Fibonacci Using Math To Make Right Market Moves_1

Post on: 12 Май, 2015 No Comment

The Fibonacci sequence is named after Leonardo of Pisa, who was known as Fibonacci. Fibonaccis 1202 book Liber Abaci introduced the sequence to Western European mathematics, although the sequence had been described earlier in Indian mathematics.

Fibonacci numbers are closely related to Lucas numbers in that they are a complementary pair of Lucas sequences. They are intimately connected with the golden ratio, for example the closest rational approximations to the ratio are 2/1, 3/2, 5/3, 8/5, . Applications include computer algorithms such as the Fibonacci search technique and the Fibonacci heap data structure, and graphs called Fibonacci cubes used for interconnecting parallel and distributed systems. They also appear in biological settings, such as branching in trees, arrangement of leaves on a stem, the fruit spouts of a pineapple, the flowering of artichoke, an uncurling fern and the arrangement of a pine cone. Being stock traders we observe and use fibonacci numbers in our technical analysis while trading stocks.

People ask: Why do these fibonacci ratios occur in the stock market? One explanation is that the crowd that is trading the stocks is part of the nature and it’s actions result in natural behavior bound by the laws of nature, thus the prices often revolve around fibonacci levels. Another explanation is that a great number of traders and nowadays computers, watch these fibonacci levels and they act on them making it a self fulfilling prophecy providing support or resistence for prices.

Learn to apply Fibonacci ratios to calculate price targets in stocks

The Fibonacci ratio can be an invaluable tool for calculating price retracements and projections in your analysis and trading. This excerpt from The Best Technical Indicators for Successful Trading explains the origins of the Fibonacci sequence and how you can apply it to the markets.

You can read the entire Fibonacci section, plus 7 more lessons on how to use technical indicators to improve your trading for FREE, see below.

Leonardo Fibonacci da Pisa was a thirteenth-century mathematician who posed a question: How many pairs of rabbits placed in an enclosed area can be produced in a single year from one pair of rabbits, if each gives birth to a new pair each month starting with the second month? The answer: 144.

The genius of this simple little question is not found in the answer, but in the pattern of numbers that leads to the answer: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, and 144. This sequence of numbers represents the propagation of rabbits during the 12-month period and is referred to as the Fibonacci sequence.

In addition to recognizing that the stock market undulates in repetitive patterns, R. N. Elliott also realized the importance of the Fibonacci ratio. In Elliotts final book, Natures Law, he specifically referred to the Fibonacci sequence as the mathematical basis for the Wave Principle. Thanks to his discoveries, we use the Fibonacci ratio in calculating wave retracements and projections today.

How to Identify Fibonacci Retracements

The primary Fibonacci ratios that I use in identifying wave retracements are .236. 382. 500. 618 and .786. Some of you might say that .500 and .786 are not Fibonacci ratios; well, its all in the math. If you divide the second month of Leonardos rabbit example by the third month, the answer is .500, 1 divided by 2; .786 is simply the square root of .618.

There are many different Fibonacci ratios used to determine retracement levels. The most common are .382 and .618. However. 472. 764 and .707 are also popular choices. The decision to use a certain level is a personal choice. What you continue to use will be determined by the markets.

Its worth noting that Fibonacci retracements can be used on any time frame to identify potential reversal points. An important aspect to remember is that a Fibonacci retracement of a previous wave on a weekly chart is more significant than what you would find on a 60-minute chart.

See charts that show the application of Fibonacci ratios, plus 7 other lessons on technical indicators, by accessing your free report now.

Learn the Best Technical Indicators for Successful Trading

In this free report, you will learn the tools of the trade directly from the analysts at Elliott Wave International. Using both video lessons and reports, they teach you how to incorporate technical indicators into your analysis to improve your trading decisions.

You will learn:

- How to employ Fibonacci ratios to calculate possible turning points.

- How to interpret technical indicators such as Moving Average Convergence/Divergence MACD.

- How to exploit trendlines to uncover trading opportunities when stock charting.

- Technical patterns that can alert you to major moves, and how to know if it’s a legitimate pattern.

- And more 8 lessons in all!

Get your Technical Indicators report now .

Elliott waves often correct in terms of Fibonacci ratios. The following article, adapted from the eBook How You Can Use Fibonacci to Improve Your Trading. explains what you can expect when a market begins a corrective phase. Learn how you can read the entire 14-page eBook below.

Retracements Corrective Waves

We see that wave 4 makes a shallow retracement of wave 3. It goes just beyond the .382 retracement. 382 is 1169.1, and wave 4 actually bottoms at 1163.75.

In a nutshell, this is what we mean when we say that Elliott waves often correct in terms of Fibonacci ratios.

Learn How You Can Use Fibonacci to Improve Your Trading If youd like to learn more about Fibonacci and how to apply it to your trading strategy, download the entire 14-page free eBook, How You Can Use Fibonacci to Improve Your Trading.

EWI Senior Tutorial Instructor Wayne Gorman explains:

- · The Golden Spiral, the Golden Ratio, and the Golden Section

- · How to use Fibonacci Ratios/Multiples in forecasting

- · How to identify market targets and turning points in the markets you trade

- · And more!

- See how easy it is to use Fibonacci in your trading. Download your free eBook today >>

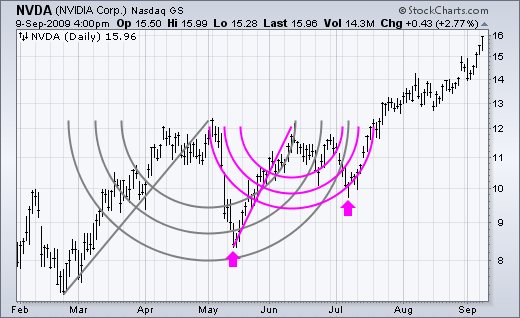

Applying Fibonacci to the Stock Market Patterns

Patterns are everywhere. We see them in the ebb and flow of the tide, the petals of a flower, or the shape of a seashell. If we look closely, we can see patterns in almost everything around us. The price movements of financial markets are also patterned, and Elliott wave analysis gives you the tools to interpret those patterns.

The Fibonacci sequence is vital to Elliott wave analysis as a matter of fact, R.N. Elliott wrote that the Fibonacci sequence provides the mathematical basis of the Wave Principle. Once you understand the Fibonacci sequence, its easy to apply it to the markets you trade.

The following excerpt is from a new eBook from Elliott Wave International Senior Tutorial Instructor Wayne Gorman: How You Can Use Fibonacci to Improve Your Trading. Wayne explains how the Fibonacci sequence is derived and how it can be used to understand market behavior.

Learn how you can download the entire 14-page eBook below.

The Golden Ratio and the Golden Spiral

This is a diagram of the Golden Spiral. The Golden Spiral is a type of logarithmic spiral that is made up of a number of Fibonacci relationships, or more specifically, a number of Golden Ratios. For example, if we take a specific arc and divide it by its diameter, that will also give us the Golden Ratio 1.618. We can take, for example, arc WY and divide it by its diameter of WY. That produces the multiple 1.618. Certain arcs are also related by the ratio of 1.618. If we take the arc XY and divide that by arc WX, we get 1.618. If we take radius 1 (r1), compare it with the next radius of an arc thats at a 90° angle with r1, which is r2, and divide r2 by r1, we also get 1.618.