Financial ETFs in Focus on Rising Rates Buzz ETF News And Commentary

Post on: 25 Июнь, 2015 No Comment

The stock market saw one of its worst sell-offs this year on Tuesday as investors feared that the Fed may begin normalizing its monetary policy long after six years, sooner than previously expected. Last week’s sturdy February job data in the U.S. European woes and the oil price plunge hit the panic alarm and triggered the sell-off.

The Dow Jones industrial average fell 1.9% to settle at 17,663 representing its steepest drop since October 9, 2014. The S&P 500 index slipped 1.7% to 2044. Both the Dow and S&P 500 are now in red from a year-to-date look.

The latest job data for February indicates that the U.S. economy added 297K jobs in February, far above the market expectation of 240K and the prior month’s tally of 239K. This was the 12 th successive month of over 200K job creation. In fact, the momentum became sound from 2014 which marked the best year of job generation since the late 1990s.

Unemployment dropped to a six-and-half low of 5.5%. Average hourly wages of $24.78 rose 48 cents over the past 12 months. All these spurred speculations over a sooner-than-expected rise in the Fed’s short-term interest rate.

There is no doubt that the Fed’s easy money policy was the maker of the U.S. stock market rally and now is now playing the role of the breaker too due to its looming tightening. While investors remain jittery over this likely step of the Fed, they should note that rising rates are not necessarily bad for stocks. In the face of rising rates, bond prices normally fall, instigating the ‘great rotation’ from bonds to stocks.

Following the job report, short-duration bond yields posted the biggest gain in a month while long-term yields spiked even further with the benchmark 10-year treasury yield registering its highest move in over a year. Yields on the two-year treasuries against long-dated yields expanded the most in more than two months, suggesting a likely faster-than-expected hike in rates, per analysts.

While we will see several more wild sessions in the equity market as and when the domestic economy turns up with upbeat economic data, investors should note that there are a few sectors which stand to benefit from the rising rates. Financials is one of them. Below we have highlighted three financial ETFs which are worth a look during the process of Fed tightening.

Regional Bank ETFs

A rising interest rate scenario would be highly profitable for the banking sector. This is because banks borrow money at short-term rates and lend the capital at long-term rates. Following the job report, rising yields have led to a widening spread between long- and short-term rates, thereby benefitting the net interest margin earned by banks. Further, U.S. banks now have much stronger balance sheets.

Thanks to the widening spread between short and long-dated yields, regional bank ETFs emerged as winners in the recent sessions. SPDR S&P Regional Banking ETF ( KRE ) is one such gainer.  This is one of largest and the most popular ETFs in the banking space with AUM of nearly $1.63 billion and average daily volume of more than 4 million shares.

The product follows the S&P Regional Banks Select Industry Index, charging investors 35 basis points a year in fees. Holding 86 securities in its basket, the fund is widely spread out across each security, which minimizes the company specific risk thanks to an equal-weigh approach.

However, small caps dominate the fund’s return at 65%.  The fund added about 1.14% in the past five trading sessions (as of March 10, 2015) versus 0.9% loss in ultra-popular Vanguard

However, investors should note that KRE is a Zacks ETF #4 (Sell) ranked product and is likely to underperform when the Fed actually hikes short-term rates. Long-term bonds would then enjoy demand among the Euro zone and Japanese investors due to their drive for higher income that should squeeze the yield spread.

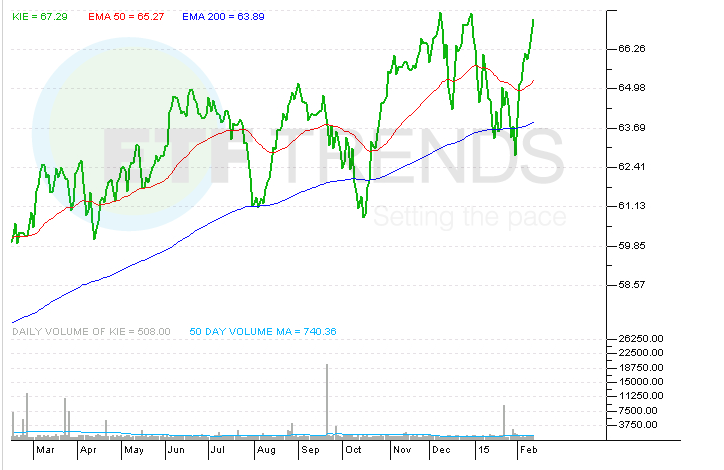

Insurance ETFs

Insurance companies would benefit from rising interest rates, as these are able to earn higher returns on their investment portfolio of longer-duration bonds. At the same time, these firms incur loss as the value of longer-duration bonds goes down with rising interest rates.

Nevertheless, since insurance companies have long-term investment horizons, they can hold investments until maturity and hence, no actual losses will be realized (read: Should You Buy Insurance ETFs Now? ).

Investors could easily tap the sector with iShares U.S. Insurance ETF ( IAK ). which amassed $134 million in its asset base and sees light volume of around 18,000 shares a day. The fund charges 43 bps in annual fees. The product holds 65 stocks in its basket with considerable company-specific concentration risks.

Though IAK lost about 0.2% in the last five trading sessions, it is a Zacks ETF #2 (Buy) ranked product and is likely to outperform post Fed tightening. The fund was up 2.6% in the last one month (read: Insurance ETFs Driving Up on Q4 Earnings ).

Broad Financial ETFs

Investors seeking broad exposure to the financial sector could find this overlooked ETF iShares U.S. Financial Services ETF ( IYG ) an interesting choice. This product holds 112 stocks in its basket. Banks take the top spot at 55% from the sector look while other financial services make up for the remainder (read: Earnings Recap for Financial Sector and Impact on ETFs ).

IYG has amassed $593.2 million in its asset base and trades in a lower average daily volume of about 60,000 shares. It charges an annual fee of 43 bps from investors. The fund lost about 0.4% in the last five trading sessions while it is up 2.4% in the last one month. IYG has Zacks ETF Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report