Financial Statements Questions and Answers For Investors

Post on: 27 Май, 2015 No Comment

Investors in corporate stock and debt securities should know the answers to the following fundamental questions concerning financial statements. These questions are answered from the view-point of the typical individual investors, not an institutional investor or professional investment manager. Portfolio managers manage over $100 billion of investments. I assume such portfolio managers already know the answers to these questions.

Advertisement

Question. Are financial statements reliable and trustworthy?

Yes, the vast majority of audited financial statements are presented fairly according to established standards, which are called generally accepted accounting principles [it is now IFRS]. If not, the CPA auditor calls deviations or shortcomings to your attention. So, be sure to read the auditors report. You should realize, however, that financial accounting standards are not static. Over time these profit measurement methods and disclosure practices change and evolve. Accounting s rule-making authorities constantly monitor financial reporting practices and problem areas. They make changes when needed, especially to keep abreast of changes in business and financial practices, as well as developments in the broader political, legal, and economic world that business operates in.

Question. Nevertheless, are some financial statements misleading and fraudulent?

Yes, unfortunately. The Wall Street Journal and the New York Times, for example. carry many stories of high-level management fraud—illegal payments, misuse of assets, and known losses were concealed; expenses were under-recorded; sales revenues were over-recorded or sales returns were not recorded; and, financial distress symptoms were buried out of sight.

It is very difficult for CPA auditors to detect high-level management fraud that has been cleverly concealed or that involves a conspiracy among managers and other parties to the fraud. Auditors are highly skilled professionals, and the rate of audit failures has been low. Sometimes, however, the auditors were lax in their duties and deserved to be sued—and were! CPA firms have paid hundreds of millions of dollars to defrauded investors and creditors.

Theres always a small risk that the financial statements are, in fact, false or misleading. You would have legal recourse against the companys managers and its auditors once the fraud is found out, but this is not a happy situation. Almost certainly youd still end up losing money, even after recovering some of your losses though legal action.

Question. Is it worth my time as an individual investor to read carefully through the financial statements and also to compute ratios and make other interpretations?

I doubt it. You maybe surprised by this answer, and I dont blame you. The conventional wisdom is that by diligent reading of financial statements you will discover under- or over-valued securities. But, the evidence doesnt support this premise. Market prices reflect all publicly available information about a business, including the information in its latest quarterly and annual financial reports. If you enjoy reading through financial statements, as I do, fine. Its a valuable learning experience. But dont expect to find out something that the market doesnt already know. Its very unlikely that you will find a nugget of information that has been overlooked by everyone else. Forget it; its not worth your time as an investor. The same time would be better spent keeping up with current developments reported in the financial press.

Question. Why should I read financial statements, then?

To know what you are getting into. Does the company have a lot of debt and a heavy interest load to carry? For that matter, is the company in bankruptcy or in a debt workout situation? Has the company had a consistent earnings record over the past 5 to 10 years, or has its profit ridden a roller coaster over this time? Has the company issued more than one class of stock? Which stock are you buying, relative to any other classes?

You would obviously inspect a house before getting serious about buying it, to see if it has two stories, three or more bedrooms, a basement, a good general appearance, and so on. Likewise, you should know the financial architecture of a business before putting your capital in its securities. Financial statements serve this getting-acquainted purpose very well.

One basic stock investment strategy is to search through financial reports, or financial statement data stored in computer databases, to find corporations that meet certain criteria—for example, whose market values are less than their book values, whose cash and cash equivalent per share are more than a certain percent of their current market value, and so on. Whether these stocks end up beating the market is another matter. In any case, financial statements can be culled through to find whatever types of corporations you are looking for.

Question. Is there any one basic litmus test for a quick test on a companys financial performance?

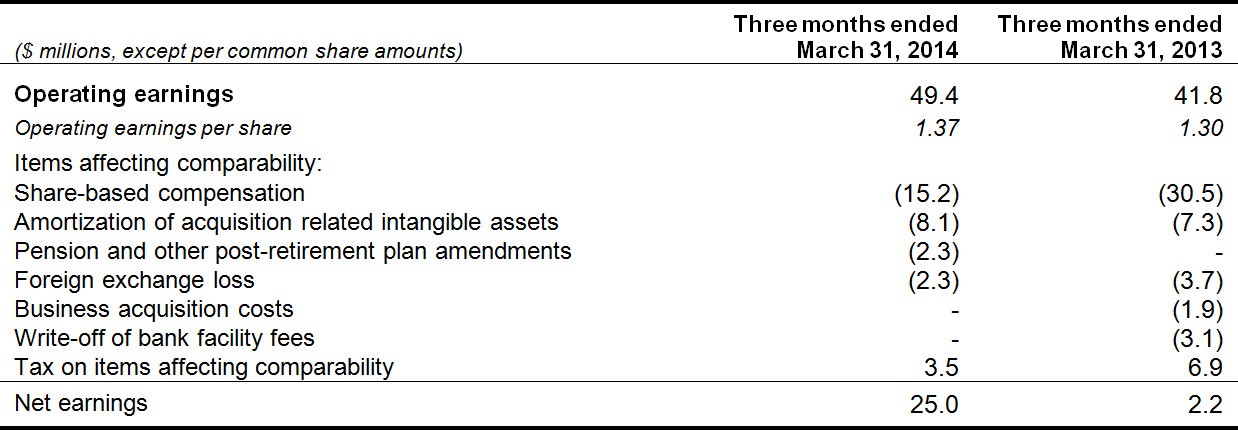

Yes. I would suggest that you compute the percent increase (or decrease) in sales revenue this year compared with last year, and use this percent as the baseline for testing changes in bottom-line profit (net income) as well as the major operating assets of the business. Assume sales revenue increased 10% over last year. Did profit increase 10%? Did accounts receivable, inventory, and long-term operating assets increase 10%?

This is no more than a quick-and-dirty method, but it will point out major disparities. For instance, suppose inventory jumped 50% even though sales revenue increased only 10%. This may signal a major management mistake; the overstock of inventory might lead to write-downs later. Management does not usually comment on such disparities in financial reports. Youll have to find them yourself.

Question. Do conservative accounting methods cause conservative market values?

For publicly owned corporations that have active trading in their securities, the general answer would seem to be no. Many businesses select conservative accounting methods to measure profit, which results in conservative book values for their assets and liabilities. On occasion even conservative methods can cause opposite effects (i.e. higher earnings) in a particular year because of such things as LIFO liquidation gains in that year.

The evidence suggests that securities markets take into account differences in profit measurement methods between companies in determining stock market values. In other words, the market is not fooled by differences in accounting methods, even though earnings, assets, and liabilities are reported by different methods of accounting from company to company.

To be honest, this is not an easy general conclusion to prove. There are exceptions, but not on any consistent basis. Overall, differences in accounting methods seem to be adjusted for in the marketplace. For instance, a business could not simply switch its accounting methods to improve the market value of its stock shares. The market will not react this way; investors do not blindly follow accounting numbers.

I advise caution and careful attention to accounting methods when you are considering buying or making a major investment in a privately held business for which there is no market to establish values for the stock shares issued by the business .

Question. Do financial statements report the truth, the whole truth, and nothing but the truth?

There are really two separate questions here. One question concerns how truthful is profit accounting, which depends on a companys choice of accounting methods from the menu of generally accepted alternatives and how faithfully the methods are applied year in and year out. The other question concerns how honest and forthright is the disclosure in a companys financial report.

Profit should be faithful to the accounting methods adopted by the business. In other words, once accounting choices have been made, the business should apply the methods and let the chips fall where they may. However, there is convincing evidence that managers occasionally, if not regularly, intervene in the application of their profit accounting methods to produce more favorable results than would otherwise happen—something akin to the thumb on the scale approach. This is done to smooth reported earnings, to balance out unwanted perturbations and oscillations in annual earnings. Investors seem to prefer a nice steady trend of earnings instead of fluctuations, and managers oblige. So, be warned that annual earnings probably are smoothed to some extent.

Disclosure in financial reports is quite another matter. The majority of companies are reluctant to lay bare all the facts. Bad news is usually suppressed or at least deemphasized as long as possible. Clearly, there is a lack of candor and frank discussion in financial reports. Few companies are willing to wash their dirty linen in public by making full disclosure of their mistakes and difficulties in their financial reports.

There is a management discussion and analysis section in financial reports. But usually this is a fairly sanitized version of what happened during the year. The history of financial reporting disclosure practices, unfortunately, makes clear that until standard-setting authorities force specific disclosure standards on all companies, few make such disclosures voluntarily.

Some years ago the disclosure of employee pension and retirement costs went through this pattern of inadequate reporting until, finally, the standard-setting bodies stepped in and required fuller disclosure. Until a standard was issued, few companies reported a cash flow statement, even though this statement had been asked for by security analysts since the 1950s! Recalls of unsafe products, pending lawsuits, and top management compensation are other examples of reluctant reporting.

Question. Does a financial report explain the basic profit-making strategy of the business?

Not really. In an ideal world, I would argue, a financial report should not merely report how much profit (net income) was earned by the business and the amounts of revenue and expenses that generated this profit. The financial report should also provide a profit road map, or an earnings blueprint of the business. Financial report readers should be told the basic profit-making strategy of the business, including its most critical profit-making success factors.

In their annual financial reports publicly owned corporations are required to disclose their sales revenue and operating expenses by major segments (lines of business) ; this provides information about which product lines are more profitable than others. However, segments are very large, conglomerate totals that span many different products. Segment disclosure was certainly a step in the right direction. For example, the breakdown between domestic versus international sales revenue and operating profit is very important for many businesses.

Businesses do not report the profit margins of their key product lines. Both security analysts and professional investment managers focus much attention on profit margins, but you dont find this information in financial reports. And, you dont find any separation between fixed as opposed to variable expenses in external income statements, which is essential for meaningful profit analysis.

In management accounting, you quickly learn that the first step is to go back to square one and recast the income statement into a management planning and decision making structure that focuses on profit margins and cost behavior.

In short, the income statement you find in an external financial report is not what you would see if you were the president of the business. Profit information is considered very confidential, to be kept away not only from competitors but from the investors in the business as well.

Question. Do financial statements report the value of the business as a whole?

No. The balance sheet of a business does not report what the market value of a company would be on the auction block. Financial statements are prepared on the going concern, historical cost accounting basis—not on a current market value basis. Until there is a serious buyer or an actual takeover attempt its anyones guess how much a business would fetch. A buyer may be willing to pay much more than or only a fraction of the reported (book value) of the owners equity reported in its most recent balance sheet.

The market value of a publicly owned corporations stock shares is not tied to the book value of its stock shares. Market value, whether you are talking about a business as a whole or per share of a publicly owned corporation, is a negotiated price between a buyer and seller and depends on factors other than book value.

Generally speaking, there is no reason to estimate current replacement cost values for a companys assets and current settlement values of its liabilities .

Furthermore, even it this were done these values do not determine the market value of stock shares or the business as a whole. The market value of a business as a whole or its stock shares depends mainly on its profit-making ability projected into the future. A buyer may be willing to pay 20 times or more the annual net income of a closely owned, privately held business or 20 times or more the latest earnings per share of publicly owned corporations. Investors keep a close watch on the price/earnings (P/E) ratios of stock shares issued by publicly owned corporations.

Also, it should be mentioned that earnings-based values are quite different from liquidation-based values for a business. Suppose a company is in bankruptcy proceedings or in a troubled debt workout situation. In this unhappy position the claims of its debt securities and other liabilities dominate the value of its stock shares and owners equity. Indeed, the stock shares may have no value in such cases.

Question. Should financial statements be taken at face value when buying a business?

No. The potential buyer of a business as a whole (or the controlling interest in a business) should have in hand the latest financial statements of the company. The financial statements are the essential point of reference but are just a good point of departure for many questions. For example, are book values good indicators of the current market and replacement values of the companys assets?

Current values usually are close to book values for some assets—marketable securities, accounts receivable, and FIFO-based inventory. On the other hand, book values of LIFO-based inventory, long-term operating assets depreciated by accelerated methods, and land purchased many years ago may be far below current market and replacement values.

Cash is usually a hard number, although a buyer should be aware that there may be some window dressing .

Every asset other than cash presents potential valuation problems. For example. a business may not have written off all of its uncollectible accounts receivable. Some of its inventory may be unsalable, but not yet written down. Some of its fixed assets may be obsolete and in fact may have been placed in the mothball fleet, yet these assets may still be on the books. Some potential or contingent liabilities may not be recorded, such as lawsuits in progress. In short, a buyer probably will have to do some housecleaning on the assets and liabilities of the business, and then start negotiations on the basis of these adjusted amounts.

A potential buyer should also ask to see the internal management profit reports of the business, but management may be reluctant to provide this confidential information. For that matter, the business may not have a very good management reporting system. The buyer can ask for information about product costs and sales prices to get a rough idea of profit margins. In short, the buyer needs both the external income statements of the business and its internal management information as well.

A business might have certain valuable assets that the buyer wants for the purpose of selling them off, or the buyer may be planning radical changes in the financial structure of the business. There have been cases of a buyer paying less than a companys net cash amount—cash and cash equivalents minus liabilities. In other words, the buyer bought in for less than the immediate liquidation value of the business. This is very rare, of course.