Fed Warns Of Potential Cascade Stock Market Crash

Post on: 1 Май, 2015 No Comment

In a recent Fed paper [pdf], the Fed studies the impact of Leveraged and Inverse Exchange Traded Funds (LETFs) and their potential impact on the market, specifically compared to portfolio insurers that helped exacerbate the 1987 stock market crash.

If the paper had come from any institution other than the Fed, it wouldn’t be nearly as significant. When the Fed is researching leverage in the stock market, we should listen.

The way LETFs work is much like other ETFs except they use leverage. Therefore, investors can utilize leverage (maybe not offered directly by their broker) to gain or lose a higher per point value with the rise or fall of broad indexes. Similar to ETFs, LETFs balance themselves daily to ensure the NAV of the portfolio represents real market positions. The Fed concludes the detailed report by posing the possibility that this rebalancing, in a volatile market, could exacerbate any volatile market event (positive or negative, but of course the concern is about a market crash not a spike higher).

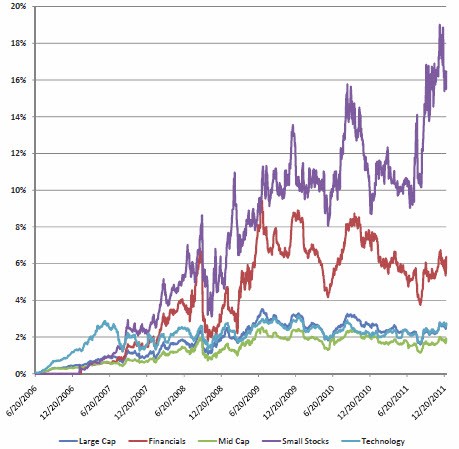

The implied price impact estimates of LETFs on broad stock-market indexes become significant during periods of high volatility, especially for the stocks of financial firms. LETF rebalancing in response to a large market move could amplify the move and force them to further rebalance which may trigger a cascade reaction. Rebalancing in the last hour of trading could, in fact, reduce the possibility of a price dislocation since the market close could serve as a prolonged circuit breaker. On the other hand, executing orders within a short period of time, such as the last hour of trading, may cause disproportionate price changes. A significant price reduction at market close may also impair investor confidence. If the market closes with depressed prices, the stock market could experience large investor outflows overnight.

ETFs and LETFs represent a large percentage of overall market share. Assets in ETFs vary from smaller ETFs with a few million, to the larger and more popular ETFs such as (NYSEARCA:SPY ) and (NYSEARCA:GLD ) that can have over one hundred billion.

The paper says that hypothetical LETF rebalancing can be as high as 6% of daily market volume for the underlying issues. For broad index LETFs this can represent significant flows. In the example of a big down day, the LETFs would exacerbate the trend by selling into a down market, at or near the close, and possibly after hours.

Other data

The timing of the report is curious, as other stock market related data warning of a potential crash have been released in the past few months.

A Deutsche Bank report, summarized here. titled Red Flag! — The curious case of NYSE margin debt looks at the increase of use of leverage through margin debt before a bubble pops, and news articles of the time that serve as a canary in the coal mine. Other reports have looked into the increase of the market correlated to the increase in margin debt, and it has been getting attention in the past few months from financial news reporters such as the Wall Street Journal. Some have surmised that the increase in margin debt to a certain point indicates a market crash.

Other disturbing data is that the SPY has a record low volume, while at the same time, has a record number of quotes generated. This indicates many algo players in the market, but in this case they aren’t actually trading they are just throwing out quotes. Those algorithms looking for momentum could also exacerbate a crash. In addition, it shows that much of the market increase may be caused by a combination of Fed QE, margin debt usage, algorithmic trading mostly by institutions, and momentum day traders. That is to say the rise in the market is not caused by real economic factors, retail investors buying, or strong corporate profits. In other words the buyers pumping up the market are fickle players, generally speaking they are speculators and not investors. In the case of algorithmic systems and LETF rebalancing, their selling during a big decline would be automated. Circuit breakers will likely prevent a huge one day decline, but pressure from LETF rebalancing, for example, could extend the decline to last for days or weeks, as they are forced in the market to rebalance their portfolios.

How to protect yourself

The report warns of exaggerated losses due to a potential crash but says the same could be true in a big spike up, it’s really an indication that LETF rebalancing will increase volatility and momentum on volatile days.

Any individual position can be protected with a stop-loss. However if you want to protect your portfolio or do not want to exit positions in the event of a crash, the best way to protect your portfolio is with the use of options. Options are available on most individual stocks, indexes, and ETFs. For those who have access to futures, futures options also cover the broader indexes, one of the most popular being the e-mini S&P symbol /ES. Most liquid ETFs such as (NASDAQ:QQQ ), (NYSEARCA:VWO ), (NYSEARCA:IVV ), and others, have options available. Each issue will vary in dates available, liquidity, and some will have a mini contract while others don’t.

To protect from a market decline, the best options strategy is to purchase a put. This provides limited risk (the cost of the put) and theoretically unlimited profit, although it will be capped at if the underlying goes to zero (which is nearly impossible). With more complicated portfolios, strike prices should be calculated against underlying long positions. Also remember that even if the market doesn’t crash, it just declines, those puts will increase in value and can always be resold for a profit. In a hedge situation, the profit should at least be equal to or greater than losses incurred by the long portfolio. This can be calculated using tools provided by most stock brokers, although it’s not exact (as the trading of options in the future will change the price).

Conclusion

The Fed isn’t supposed to worry about the stock market. However, the Fed has strong support when the market is strong, regardless of job numbers, inflation, and other economic data. When the Fed releases a report like this, investors should take note. You can read the full report here [pdf]. By itself, LETF rebalancing is nothing new. It has been around for some time. But combined with the Fed’s QE program, increase in use of margin debt, and an increase in algorithmic trading, it could be another significant factor exacerbating a potential market crash.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.