Find Your Next Penny Trade in 5 Minutes with This Stock Screen

Post on: 22 Июнь, 2015 No Comment

Find Your Next Penny Trade in 5 Minutes with This Stock Screen

Start your Free Tomorrow In Review Preview — Sign Up Here: />

It’s true – one simple strategy could deliver your next slam-dunk penny stock play in only five minutes… It sounds crazy, but I’m actually just talking about one of the most popular tools used by traders on and off Wall Street: the stock screener. Getting serious value out of screeners requires a little bit of investing know-how, of course… That’s why, today, I’m here to give you an insider’s guide to effectively screening for small-cap investments.

But let’s start with the basics – what’s a “stock screener” anyway? Essentially, stock screeners are computer programs that let you filter the investment world down to particular companies that you might be interested in. You can specify, that you’re only interested in stocks under $5 that have a price-to-earnings ratio of less than 10, for example, and any half decent screener will spit out a list of the resultant stocks.

Screeners by themselves are really useless, however. Despite the promise that stock screeners will revolutionize the way you invest, most investors who use stock screeners fare no better than investors who scour for stocks the old fashioned way. That’s because in order to use a stock screener effectively, you need to know how to ask it for the right kind of stocks.

More on that in a second…

In the past few years, nearly every major online finance portal – from Google Finance to Morningstar – has come out with its own free screener. That’s a big change from the way things used to be.

Just a couple of decades ago, screeners were the exclusive domain of storied Wall Street firms – the ones that could afford the expensive and complex computer systems that were available at the time. But with the advent of widespread personal computing and broadband internet connections, the investing world has become significantly democratized.

When you use a screener, you need to consider two questions: What kind of screen am I trying to run? And which screener will give me the best results?

What Kind of Screen Am I Trying to Run?

The type of screen you run all comes down to your investment strategy. Are you looking for value stocks, growth plays, or short term technical trades? The screening criteria you use are going to be determined by the kind of investment strategy you’re looking for.

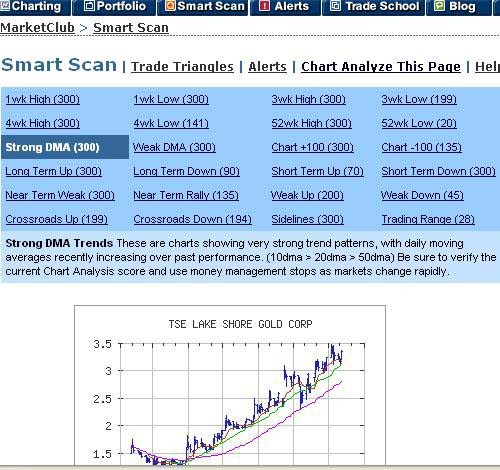

Traditionally, fundamental screens – like growth and value – have been the only kind of strategy that screeners were capable of. Today, however, an increasing number of screeners support technical analysis, a strategy that’s absolutely essential for traders on the lookout for short-term gains.

Although every investor takes different metrics into account when picking stocks, I told you that I’d have you screening your way to your next penny stock pick in five minutes – to do that, I’ve put together a simplified value screen for you… All you need to do is plug these criteria in (I’ll show you how to do that next):

- We’re looking for a good value play, so its share price should be in line with the company’s assets. To do that, specify a price-to-book ratio of 1.5 or less.

- Earnings are essential – and we don’t want to overpay for them. Requiring a P/E ratio of less than 12 keeps things reasonable.

- Debt is often one of the key reasons why stocks are undervalued – make sure that the stock’s debt-asset ratio is less than 1.2 in this credit market.

- We want a company that is at least keeping up with its business expectations. Make sure that revenue growth is positive.

- Last but not least, we’re looking for penny stocks … Specify a share price of less than $10 and a market cap under $2 billion.

What Kind of Screener Will Give Me the Best Results

Naturally, those criteria won’t do you much good without a screener to plug them into. How you do that depends on the screener. Some have you pick filters from a list, others use formulas to fill them in, and others still use plain English. And for the charting fans, at least one new website allows you to screen stocks visually based on chart patterns.

Whether you’re a novice investor or a pro, there’s a screener that’s ideal for you. As with most things in the investment world, however experience is the only way to know which.

Here’s a sampling of some of the free screeners available online:

This company offers investors a nice selection research and screening tools.

For more complex stock screens, Portfolio123’s free membership is worthwhile.