Finding the premium or discount of an ETF is easy

Post on: 2 Июнь, 2015 No Comment

Q: How can I find out how much the basket of stocks in an exchange-traded fund is worth and how much more or less investors are paying for that basket? Can you use EGA Emerging Global Shares (EMT) as an example?

A: Both exchange-traded funds (ETFs) and mutual funds have the same purpose. Both make it easy for investors to buy just one security, which gives them a stake in many securities.

Both ETFs and mutual funds can help investors build diversified portfolios, which is the cornerstone of a sound investment strategy.

But while ETFs and mutual funds both help get investors to the same destination diversification they take different paths to get there.

Mutual funds, and I’m addressing the most common type called open-ended mutual funds, pool all investors’ money and use that money to buy securities for the fund. When you add money to your mutual fund, the fund company uses it to buy more securities for its portfolio. The price of an open-end mutual fund is calculated at the end of the day, based on the net asset value of the securities it owns. So there is no premium or discount.

ETFs work differently. Behind the scenes, large investors trade units of ETFs, which own a preset basket of securities. Individual investors can then buy and sell those individual units, just as they would shares of stock. The trading of these ETFs pushes the price around, usually near the value of the ETF’s holdings. If the price of an ETF diverges from the value of the securities in the basket, institutions can trade them or create units, bringing the price back in line.

Usually the constant buying and selling of ETFs does exactly what it’s supposed to: Keep the market price of the ETF close to the value of the securities it owns. This is especially true with the most popular ETFs, such as those that track the Standard & Poor’s 500 or Nasdaq 100 stock indexes.

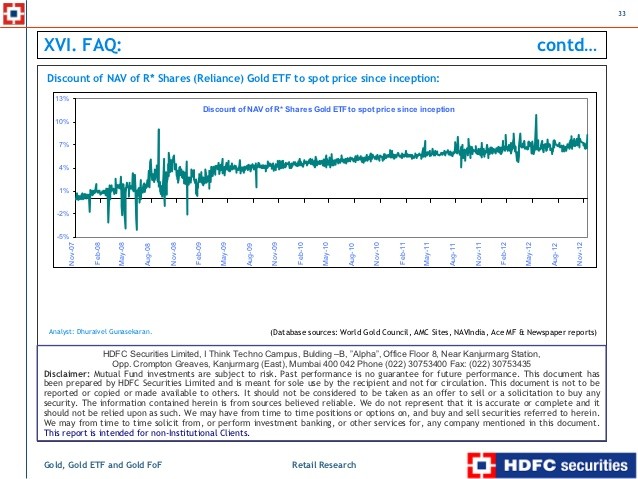

But less heavily traded ETFs can see strange things happen. Sometimes the market price of an ETF can get much higher than the value of the assets it owns, which is called a premium. And the reverse can happen, when the market price is below the value of the assets the ETF owns, called a discount.

Knowing whether an ETF has a large premium or discount is important for ETF investors. You don’t want to pay $105 for a basket of stocks worth just $99.

USATODAY.com’s ETF center makes it easy to see if an ETF has a premium or discount and how large it is. We’ll use the ETF you’re asking about, with the symbol EMT. Just enter the ETF’s symbol in the Get A Quote box at money.usatoday.com. and you’ll see this page .

Scroll down just a bit. On the left-hand side of the page,opposite the Management Company block, you’ll see a line called Prem/Discount, which is the premium or discount as described above. When I wrote this, the ETF you’re asking about was selling at a premium of of $0.51, or 51 cents. Now you know how to look it up.

Matt Krantz is a financial markets reporter at USA TODAY and author of Investing Online for Dummies and Fundamental Analysis for Dummies. He answers a different reader question every weekday in his Ask Matt column at money.usatoday.com. To submit a question, e-mail Matt at mkrantz@usatoday.com. Click here to see previous Ask Matt columns. Follow Matt on Twitter at: twitter.com/mattkrantz