Find Trusted Gold IRA Companies To Invest With

Post on: 23 Май, 2015 No Comment

Today, there is still a great amount of uncertainty that surrounds the stock market, as well as the economy as a whole. These uncharted waters can make for a volatile road for investors and especially so for those who are fast approaching retirement.

At this time, investors dont need get rich quick schemes, but rather they need good solid investment solutions. Yet oftentimes, the answers that they need are not being found in assets such as stocks, bonds, and mutual funds.

With that in mind, it may be time to take a closer look at an asset thats performed well for thousands of years and promises to do so going forward gold.

Why Invest in Gold for Retirement?

As an investment, there are numerous benefits to allocating at least a percentage of ones retirement portfolio to gold and other precious metals. Gold offers a myriad of investment advantages such as:

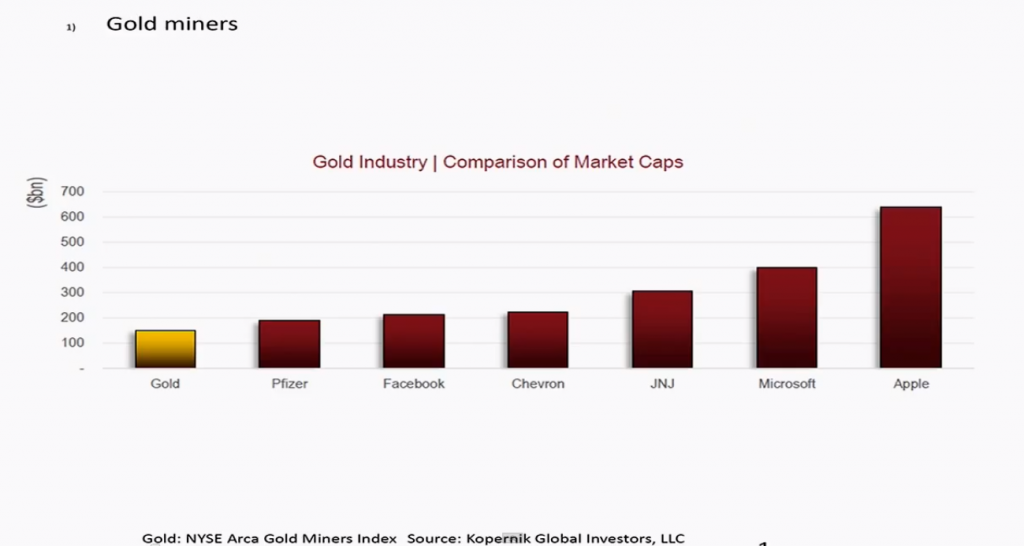

- Growth Opportunity By adding gold to a retirement portfolio, it can offer the opportunity for additional growth. The recent up and down volatility in the stock market has left many investors in panic mode. Yet gold tends to provide upward price movements that are not nearly as sporadic. For many centuries, this particular precious metal has been seen as a symbol of wealth and prosperity, and it is anticipated that it will continue to do so in the future. One reason for this is golds demand for use in consumer goods like jewelry and electronics. This tends to drive up its value and in turn, its price. Keeping a percentage of gold in a retirement portfolio can help in increasing the portfolios overall value.

- Inflationary Hedge Precious metals and gold in particular are also looked upon as a great way for investors to hedge their assets, and their income, against inflation. Inflationary hedges are assets that have what is known as intrinsic value. This means that they are correlated negatively to the movement of stocks and bonds going up when the stock or bond markets go down. Therefore, gold can provide a good way for investors to hedge against a downward moving stock market.

- Protection of Assets Due to its hedging features, gold can also provide a great way to protect other assets. Because many investors have a fear of losing more assets in the market, they are seeking ways to obtain growth, while at the same time protecting what they have. Gold will allow them to do just that.

IRA Tax Advantages

While investing in gold and precious metals can be beneficial in and of itself, by placing those assets into an IRA (Individual Retirement Account), an investor can reap additional tax related advantages.

Many investors are aware that by opening an IRA account, investments can obtain tax deferred or tax free growth opportunities, and in certain cases, contributions into the account may be tax deductible.

Types of IRAs

There are two types of Individual Retirement Accounts. These are the traditional and the Roth. While each have several similarities, they also have certain differences as well.

Traditional IRA

In a traditional IRA. investors may be able to deduct their contribution each year, depending on their annual income, as well as whether or not they are a participant in an employer sponsored retirement plan.

In addition, the gain on the investments that are inside of a traditional IRA account are allowed to grow on a tax deferred basis. This means that the account owner does not have to pay taxes on those gains until the time of withdrawal when it is likely that he or she could be in a lower income tax bracket. The tax deferred growth of investment gains can essentially allow investments to grow exponentially over time.

Roth IRA

With a Roth IRA. the annual contributions are not tax deductible. However, the gains on the investments that are inside of the account are allowed to grow on a tax free basis. In addition, at the time of withdrawal, funds come out of a Roth IRA account tax free regardless of the income tax bracket of the account owner.

Both traditional and Roth IRA accounts can be contributed to on an annual basis up to a maximum yearly amount. In 2014, investors who are age 49 and younger may deposit up to $5,500 into either a traditional or a Roth IRA account (or a combination of the two). Investors who are age 50 or over may contribute up to $6,500.

It is important to note that investors may have more than one IRA account and they may own both a traditional and a Roth. The amount of total annual contribution, however, may not exceed the IRS (Internal Revenue Service) mandated maximums.

Self Directed IRA

While most banks, brokerages, and traditional financial services institutions have the ability to open regular traditional and Roth IRA accounts, many do not deal with a different type of account known as the self directed IRA.

The self directed IRA account differs from a regular IRA account in that it allows investors much more control over the types of investments that may be placed inside of the account. Regular traditional and Roth IRA accounts are most often funded with equities such as mutual funds and stocks, as well as other common investments like bonds.

Yet, while many IRA investors choose a mix of different equities and fixed income options, their portfolios are not truly as diversified as they could be if they were to include other tangible assets like gold and precious metals.

By owning a self directed IRA, investors can open the door to many more asset choices including gold, silver, platinum, and other metals options allowing for a much more well diversified portfolio that is in a better position to protect assets and hedge against inflation.

How to Open a Gold IRA Account

When it comes time to open a gold IRA account, it will be necessary to follow the IRS mandated rules to the tee. This means completing all of the necessary paperwork and tax related forms. Typically, the application forms and other needed documents may be found on the IRA custodians websites. This can make initiating the account opening process easy and convenient.

Funding an IRA Account

Once a precious metals IRA account has been opened, it must be funded before any metals can be purchased. There are several ways to fund an IRA account. Investors may choose to fund their account in one or all of these manners:

- Annual Cash Contribution IRA owners may contribute (deposit) cash each year to their account up to a maximum amount. In 2014, this maximum limit is $5,500 for investors who are age 49 and under, and $6,500 for investors who are age 50 and over.

- IRA Transfer Investors who already have another IRA account (or multiple IRA accounts) set up may opt to transfer some or all of the funds from another account into their new precious metals IRA. There is no limit on the dollar amount of funds that may be transferred over to the new IRA account although there is a limit on the number of IRA transfers that an investor may take part in on a calendar year basis.

- Rollover Investors may also roll over funds from an employer sponsored retirement plan such as a 401(k). Here, too, there is no dollar limit on the amount that may be transferred in to the IRA. This can offer a great way to boost the amount of funds that are held in the precious metals IRA account.

Choosing the Right Precious Metals Investments

When the IRA account is open and funded, it will be ready to take the next step and begin purchasing metals investments. Prior to doing so, however, it is essential to have a good, solid investment plan in place. This starts with having both short and long term financial goals.

If goals have not yet been established, it is important to meet with a professional financial advisor in order to help determine investment time frame, risk tolerance, and other important factors prior to moving forward.

Choosing the Best Precious Metals IRA Company

Just like anything else, the success or failure of an endeavor will depend largely upon the team that is selected to work with. This is also true of investing and the company that is chosen as the custodian for an investors precious metals IRA account.

While the act of investing in precious metals is important, the company that you choose to open and manage your IRA account will have a lot to do with the success of the investments that are inside of that account. Given that, it is essential to consider several important criteria before moving forward with choosing the best gold IRA company. These factors include:

Companys Reputation & Track Record

One of the most important factors in choosing the best gold IRA company to work with will be the companys overall reputation and industry track record. When researching potential IRA custodians, it is important to ensure that the company has an excellent rating from the Better Business Bureau (BBB), as well as other rating entities such as TrustLink and the Business Consumer Alliance.

It is also a good idea to check online for any customer reviews and testimonials. This will help to provide additional information regarding how the firm treats both past and current clients. Likewise, any write ups in respected consumer publications is also beneficial.

Customer Service

Another key area is customer service. While many financial services companies may tout that they have the best customer service offering, the only way to truly determine this is to actually give it a try.

Most precious metals dealers will offer several contact methods for their customer service representatives including toll-free telephone, email, and live online chat. By choosing one or more of these methods to contact the company with a common question, it will be easy to make a determination in terms of how the company will handle you as a client.

Education

Today, precious metals IRAs are still a relatively new concept. This is why education on these types of accounts is essential for both new and experienced investors alike. With that in mind, your search for a gold IRA company should include one that offers education to its investors on how to best position metals in a retirement portfolio.

Product Selection

Product selection is another primary area where a precious metals dealer must be on top. One reason for this is because investors typically like to have a choice when investing in gold IRA assets. Another is that the Internal Revenue Service (IRA) has strict guidelines as to what types of gold and other precious metals can and cannot be placed inside of a gold IRA account.

Allowable IRA precious metals include the following:

- American Eagle gold, silver, and platinum coins

- Canadian Maple Leaf gold, silver, and platinum coins

- Australian Kangaroo Nugget gold, silver, and platinum coins

- Austrian gold, silver, and platinum coins

- U.S. Buffalo Gold Uncirculated coins (not including proof coins)

- Credit Suisse PAMP Suisse Bars

- Silver Mexican Libertad coins

- Isle of Man Noble platinum coins

- Gold, silver, platinum, and palladium bars and rounds that are manufactured by either a NYMEX or a COMEX approved refiner or assayer, or by a national government mint and that meet the minimum standards for fineness

Based upon IRS rules, the minimum standards for the fineness of precious metals that can be placed inside of a precious metals IRA account include the following:

- Gold .995

- Silver .999

- Platinum .9995

- Palladium .9995

The Bottom Line

For those investors who see the possibilities in gold investing especially in conjunction with the many tax benefits that are afforded to IRA owners there will likely be exponential financial reward. By taking the next step to opening a gold IRA account, there is no better time to do so than the present.

*CLICK HERE For Your FREE Gold Investment Kit From Our #1 Gold Company >