Fiduciary vs Suitability Which Standard is Best for Investors

Post on: 25 Апрель, 2015 No Comment

Home Fiduciary vs Suitability

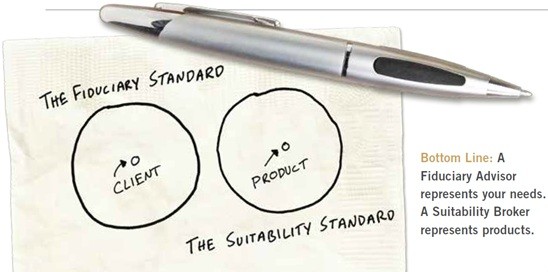

The great financial debate for investors is not about stocks vs bonds. Rather, it is about a fiduciary vs suitability standard of care when it comes to investment advice. Hopefully you know which is the right answer by now since the quality of your retirement depends on it. If you are still unsure, then check out how the Securities and Exchange Commission (SEC) defines suitability. Notice that nothing about your best interest is mentioned. To learn whether your investment/financial professional is legally, morally, and/or ethically held to a fiduciary or suitability standard of care, check out the following resources from FINRA (Financial Industry Regulatory Authority):

FINRA BrokerCheck® If your investment/financial professional is registered with FINRA, then they are legally held to the suitability standard of care. That said, FINRAs downloadable reports contain broker qualifications, registration history, and;most importantly, disclosure events (i.e. certain criminal matters; regulatory actions, civil judicial proceedings; customer complaints, arbitrations, or civil litigations; employment terminations; and financial matters in which the broker has been involved). Being registered with FINRA in and of itself is not a bad thing; however, you can be extremely confident that a Series 7-licensed financial advisor with certain disclosure events will never act in your best interest, even if they are legally, morally, or ethically required to do so. Sadly, even the Fiduciary Pledge cant protect investors from these types of financial advisors.

FINRA Professional Designations Database Research over 144 professional designations that can follow an investment/financial professionals name on their business card. You can view the issuing organizations, prerequesites, education requirements, examination types, continuing education requirements, and more. And dont forget to visit the issuing organizations website to view their code of ethics (if they even have one) and whether designees are requred to uphold a fiduciary standard of care.

Professional Designations

To help simplify your research into worthwhile professional designations, the Wall Street Journal wrote two articles on financial advisor credentials. See Is Your Adviser Pumping Up His Credentials? and Alphabet Soup of Advice .

Below are the three highly rigorous credentials/designations mentioned:

Certfied Financial Planner™ (CFP®) Even if your investment/financial professional is legally held to a suitability standard of care under FINRA regulations, Certified Financial Planners are morally and ethically bound to the fiduciary standard of care for to their clients. To learn more and to verify whether your investment/financial professional holds the CFP designation, see the CFP Board of Standards .

Chartered Financial Analyst (CFA) Even if your investment/financial professional is legally held to a suitability standard of care under FINRA regulations, Chartered Financial Analysts are morally and ethically bound to the fiduciary standard of care for to their clients. To learn more and to verify whether your investment/financial professional holds the CFA designation, see the CFA Institute .

Personal Financial Specialist (PFS) learn more and to verify whether your investment/financial professional holds the PFS desingation, see the American Institute of CPAs® .

NOTE: FiduciaryPledge.com is not endorsed by or affiliated with FINRA, the CFP Board, the CFA Institute, or AICPA in any way or manner.