Federal funds rate

Post on: 17 Июль, 2015 No Comment

February 19, 2010

Rate Rise Stirs Questions- Fed Raises Cost of Emergency Loans to Banks, Spurring Talk of Tighter Credit

Filed under: Uncategorized ktetaichinh @ 10:50 pm

The Federal Reserve raised an interest rate it charges banks for emergency loans, and emphasized that a broader tightening of credit for consumers and businesses is still at least several months away. But the late-afternoon increase in the discount rate didnt have the muted impact Fed officials hoped for.

Stock futures and bond prices fell, and the dollar rose against the euro.

The Fed can talk all day about how the discount rate hike is technical and not a policy move, but the market sees it as a shot across the bow, Christopher Rupkey, an economist at Bank of Tokyo-Mitsubishi, said in a note to clients.

Fed officials had been signaling for some time that they intended to raise the discount rate as part of an effort to wean the banking system off government credit. On Thursday, after raising that rate by a quarter percentage point to 0.75%, it indicated that the move wasnt a precursor to a broad tightening of credit.

The move doesnt signal any change in the outlook for the economy or monetary policy and is not expected to lead to tighter financial conditions for households or businesses, the Fed said. Instead, it said it was encouraging banks to return to private markets as their main source of funds and rely on the Fed only as a backstop.

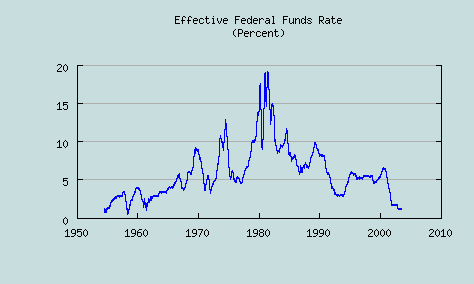

The discount-rate move didnt affect the Feds main policy tool, the federal-funds rate, a Fed-influenced rate that banks charge each other on overnight loans. That benchmark rate that filters through to other market rates. The Fed on Thursday reiterated the fed funds rate will remain near zero for an extended period, which means at least a few more months.

Still, the federal-funds futures market, where traders bet on the future level of that key rate, signaled that the market now is anticipating movement.

Before the Fed announcement, that futures market was anticipating one increase in the fed-funds rate this year, and put the chances of a second rate increase by year-end at 28%. After the announcement, the market had raised the odds of a second rate increase to 50%.

More

The market reaction highlighted the communications challenge faced by the Fed. Fed Chairman Ben Bernanke took many unorthodox steps during the financial crisis. The return to more normal Fed policy also is likely to follow an unorthodox path punctuated with bouts of market-jarring uncertainty.

Fed officials view the economy as recovering, but still weak and thus not strong enough to justify tighter credit conditions more broadly. In the depths of the financial crisis in 2008, Fed discount window loans exceeded $100 billion. As of Wednesday, they were below $15 billion.

Before the crisis, the discount rate was a full percentage point above the fed-funds rate, a penalty meant to discourage banks from using it except in extreme conditions. In the opening act of the financial crisis in August 2007, the Fed reduced the gap between the two rates to encourage banks to borrow.

With Thursdays move, which is effective Friday, the gap between the fed-funds rate and the discount rate will be a half percentage point, up from a quarter percentage point.

The Fed also shortened the maturity on discount-window loans from 28 days to overnight, a condition that prevailed before the crisis.

Borrowing from the discount window has a stigma, even though borrowers identities arent disclosed. So banks initially were reluctant to tap it during the crisis. In response, the Fed initiated an alternative way to lend to banks—auctioning off funds in an what was called the Term Auction Facility. The auctions grew to as large as $400 billion during the crisis. On Thursday, the Fed raised minimum bids on these loans to 0.5% from 0.25%.

Id emphasize that the changes are simply a reversal of the spread reduction we made to combat stigma, and like the closure of a number of extraordinary credit programs earlier this month, represent further normalization of the Federal Reserves lending facilities, Fed governor Elizabeth Duke said in remarks prepared for delivery Thursday evening.

Fed officials discussed the discount rate at their January policy meeting, and described the reasons for lifting the rate in the minutes of that meeting, which were released Wednesday. The timing of the announcement apparently was intended to emphasize that it wasnt a signal of an imminent tightening of credit.

FRANKFURT — The Federal Reserve ’s decision to start raising the interest rate it charges on short-term loans to banks reverberated around the world Friday, first unnerving markets but then reassuring them as investors shifted focus to the implicit vote of confidence in the American economy

The Fed had been holding interest rates to rock-bottom lows for more than a year as it sought to prop up the financial system. Its move to normalize lending provided another reminder that the era of extraordinarily cheap money necessitated by the crisis was drawing gradually to a close.

While the Federal Reserve had signaled its intention, the timing was a surprise, coming between scheduled policy meetings. The announcement was made after markets had closed in New York Thursday, and the Fed’s carefully worded statement emphasized that it was not yet ready to begin a broad tightening of credit that would affect businesses and consumers as they struggled to recover from the economic crisis.

The European Central Bank. which also has been allowing banks to borrow almost unlimited amounts of cash, began slowly withdrawing the emergency funds in December, and has said it will announce additional measures at its next policy meeting on March 4.

Analysts said the Fed move would not alter their prognoses of when the European Central Bank will begin to raise its benchmark interest rate from a historic low of 1 percent. “The Fed move shouldn’t have any direct bearing on the E.C.B.,” said Peter Westaway, the chief economist for Europe at Nomura in London.

However, the Fed action could bolster those who believe the European bank could begin raising rates as early as the third quarter of this year. “We feel confirmed having been on the early side,” said Michael Heise, chief economist at the German insurer Allianz.

With both the United States and Europe recovering slowly and unevenly, neither the Fed nor the European bank is expected to raise interest rates quickly or sharply.

Europe is pulling out of recession. but confidence remains fragile amid fears that European Union members will have to step in to prevent Greece from defaulting on its national debt.

Though American growth has exceeded expectations, unemployment is still near 10 percent and there are fears of a surge in loan defaults, especially in commercial real estate.

Stefan Schneider, chief international economist at Deutsche Bank. joked that the Fed is not yet taking away the punch bowl, just one of the dippers.

Mr. Heise at Allianz called the step “positive” overall. “It is an early signal that there is some normalization of conditions in the economy,” he said. “Markets were disappointed but I don’t think this is permanent.”

Asian stocks were hit the hardest, with the Nikkei 225 index in Tokyo dropping over 2 percent, and both the Kospi index in Seoul and the Hong Kong’s Hang Seng indexes showing similar declines.

France’s CAC 40 Index, Germany’s DAX Index and Britain’s FTSE 100 all fell initially but closed the day slightly higher. The Fed’s board of governors raised the discount rate on loans made directly to banks by a quarter of a percentage point, to 0.75 percent from 0.50 percent, effective Friday.

It also took two steps to begin unwinding its efforts to keep the banking system functioning after the real estate bubble inflicted huge losses that were amplified by sophisticated bets made by Wall Street.

“This is a victory lap by the Fed,” said Zach Pandl, an economist at Nomura Securities. “It is a signal that the Fed is very confident in the health of the banking system. Fundamentally, these actions are a sign of policy success.”

Many economists said banks were no longer borrowing in large amounts from the Fed using the discount rate, and so the move Thursday was, in a sense, purely technical. But it was a sign that the threat of a collapse in financial markets — so real just a year and a half ago — had dissipated.

The Fed reaffirmed last month that the key short-term interest rate it controls — the one that more directly affects consumer rates like mortgages and credit cards — would remain “exceptionally low” for an “extended period,” language it has used since March.

Randall S. Kroszner, an economist at the Booth School of Business at the University of Chicago and a former Fed governor, said after the announcement: “This is a technical change that makes sense as a precondition for other changes, but is not a precursor of short-term change.”

The exit from unprecedented emergency lending is already well underway in the Asia-Pacific region, underscoring the two-speed path of the global recovery.Last October, Australia became the first major economy to start raising the cost of borrowing. The bank has now raised its key cash rate a total of three times, by three- quarters of a percentage point, to 3.75 percent.

“The historic shift in the center of economic gravity to the Asian region is continuing, and if anything it has been highlighted by the different performances during the crisis and initial recovery,” Glenn Stevens, the governor of Australia’s central bank, told legislators on Friday. He signaled more moves are on the way.

In China, where growth has once again reached breakneck levels and inflation is becoming a worry, the authorities have deployed a different tool to cool an economy that some believe may be in a bubble. Rather than raise outright interest rates, the country’s central bank has instructed state-owned banks to set aside a larger portion of their reserves — a move that limits the amount they can lend to consumers and businesses.

A first rise in the so-called “reserve requirement ratio” for banks came in mid-January. Only a month later, an unexpected second increase took the ratio to 16.5 percent for large banks. At the start of this year, the ratio had stood at 15.5 percent.

India, which likewise avoided the banking collapses that beset the Western world, also has deployed the cash reserve ratio tool, raising the requirement for banks in late January.

As part of the changes disclosed Thursday, the Fed announced that the typical maximum maturity for primary credit loans, in which banks borrow from the discount window, would be shortened to overnight, from 28 days, starting March 18.

The Fed also raised the minimum bid rate for its term auction facility — a temporary program started in December 2007 to ease short-term lending — to 0.50 percent from 0.25 percent.

The discount rate applies to loans the Fed makes for very short terms, to sound depository institutions, as a backup source of financing.

The central bank took pains to reiterate that it was not moving in a sudden new direction.

“The modifications are not expected to lead to tighter financial conditions for households and businesses and do not signal any change in the outlook for the economy or for monetary policy,” the Fed said in its statement.

WASHINGTON (AP) The Federal Reserve seems likely to keep interest rates at record lows for several more months after news Friday that consumer prices excluding food and energy fell in January.

It was the first time such prices have fallen in any month since 1982.

The tame report on consumer prices sent a positive signal to investors and borrowers. It suggested that short-term rates can remain low to strengthen the economic recovery without triggering inflation.

Some have worried that a Fed rate increase affecting consumers and businesses might be imminent, especially after it just raised the rate banks pay for emergency loans.

Fridays news helped reassure financial markets. The Dow Jones industrial average rose about 9 points, or 0.1 percent. Broader stock averages also gained modestly. Bond prices rose, pushing yields lower.

The Fed has kept a key bank lending rate at a record low near zero since December 2008. The goal is to entice consumers and businesses to boost spending.

Many analysts said the consumer-price report reinforced their view that the earliest the Fed will start raising rates is the fall. Some said the central bank might wait until the end of this year or early next year before raising its target for the federal funds rate. Thats the rate banks charge for overnight loans.

Rate hikes remain unlikely until late 2010 or early 2011, Eric Lascelles, an economist at TD Securities, wrote in a research note.

Overall consumer prices edged up 0.2 percent in January, the Labor Department said. But excluding volatile food and energy, prices fell 0.1 percent. That drop, the first monthly decline since December 1982, reflected falling prices for housing, new cars and airline fares.

The news was better than expected, especially after the government said Thursday that inflation at the wholesale level, excluding food and energy, rose 0.3 percent in January. That was faster than the 0.1 percent increase economists had predicted.

Chairman Ben Bernanke has said the Fed will likely start to tighten credit by raising the rate it pays banks on money they leave at the central bank. Doing so would raise rates tied to commercial banks prime rate and affect many consumer loans. That would mark a shift away from the federal funds rate, its main lever since the 1980s.

The Fed announced late Thursday that it was boosting the rate banks pay for emergency loans by a quarter-point to 0.75 percent. That rate is called the discount rate .

The announcement of the discount rate increase initially roiled global financial markets. Investors feared it could be a signal that the Fed might start raising consumer and business rates because of inflation fears. The Fed increases rates to slow the economy and keep inflation pressures from rising too much.

But Fridays report of benign consumer prices calmed the initial market jitters. It solidified economists belief that the central bank is still months away from any rate change that would directly affect consumers.

The economy is still suffering from major problems, said Sal Guatieri, an economist at BMO Capital Markets. The Fed is going to err on the side of keeping policy loose because of the high unemployment rate and the minimal risk that inflation will move higher over the next couple of years.

Guatieri said he thought September was the most likely time for the Fed to start boosting rates. Others predicted it would take longer.

Economists say inflation will remain tepid as the economy struggles to sustain a rebound from the deep recession. High unemployment is keeping a lid on wage gains. And consumer spending is being constrained by the weak income growth. Businesses dont have the ability to raise prices.

Mark Zandi, chief economist at Moodys Economy.com, said he thinks the Fed will start raising rates in December. But he said that could easily slip into next year, if joblessness remains high.

I dont see them raising interest rates until the unemployment rate is headed lower on a sustained basis, Zandi said.

Zandi thinks the jobless rate, which dropped to 9.7 percent last month, will begin rising again and peak around 10.5 percent late in the year before starting to decline in 2011.

David Wyss, chief economist at Standard & Poors in New York, said the Feds decision on when to start raising rates could be complicated by the November congressional elections.

The Fed usually doesnt like to start raising interest rates in the midst of an election campaign, Wyss said.

The 0.2 percent rise in overall consumer prices reflected a 2.8 percent jump in energy costs. Thats the biggest one-month gain since August. Energy prices were driven by a 4.4 percent rise in gasoline pump prices and a 3.5 percent increase in the cost of natural gas.

Food prices rose a moderate 0.2 percent, even though fruit and vegetable costs jumped 1.3 percent. Analysts predicted bigger gains in the months ahead, reflecting crop damage from a freeze in Florida.

The Consumer Price Index report for January did show some price increases in scattered areas. The price of medical care rose 0.5 percent. It was the biggest one-month gain in two years. And the cost of tobacco products rose 0.4 percent, the sharpest increase since November.

The cost of used cars and trucks rose 1.5 percent, the sixth straight gain. Those increases have been attributed, in part, to last summers popular Cash for Clunkers program, which reduced the supply of used vehicles for sale.

Offsetting the gains, the price of airline tickets fell 2.5 percent. New-car prices slid 0.5 percent. And clothing costs dropped 0.1 percent.

The biggest factor lowering core inflation was a 0.3 percent drop in shelter costs, which accounts for 42 percent of the CPI. The drop in housing partly reflects the collapse of the housing market. More homes have been turned into rental properties, and rental costs have fallen.

Stocks end strong week with modest climb as Fed starts to remove emergency measures for banks

NEW YORK (AP) The stock market ended a strong week with modest gains after investors found good news in the Federal Reserves decision to begin dismantling emergency lending measures for banks.

The Dow Jones industrial average rose for a fourth day Friday, edging up 9 points to record its best week in more than three months.

Stocks initially fell in response to the Feds announcement late Thursday that it is raising the rate it charges banks for emergency loans, known as the discount rate. Stocks turned higher in late morning trading as investors saw the Feds move as a vote of confidence that the financial system was recovering and that banks didnt need as much support.

A tame report on consumer prices brought reassurance that the Fed would be able to hold down more important rates for consumers and business loans.

The Fed certainly isnt exiting the easy money policy door yet, said Burt White, chief investment officer at LPL Financial. They have their coats and boots on.

The central bank didnt change its more widely used federal funds rate, which is a benchmark for short-term interest rates.

Jay Leupp, president of Grubb & Ellis AGA mutual funds, said it wasinevitablethat the Fed would raise the discount rate. However the timing and size of future rate hikes for both the discount rate and the federal funds rate are still quite uncertain, he said.