Fidelity® Magellan® Fund (FMAGX)

Post on: 3 Июль, 2015 No Comment

# 62 Large Growth

U.S. News evaluated 461 Large Growth Funds. Our list highlights the top-rated funds for long-term investors based on the ratings of leading fund industry researchers.

Summary

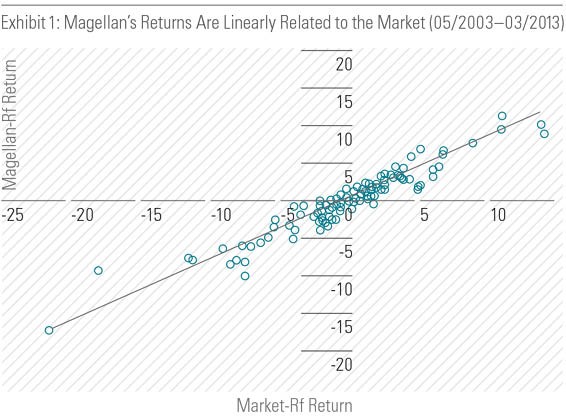

The Fidelity Magellan Fund has ridden the ups and downs of the market roller coaster. Over the years, the legendary fund has seen several changes in management and is currently experiencing steady growth under its newest manager, Harry Lange.

As of February 04, 2015, the fund has assets totaling $16.08 billion. Its portfolio consists of growth and value stocks across the capitalization spectrum from both the United States and abroad. The fund keeps about 20 percent of the holdings in foreign stocks, according to the fund.

Instead of investing defensively in 2008, management stayed aggressive and lost badly. After flopping in 2008, some of the stocks bounced back in 2009. Lange bet on big banks like Wells Fargo early on, and the fund’s returns have soared since then. Throughout 2009, management says the fund benefited from its overweighted position in the information technology sector and its stock selection in the materials and industrials sector. The fund beat the average fund in its category by more than 5 percentage points in 2009. Magellan has returned 13.40 percent over the past year and 18.77 percent over the past three years.

The fund launched in 1963 and has a “storied but spotty history,” according to Kiplinger’s Personal Finance magazine. From 1977 until 1990, well-known Fidelity manager Peter Lynch managed Magellan and ratcheted up a 29 percent annualized return. After Lynch left, the fund went through a series of managers who were unable to repeat his successes, though in 2000 the fund’s assets peaked at more than $100 billion, briefly making it the world’s largest stock fund. In 2005, Lange took over. He follows a “go-everywhere” approach, investing in companies of all sizes and in all sectors of the market. After being closed for more than a decade, the fund reopened in January 2008, shortly before the financial crisis. The fund has returned 13.05 percent over the past five years and 5.71 percent over the past decade.

Investment Strategy

Manager Harry Lange selects fast-growing companies that are profiting from larger market trends. He focuses on buying companies in tried-and-true growth sectors such as technology hardware. Lange invests across industry sectors. He looks for solid earnings growth, good fundamentals, and attractive valuations. He prefers companies with the top market positions or those that are gaining shares within their market. Lange believes companies that focus on growth versus cost-cutting may have more sustainable earnings growth, according to the fund.

Role in Portfolio

Morningstar calls Magellan a core player in a portfolio. “Manager Harry Lange runs this fund with a growth bias,” Morningstar says, “but isn’t so aggressive that the fund can’t serve as a core holding.”

Manager Harry Lange has a long history with Fidelity, having managed Fidelity Capital Appreciation for almost 10 years and Fidelity Advisor Small Cap for nearly seven years. He joined Fidelity in 1987. Lange has support from Fidelity analysts and also works with other Fidelity growth-oriented managers, like Will Danoff and Fergus Shiel, according to Morningstar.