FEDERAL RESERVE PURCHASED 80% OF TREASURY ISSUES IN 2009!

Post on: 20 Апрель, 2015 No Comment

An 80% Sham Market, Zombie

Armies & Cheating Investors

by Daniel R. Amerman, CFA

Overview

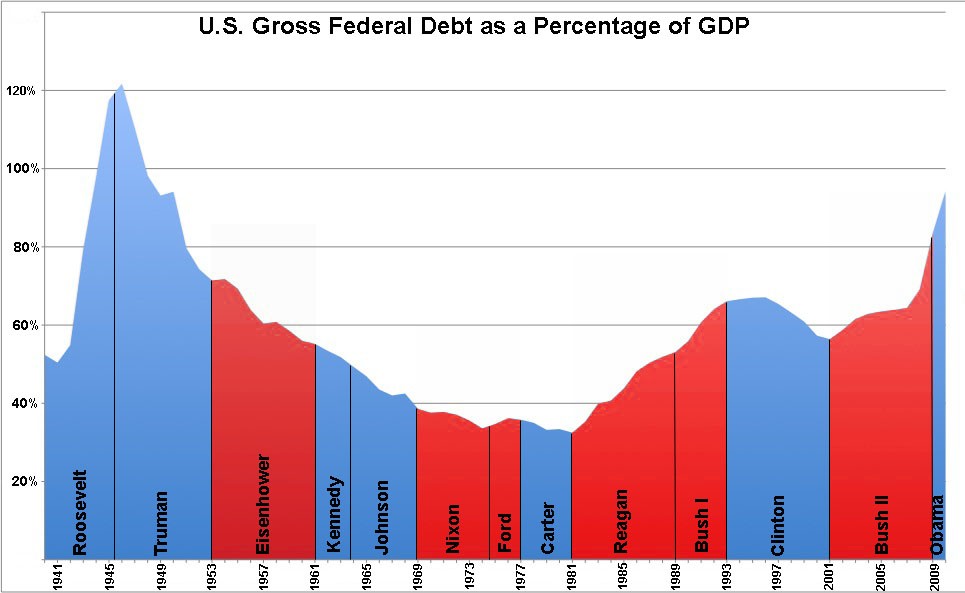

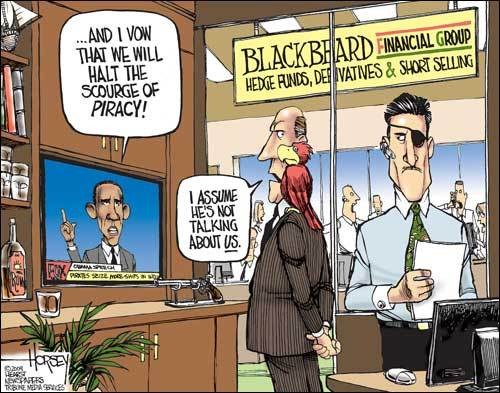

About 80% of net issuance of total US Treasury and Agency debt has become an artificial market, lacking real investors, and relying on the fiction of Federal Reserve purchases with imaginary money in order to prop up prices and hold down yields. At the same time, Treasury secretary Geithner claims to be so pleased with this non-existent market that he wants to increase the average term of Treasury borrowings. The juxtaposition is deeply bizarre, yet passes nearly without comment in the mainstream media. In this article we will delve beneath the façade being maintained by the government, Wall Street and the media, and will uncover the cheating of small investors in a market where most of the buyers don’t actually exist. Finally, we will introduce the hidden opportunities within sham markets.

A “Twilight Zone” Treasury Market

When reading the financial pages, do you ever get the feeling that youre reading the script for an episode from the old television series, “The Twilight Zone”? Perhaps one where the normal family is inside eating dinner, getting ready to let the kids go outside and play, but what they dont realize is that all the normal looking people they see walking past their windows are in fact zombies, and the entire town has been taken over?

I usually dont spend too much time thinking about zombies, but this is the exact kind of feeling that I got when reading about United States Treasury Secretary Geithners plan to increase the duration of US treasury borrowings. That is, he wants to take advantage of the “current low level of interest rates” to substantially increase the average term at which the Treasury borrows, so instead of an average due date of 49 months, he intends to move it out to an average of 72 months.

I first read about this in a Bloomberg article, and what brought “The Twilight Zone” to mind was that the entire article was written with a straight face, so to speak. Reading the article, one would think we actually had a free market for US treasury debt, where demand for the debt and the interest rates on that debt were in fact being determined by investors of their own free will.

This is where the zombie army comes in, that purported vast army of investors whose investment choices are determining current interest rates for US long-term and agency debt. They dont really exist. Instead, the largest buyer of net issuances of US treasury bonds, of long-term agency debt, of mortgage-backed securities, is in fact the Federal Reserve. (Net issuances being the excess of newly issued debt over retired debt, i.e. the net amount by which government debt is growing.) And the Federal Reserve is effectively creating money out of thin air to buy these long-term treasuries.

Plainly put –when one branch of the government is creating money out of nothingness to buy the debt of another branch of the government – they aren’t real buyers nor investors, but a sham. A very dangerous sham for investors, who, based upon reading the mainstream financial media, believe the financial world is anywhere close to normalcy, and that they are getting fair returns for their investments.

The Real Source Of Funding (aka The Zombie Army)

Hedge fund analyst Jon Harooni and macro analyst Ravi Tanuku, in their article Who Is Really Lending The U.S. All This Money? (published in the hedge fund industry periodical Absolute Return + Alpha). track down what is actually happening, the real source of these funds.

Out of nearly $2.1 Trillion of net issuance across the Treasury, Agencies and MBS markets from June 2008-9, the Federal Reserve has accounted for nearly 40% of the total demand, buying more than every foreign government combined. It is also not a stretch to say the Fed has become the entire mortgage market; it has purchased nearly $500B of MBS securities during a period where there was only $350B issued. Looking at the first seven calendar months of 2009 yields similarly startling results: of the total $1.1 Trillion of net issuance across these markets, the Fed has purchased $861B or almost 80%. (bold emphasis mine)

The reason that the Federal Reserve has been taking these unprecedented steps on a massive scale is that given the huge amount of current United States government deficits, combined with the weak economy, the vast amount of spending for bailout, stimulus and so forth, there simply arent enough buyers for all this debt. Moreover, in a true free market, investors would demand a far higher interest-rate level than what theyre getting right now, if they were to continue to fund a government that is spending with neither restraint nor a credible source of funding for repayment. In a free market, we would expect those interest rates to keep rising until they are so attractive that actual investors buy up all the debt.

If this free market scenario were to happen, the US government budget deficit would skyrocket to a far higher level, because the US government would be paying higher interest rates on its borrowing (the missing free market link that is supposed to restrain governments). There would also be high pressure on housing markets, as mortgages became unaffordable. So the situation is that in order to fulfill its plans, the US government needs to borrow fantastic sums of money – but the lenders simply arent there. As the only alternative, the Federal Reserve effectively creates the money out of thin air to fund the rest of the government.

That is an extraordinary result, which shows just what a bizarre place the financial world has become, even as the government, media and investment firms struggle to put up a façade of normalcy.

Eighty percent of the US debt market no longer exists, in terms of net new debt issuance. There isn’t enough demand, and increasing rates to find demand would inflict punishing damage. So artificial “Zombie” investors are created, who buy the debt with artificial money, and the façade is maintained – at least for now.

The Systemic Cheating Of Small Investors

What is the price for individuals of buying into this façade? Of leaving the safety of their home, and joining the Zombie army of phantasmic investors, buying at current market levels? Whether directly, or through their mutual funds or retirement accounts?

This is not an innocent process, nor is it for the greater public good. Instead, let me suggest that it is a process that deliberately takes wealth from naïve investors, particularly individual investors who believe what they read in the mainstream media, and it transfers that wealth to both Wall Street and to the federal government. This is something that I have been writing and speaking about for a long time now (my article Fed Manipulations Subsidize Wall Street And Cheat Investors, addressed this subject two years ago). So its been happening for quite a while, but it keeps getting worse and worse, and the idea that were indeed in the financial “Twilight Zone” becomes increasingly difficult to deny.

The problem with systemic government interventions is that as they grow in scale, the degree of mispricing grows greater and greater. As any bond investor knows, for a given bond with a fixed coupon, the higher that interest rates move, the lower the price of that bond goes. Why would anyone pay 100 cents on the dollar for a bond that pays a 3% interest rate, when there are plenty of new bonds around at 6% that can be bought at “par” (100 cents on the dollar)? Therefore, anyone who pays full value for a new bond with a rate that is below market, is getting cheated at the moment they make their purchase.

This principle is illustrated in the graph above. The all blue bar on the left side of the graph represents the value of 10 year US Treasury bonds with a 3.50% coupon. If 3.50% were the real market rate (in which case Fed purchases would be unnecessary), then this bond would be worth 100 cents on the dollar. With each bar to the right, the real interest rate shown on the bottom goes up – and the market price for 3.50% ten year bonds goes down.

For instance, if real market rates would be 6.50% without zombie investors – the free market price would be less than 80 cents on the dollar. Meaning current purchasers who buy into a manipulated market where the other investors don’t really exist, are getting cheated out of 20 cents on the dollar, every time their fixed income fund buys a 10 year treasury bond.

However, keeping in mind that the US government was already effectively bankrupt before the financial crisis ever hit due to Boomer retirement obligations that can’t be paid, and the government is currently spending trillions without restraint 6.50% would be a very low free market rate for the current situation. If the proper market were 9.50% for the world’s largest unrepentant spendthrift every investor is getting cheated out of about 40% of the value of their investment.

At 12.50% the true market price should be less than 50 cents on the dollar, and at 15.50%, it would be about 40 cents on the dollar. Meaning investors are getting cheated out of 60 cents with each new bond they buy. What the true market yield would be for the government to actually borrow “real” dollars, we can’t tell without a legitimate free market of actual investors. But whatever the level, any individual who buys today at rates set by a market primarily made up of unreal investors, is getting cheated on a very real basis.

(It is a quite different story for institutional investors who borrow from the Fed at artificially low rates, to purchase bonds from the Treasury at somewhat higher artificially low rates, as covered in my previously mentioned article Fed Manipulations Subsidize Wall Street And Cheat Investors.)

Now the price of this manipulation after manipulation on top of manipulation is mispricing, mispricing, mispricing from the perspective of the average individual investor. Believing what theyve been hearing from the economics and financial community, and believing in what theyre reading in the mainstream financial media, these investors think that when they buy US treasury bonds theyre getting a fair rate of return on that treasury bond. They believe if they step up and buy a mortgage-backed security, theyre getting a fair rate on that mortgage backed security. And they believe if they purchase a stock with their 401(k) or IRA, theyre getting a fair price on that stock.

They’re not. Instead, the Federal Reserve and US treasury are cheating small investors out of returns that should be theirs. If someone buys a US treasury bond or a mortgage-backed security, the yield ought to be far higher in compensation for the risks that are involved right now with the US economy and the massive extraordinary government deficits.

The Next Step

Almost two years ago, in a series of public articles, I predicted not just financial disaster, but the process with which financial disaster would unfold.

- Using my professional background as a derivatives author and former investment banker, I explained why the subprime mortgage crisis would get much worse.

- I explained the understandable, human reasons why the investment banking industry was creating enormous systemic risk with credit derivatives, and that the crisis would jump from mortgage derivatives to credit derivatives (i.e. AIG).

- Long before September of 2008, I explained how Wall Street could melt down in a week or an afternoon, not from accounting losses, but from losing the short term funding that the heavily leveraged financial giants relied upon, as the extent of losses become clear to creditors during a derivatives market collapse.

- I predicted that the government would not allow this meltdown to occur, but would instead engage in the largest bailout in financial history.

- I projected that the bailout would necessarily reach a size that it could no longer be financed conventionally, and the Federal Reserve would resort to directly creating money without limits, to fund the massive bailout.

- I explained why this would ultimately lead to the destruction of the dollar and of retirement savings through a massive bout of monetary inflation.

(All of these explanations were publicly published through contrarian websites and widely circulated on the Internet at that time.)

To my knowledge this accurate, step by step explanation of what would be happening and why, was absolutely unique – though for the sakes of all of us and of our families, it would have been much better if I had been entirely mistaken.

Unfortunately, it is very difficult to see any path out of this other than Step #6 – massive inflation that will destroy the value of the dollar, and conventional investment strategies along with it. Indeed, it has already happened, and all that prevents a sudden spike in interest rates is the Fed’s 80% funding of the market for US and agency debt, in combination with China and Japan’s urgent economic need to prop up the dollar, manipulating its value through the purchases of US government debt. Each source of funding creates ever growing instability, and that foreign investors are fleeing longer term agency debt is a sign that they are keenly aware that the end may be nigh.

Your Choice: Victim or Beneficiary

So what is an individual to do?

Let me suggest there are powerful reasons not to be taking your assets – particularly your retirement savings – and purchasing investments where we know that the value is being deliberately manipulated by the US government and Wall Street for their own purposes. To purchase under those conditions is to set yourself up for victim status. I would argue that this applies as much to stocks as it does to Treasury Bonds.

There is another approach, which is to say that these fundamental unfairnesses, these fundamental manipulations, these fundamental mispricings by their very nature necessarily create arbitrage opportunities for individuals and institutions that know how to look for them. Indeed, that is their very purpose to effectively give Free Money to Wall Street in the form of huge profits with reduced risk, in order to rebuild firm capital with much of those profits then passing directly into the bonus pools of the exceptionally politically well connected individuals involved.

However, participating in these handouts is not your intended role. From a traditional mainstream finance perspective, your role is to systematically take your savings and every month invest them in mispriced securities, for which you will pay the financial institutions an all-in average of about 2% in fees every year, even while the benefits of the mispricing pass to others. As an individual, you cannot directly participate in Wall Street’s insider’s game, not unless you are bringing many millions to the table, and then it is still somewhat problematic whether you will end up as predator or prey. However, in the process of manipulating markets, the government also necessarily did something else – and that was to leave the back door open.

A mispriced market is a market that is rife with profit opportunities. The trick being how to access these opportunities, when traditional personal finance strategies involve buying overpriced securities. To find the back door, we have to leave the traditional personal finance strategies behind, and learn exactly how the system is being manipulated for the benefit of institutional insiders, through liability based bailouts. When we clearly see those manipulations, then we have something else that opens up for us a veritable playground of opportunities for investment, indeed, some of the best we may find in our lifetimes.

But first we need to be able see these opportunities and that means we need to start with education.