Financial Market Commentary

Post on: 16 Март, 2015 No Comment

Sector Performance Mixed as Stocks Search For a Catalyst

U.S. stocks were in the negative for January, a signal that often predicts how the rest of the year will go. Analyzing the performance of stock market sectors, known as sector rotation, can provide additional clues about the markets next move. For example, when risk-on sectors such as Consumer Discretionary, Energy and Information Technology lead the market on the way up, it often signals the beginning of a broader, sustained rally. When risk-off sectors such as Utilities and Consumer Staples lead the market, however, it often signals a period of sideways consolidation or correction.

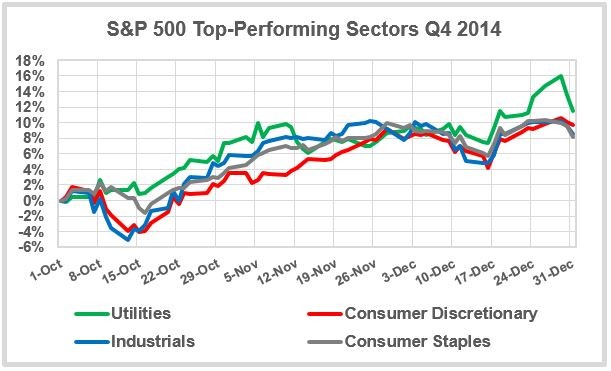

The 4th quarter of 2014 was characterized by the largest correction in equities in 3 years (-9% in October), after which stocks soared into a period of high-volatility consolidation that has lasted almost 2 months.

Despite the October 2014 mini-correction, 8 out of 10 S&P 500 sectors finished higher in Q4, and did so in an unusually tight range of performance. There are two risk-on sectors among the top performers (Industrials and Consumer Discretionary, suggesting investor bullishness) as well as two risk-off sectors (Utilities and Consumer Staples, suggesting caution and a possible flight-to-safety as investors reached for higher yields while interest rates fell). Utilities declined by the least amount during the October correction, and Staples stocks benefitted from falling energy prices.

The mid-performing sectors in Q4 were also mixed, with a defensive sector (Health Care) leading risk-on sectors like Financials and Information Technology.

The worst performers in Q4 were Energy (decimated by the decline in oil and gas prices) and Materials stocks, reeling from declines in commodity prices and a slowdown in global construction.

Equities remained in the negative overall in early 2015, although 2 defensive sectors (Health Care and Consumer Discretionary) posted modest gains, along with 2 risk-on sectors (Materials and Consumer Staples). Continuing the theme from 2014, there is no clear signal from this type of sector performance.

Sectors earning approximately zero returns in early 2015 include Energy, which recovered from additional losses in mid-January, along with Information Technology and Industrials. If the market was mounting a serious advance, we would expect more leadership from these sectors.

Rounding out the back of the pack in early 2015 were Utilities (risk-off) and Financials (risk-on). Financial stocks seem particularly affected by news that regulators might actually regulate banks a bit in 2015 shocking.

Despite Q4s gains, the markets overall lack of direction is reflected in this type of mixed sector performance. It will be important to continue watching stocks reaction to geopolitical and macro news (and the implications of the news narrative) to determine if 2015 is shaping up to be a positive or negative year.