Finding Fortune In ForeignStock ETFs

Post on: 24 Июнь, 2015 No Comment

The foreign equity asset class is an area that many investors neglect to consider for their portfolios. Unfortunately, by ignoring the opportunities outside of U.S. borders, investors are giving up a chance to increase their portfolio returns. The biggest benefit is not the potential for higher returns, but rather the lowered risk that this type of diversification provides.

Add in the hedge against a weak U.S. dollar, and foreign investments become essential for nearly all investors — regardless of individual tolerance. One way to invest in foreign markets is through foreign exchange-traded funds (ETFs). Read on to learn about foreign-stock ETFs and how they can help you to diversify your portfolio, combat the effects of a weak U.S. dollar and, if you choose carefully, increase your portfolio’s risk/reward ratio.

Foreign-Stock ETFs and U.S. Markets

The introduction of ETFs that concentrate primarily on overseas investments has opened a new door of opportunity for investors. Instead of relying on their stock-picking skills, investors now have the option of investing in specific countries or regions of the world. This type of investing is also different because rather than using the bottom-up approach that many investors implement when picking individual stocks, the best way to choose the appropriate foreign-stock ETF is a top-down method. (To read more, check out What’s the difference between top-down and bottom-up investing? )

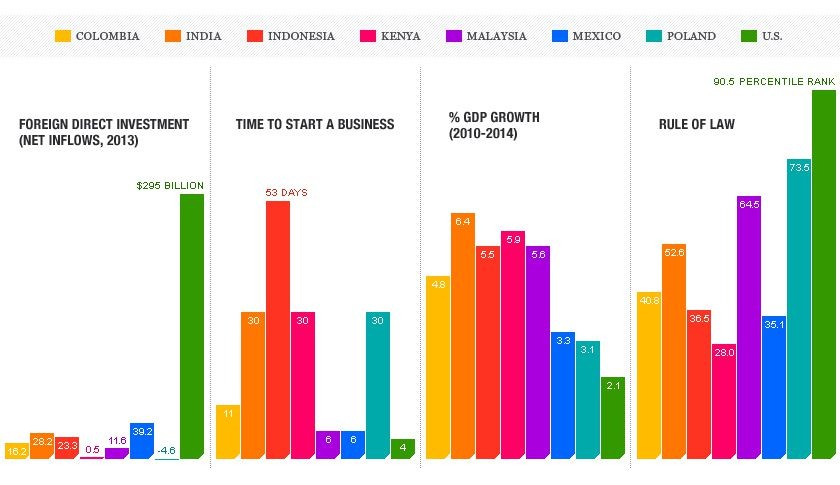

Since the start of this century, America’s role as a leader in world economic growth has diminished as a number of other countries step to the front of the line. The two countries that most investors think of when they are searching for growth are China and India. With real gross domestic product growth rates well above U.S. rates, it is only natural for the stock markets to join in the expansion as investors seek out high-growth opportunities. This process allowed foreign markets to grow while U.S. market growth slowed and, consequently, may have caused some losses in U.S. markets.

When growth in the U.S. slowed in the early 2000s, the stock market was directly affected. During the first six years of the twenty-first century, the S&P 500 averaged a loss of 1.4% annually, thanks in large part to slowing growth. During the same time frame there were a number of countries that produced sizable annual gains. One of the leaders was the Australian ASX All Ordinaries Index, which had an annual gain of 7.5% between 2000 and 2005.

This negative correlation between the Australian and U.S. stock markets is one of the primary benefits of investing in foreign-stock ETFs because when markets move opposite to one another, by investing in both markets, investors achieve greater diversification and protection from risk. (For further reading see, Broadening The Borders Of Your Portfolio and Getting Into International Investing .)

Foreign Economic Risk Factors

Other factors to consider when choosing specific foreign-stock ETFs for your portfolio include country-specific risk and the risks involved with investing in emerging versus developed countries. All country-specific ETFs will carry significant country-specific risk. This means that the performance of the investment will be very dependent on the country’s overall stage of political and economic development.

Investors can reduce country-specific risk by choosing an ETF that invests in an entire region, rather than one particular country. For example, instead of investing in a Brazilian ETF, an investor could opt for lower risk by investing in an ETF that encompasses a number of South American countries.

The level of risk that investors take on will also be determined by whether they invest in ETFs that focus on developed countries or ETFs that focus on emerging-market countries. Historically, developed countries have not grown as quickly as emerging-market countries and, therefore, ETFs from developed countries are generally regarded as more conservative.

For most investors, an appropriate mix of emerging-market and developed-country ETFs depends on risk tolerance. Investors who are less willing to take on risk would probably be more comfortable with investing in fewer emerging country ETFs and vice versa. (For more insight, read What Is An Emerging Market Economy? )

Hedging Against a Weak Greenback

After reaching its peak in 2001, the U.S. Dollar Index began breaking down — a weakness that, in 2006, has yet to subside. With an increasing federal budget deficit and current account deficit. it appears that the greenback will continue its long-term downtrend. If this trend continues, investors may want to hedge their portfolios against it by investing in foreign-stock ETFs. This strategy will allow investors to take advantage of the decline of the U.S. dollar, which has resulted in a boost in profits for companies based outside the U.S.

The commodity sector is another area that has been able to profit from a weak U.S. dollar. A number of the large commodity companies based overseas are held by foreign-stock ETFs. For example, iShares MSCI Brazil Index ETF(EWZ) has more than 50% of its assets in commodity-related stocks. From 2002 to 2005 this ETF was one of the best performing ETFs as commodities boomed and the U.S. dollar fell. Canada is another country rich in natural resources that has benefited from the commodity boom and weak greenback.

The iShares MSCI Canada Index ETF (EWC) boasts returns of more than three times those seen on the S&P 500 between 2002 and 2005. These examples suggest that successful ETFs can be found in both developed and emerging countries (Brazil is considered a moderately risky, emerging-market country whereas Canada is more conservative and already economically developed). This is where asset allocation and diversification become important in selecting the appropriate ETFs for your portfolio.

Specific Foreign-Stock ETFs

Interestingly enough, from the start of the year 2000 through the end of 2005, the strongest performing ETFs were concentrated in several regions of the world. However, none of these ETFs were associated with the U.S. In fact, the top four ETFs had ties to emerging countries located in Eastern Europe.

The Templeton Russia and Eastern European Fund (TRF), an actively managed closed-end fund. led the way with a gain of more than 200%. The only country-specific ETF in the top five was the iShares MSCI Austria Index ETF (EWO). Because Austria is considered to be more stable than most of Eastern Europe, EWO is seen as a gateway into the emerging region and a lower-risk option for investing in a somewhat volatile area.

Looking at the rest of the decade, there were a number of regions throughout the world with the potential to outperform the U.S. stock market. The Far East has had its moments in the last five years and, overall, it has outpaced the U.S. Investors with a higher risk tolerance may want to look into country-specific ETFs based in countries like Singapore, South Korea and Taiwan.

Investors with a lower risk tolerance may want to opt for regional ETFs such as the Asia Tigers Fund (GRR), which gives investors exposure to several southeast Asian countries including South Korea, Hong Kong and Taiwan. These types of funds reduce country-specific risk without decreasing returns, resulting in a more attractive risk/reward ratio.

There are a few negative aspects investors must consider before buying foreign-stock ETFs. The regulations outside the U.S. specifically in emerging countries, can be much more lenient than those imposed on U.S. businesses and could result in unethical business practices, which can threaten investors’ returns.

Geopolitical risk also tends to be more prevalent in foreign countries due to the current tensions throughout the world and there is currency risk associated with companies based overseas that could affect their performance. Finally, volatility can be higher in foreign countries than it is in the U.S. and, therefore, foreign investment may not be appropriate for all investors.

The Bottom Line

For investors, putting some money into foreign investments can present significant advantages. Instead of taking the time and effort to pick individual stocks, a simple way to diversify a portfolio without taking too many positions is by investing in foreign-stock ETFs. The negative correlation between specific countries and the U.S. stock market will help lower a portfolio’s overall downside.

Therefore, if the goal of your portfolio is to increase potential rewards without greatly increasing risk, you must consider foreign-stock ETFs. Keep in mind, however, that the appropriate mix of ETFs from a number of regions is essential in maximizing the risk/reward ratio.

For more on this topic, check out ETFs Vs. Index Funds: Quantifying The Difference and Introduction To Exchange-Traded Funds .