each year, and still be sure that you will have enough savings to support you for the rest of your life?

There are three key elements that will help you keep these goals in balance and allow you to maintain a successful retirement portfolioone that you can comfortably live off of, and that can survive during bull and bear markets:

- You need an appropriate systematic withdrawal approach that focuses on realistic rates of withdrawal.

- You need an appropriate asset allocation that includes diversification among the three major asset classes (stocks, bonds and cash) and diversification within the most volatile categories (particularly stocks).

- You need an appropriate monitoring system that includes: 1) Rules regarding annual spending amount increases and decreases to help ensure that you stay on course; and 2) Periodic reassessments of your asset allocation and rebalancing.

This article focuses on the first key, and helps you answer the question: How much of your retirement savings can you safely withdraw each year?

Your Withdrawal Approach

To answer this question, you first have to settle on the approach you are going to use to determine your annual withdrawal amount. The approach that you choose is critical, because it will have a big impact not only on the obvious issues of how much you can withdraw each year and on protecting your savings so they last your lifetime, but also on your asset allocation strategy.

For example, one relatively popular rule-of-thumb is to withdraw only the income generated from your investments. This approach is popular because it seems like a good way of protecting your principal valueafter all, youre spending only the income.

However, the typical impulse is to maximize income by putting a large amount in higher-yielding investments, such as bonds. The downside to this approach is that, over the long term, both your savings and the income it generates may not be able to grow in real terms to keep pace with inflation, and eventually you may be forced into a lower standard of living. In other words, you will be consuming current income at the expense of future growth.

One way around this problem would be to simply invest your assets for maximum return and live off of your portfolios real rate of return each year. This approach encourages a heavier stock commitment, which maximizes long-term growth.

However, the returns over the last few years illustrate perfectly the havoc this approach can wreak to your income: Using this approach, your income tends to fluctuate wildly year-to-year. It does not produce a steady source of income.

A more useful approachthe one that is used by most financial advisers todayis to basically create an immediate annuity out of your savings portfolio. To do that, you:

- Total up all of your investable assets, estimate your life expectancy, and determine a first-year withdrawal rate for that portfolio. The withdrawal rate takes into consideration all of the earnings that will be received on all amounts of your remaining invested savings until the portfolio is exhausted, and it divides everything up equally over the time horizon. This basically allows you to withdraw both principalyour original savingsas well as earnings on that principal amount, over your lifetime.

- That first-year withdrawal rate is translated into a dollar amount, which becomes your first-year incomethe actual dollar amount that you can withdraw from your portfolio.

- The next year, you are allowed to withdraw your prior-year dollar amount increased by the rate of inflation.

Under this approach, in your first year of retirement, a first-year withdrawal rate is determined that is a percentage of your first-year investment portfolio; that percentage rate translates into a specific dollar amount that becomes your first-year withdrawal. That first-year dollar amount then becomes your annual withdrawal amountalthough typically the dollar amount is increased each year by the rate of inflation. Note that, in subsequent years, your withdrawals as a percentage of your portfolio value will vary, depending on your portfolios performance.

For instance, if you have a $1 million portfolio in your first year of retirement, and your first-year spending rate is 4%, your first-year withdrawal would be $40,000. The next year you would increase $40,000 by the rate of inflation and withdraw that dollar amount.

Now, if several years down the road your portfolio has had significant losses, your annual spending rate in those years may be greater than 4% of that years portfolio value; if your portfolio has had significant gains, your annual spending rate in those years may be less than 4% of that years portfolio value.

SPECIAL OFFER: Get AAII membership FREE for 30 days!

Get full access to AAII.com, including our market-beating Model Stock Portfolio, currently outperforming the S&P 500 by 4-to-1. Plus 60 stock screens based on the winning strategies of legendary investors like Warren Start your trial now and get immediate access to our market-beating Model Stock Portfolio (beating the S&P 500 4-to-1) plus 60 stock screens based on the strategies of legendary investors like Warren Buffett and Benjamin Graham. PLUS get unbiased investor education with our award-winning AAII Journal. our comprehensive ETF Guide and more – FREE for 30 days

Withdrawal Rate Clarification

It should be emphasized that the rate I am talking about in terms of the withdrawal rate approach is a rate that applies to your first-year withdrawal only.

You should also be aware that the withdrawal amount I am talking about in using this approach is a gross income type of figure. This gross amount, along with any other sources of income, is what is used to pay your annual living expensesand by that I mean all expenses, including taxes. The withdrawal amount does not take into consideration taxes due based on the source of the withdrawal. So, two individuals may have the same initial withdrawal amount, but one may have a much higher tax billand therefore less to spend on everything elsethan the other individual, depending on how they are withdrawing from their savings.

Lastly, please be aware that the withdrawal rate discussed in this article has nothing to do with required minimum withdrawals from retirement accounts.

The advantage to this approach is that it allows you to separate your asset allocation decision from your withdrawal needs, so that you are not focusing too much on one particular need at the expense of another. This tends to encourage you to invest for the long term, since the withdrawal rate does not depend on any income component. Therefore, higher-growth potential investments such as stocks are less likely to be pushed aside in favor of higher-income but lower long-term growth investments.

Adapting the Approach to the Real World

Before you get worried about annuity formulas and how to figure out the percentage rate, well take a look at how this approach has been adapted to the real worldand youll see that you dont need to worry about working through any formulas.

If you were to use a strict annuity approach, you would plug your assumed long-term average annual rate of return on your portfolio into an annuity formula and you would come up with a withdrawal rate. But that withdrawal rate would probably be a much higher rate than is warranted. Thats because that average annual rate of return over your time horizon comes from actual returns that in the real world vary tremendously year-to-year: One year your return may be up 15%; the next year, it could be down 45%.

The annuity formula would work fine if you were to make no changes to your portfolioif you neither added money to nor withdrew money from your portfolio: The sequence of returns makes no difference to your ending amount for any given long-term rate of return. But if you are making withdrawals from a portfolioas anyone living off of their retirement savings would bethe timing and sequence of the returns that you receive make a big difference on your ending portfolio value: If you receive higher returns in the earlier years, when your savings are at their highest level, your risk of outliving your assets is much lower than if you receive higher returns toward the end of your life, when you have less savings because of all your withdrawals.

Unfortunately, investors have no control over return sequences. Fiddling with your asset allocation by substantially increasing your commitment to low-volatility assets wont solve the problem because that substantially lowers your average long-term rate of return.

Sothe solution still uses the annuity concept, but not the actual formulaand that concept has been adopted very carefully by the financial planning community and financial academics.

Instead of relying on one annuity formula, they have been testing the concept using various rates of withdrawals and different asset allocations over real market conditionswith lots of different return sequencesto see which withdrawal rates and portfolio combinations are actually safest. In other words, they examine a portfolios success rate, which is the percentage of times that a portfolio is able to sustain the given payout over the entire time period without running out of assets prematurely.

Withdrawal Success Rates

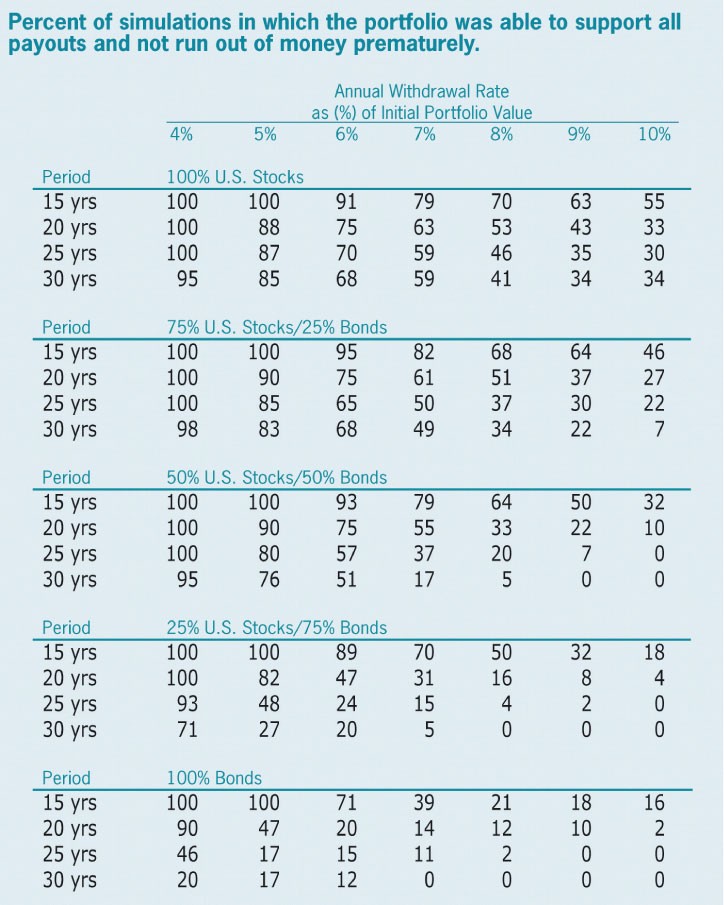

Figure 1 is from an article that appeared in the AAII Journal way back in February of 1998 written by three finance professors from Trinity University in Texas. This study is frequently quotedit was one of the first and, I think, one of the best because of the long time period it covered. For that reason, I think it is still valid, even though it may appear to be a bit dated.

This figure shows the portfolio success rates of various stock and bond combinationsthe top grouping is a portfolio consisting solely of U.S. large-cap stocks; the second group is a portfolio of 75% stocks and 25% bonds, and so on.

* Assumes inflation-adjusted withdrawals in subsequent years. Source: Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable, by Philip L. Cooley, Carl M. Hubbard, and Daniel T. Walz, AAII Journal, February 1998.

These success rates were determined based on the actual annual sequence of returns from 1926 to 1995 for varying rates of withdrawal (the vertical columns, starting with 4%), and payout periods (the leftmost column covering 15 years, 20 years, 25 years and 30 years of payouts).

The success rate is the number of times a portfolio was able to make annual withdrawals without running out of assets over the time period relative to the number of total scenarios. The annual withdrawals are determined in the same way I described earlieran initial spending rate is determined, converted into a dollar amount and then increased for inflation in subsequent years.

For instance, if your portfolio were invested 75% in stocks and 25% in bonds, and your withdrawal rate was 4% of the initial portfolio value with inflation increases in the following years, your investment portfolio would have completely supported you for 98% of all 30-year time periods from 1926 to 1995.

In other words, there would have been a 2% chance you would have run out of money if you lived off of your portfolio for any 30-year time period between 1926 and 1995.

In contrast, if you withdrew 6% of the initial portfolio value with inflation increases in the following years, your investment portfolio would have completely supported you for only 68% of all 30-year time periods.

Interestingly, the professors originally set out to study the importance of asset allocation in a withdrawal portfolio (a portfolio from which withdrawals are being made annually). Certainly, the study did show that asset allocation was an important aspect.

However, the most important conclusion they came toand that more recent studies supportis that the primary way to ensure your own investment portfolios success rate is to establish a realistic initial withdrawal rate of not more than 4% to 5% of your investment portfolio assets.

You can clearly see from the table that withdrawing at higher rates will significantly increase your risk of outliving your assets, especially for longer payout periods.

More Recent Studies

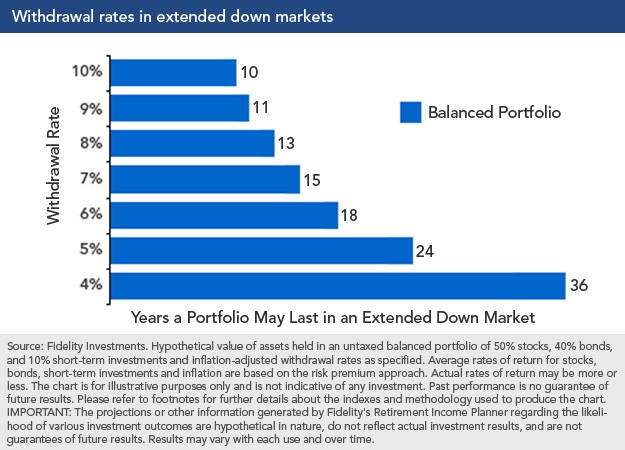

Figure 2 shows a more recent study based on returns that ran through 2005. It only considered a 30-year payout period, but used a wide range of withdrawal rates and a wide variety of stock and bond allocations. The curved lines represent various withdrawal rates, with a 3% rate running along the bottom, close to the horizontal axis.

Simulated return sequences were determined by randomly selecting 30 one-year real returns from 1926 to 2005 for each 30-year period. A total of 10,000 separate 30-year sequences were calculated, so you can see they are using a slightly different methodology than the Trinity study.

Source: “Guidelines for Withdrawal Rates and Portfolio Safety During Retirement,” by John J. Spitzer, Jeffrey C. Streiter and Sandeep Singh, Journal of Financial Planning, October 2007.

This chart shows runout percentage, which is the opposite of survival ratesit indicates the percentage of times a portfolio was unable to sustain all of the payouts.

This study is shown because it includes returns from a more recent time period. But its results are strikingly similar to that of the first study: For an investment horizon of 30 years, a 3% withdrawal rate would keep you safe under almost any scenario, but thats an exceptionally low withdrawal rate. As you can see in the chart, if you want to remain at 10% or under in terms of shortfall risk, you need to keep your annual withdrawal rate low, at around 4%.

(To put a shortfall risk into perspective, remember that the actual chance this will occur is combined with the chance that you or you and your spouse will survive over that entire time period.)

Keep in mind, too, that in all of these studies, the stock portfolios were diversified, typically by using a major market index, and the asset allocations were held steadythere was no attempt to time the markets.

The Bottom Line: Realistic Withdrawal Rates

The bottom line from these studies is that you dont need a rock-bottom withdrawal rate to be safe. However, you do need to keep the withdrawal rate realisticand in these studies, that meant taking not more than 4% each year if you want your portfolio to survive throughout retirement.

Keep in mind that this doesnt mean you can select a realistic withdrawal rate and then put your portfolio on autopilot. You still need the other elements of portfolio management: a proper asset allocation that includes commitments to all three major asset classes, and a portfolio monitoring system that includes spending adjustmentsmidcourse correctionsto ensure that you stay on track.

But setting a realistic withdrawal rate is the first step toward reaching your ultimate goal of striking the fine line between spending the maximum amount of your retirement savings each year and being assured you will have enough savings to support you for the rest of your life.

The Withdrawal Rate Approach

These are the major points to keep in mind:

- The advantage of a withdrawal rate approach is that it allows you to separate your asset allocation decision from your immediate withdrawal needs so that they do not drive your asset allocation decision.

- This encourages you to invest for the long term, since the withdrawal rate does not depend on any income component.

- Annuity tables assume unvarying return rates each year, but your return rates will vary significantly year-to-year.

- For that reason, base your withdrawal rate on studies of portfolio success rates. You can use the tables here to help you determine an appropriate initial withdrawal rate. This withdrawal rate only applies to your first-year withdrawal; after that, you can withdraw the same dollar amount as the prior year adjusted for inflation. This is a pretax amount that does not take into consideration what type of account your withdrawals are made from (taxable or tax-deferred).

- Make sure you use a realistic spending ratenot more than 4% of the initial portfolio value.

- This approach is not an autopilot approach. You still need to develop an appropriate asset allocation strategy and a portfolio monitoring system that allows for midcourse adjustments to ensure that your portfolio remains on track.