Fed ties interest rates to 6 5% unemployment

Post on: 20 Апрель, 2015 No Comment

Story Highlights

- Central banks stimulus actions aimed at reducing borrowing costs, unemployment rate

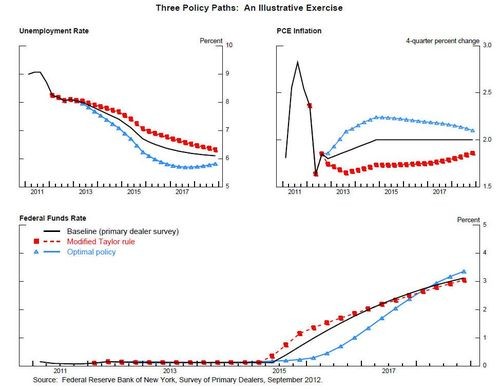

The Federal Reserve on Wednesday agreed to keep a key short-term rate near zero until the 7.7% unemployment rate is 6.5% or lower.

The short-term rate will also stay unchanged at 0.25%, the Fed said, until the current 2.2% inflation pace hits 2.5%. Tying the one rate it controls to unemployment and inflation targets is unprecedented, economists said.

The Fed’s aim is to spur economic growth and lower long-term borrowing costs for consumers and Corporate America.

To further that goal, the Fed also said it will continue monthly purchases of $45 billion in long-term government bonds. By year’s end, it will stop selling a similar amount in short-term Treasury notes, which it had been doing to keep its total holdings of government bonds stable.

Extension of the Fed’s bond-buying programs was widely anticipated. Key stock indexes rose 0.5% shortly after the announcement. The yield on the 10-year Treasury bond rose to 1.70%. Gold prices also jumped before settling back to an increase of $8.40 an ounce, or 0.5%, at $1,716.60.

Some investors may have been surprised that the Fed chose this meeting to set an unemployment target, but 6.5% is about where the market thought the Fed would set it if it went that route, said Miller Tabak economic strategist Andrew Wilkinson.

It’s unclear what impact the Fed setting targets on unemployment and inflation will have. The Fed’s economic forecast out Wednesday put the jobless rate at 6.8% to 7.3% by the end of 2014 and 6.0% to 6.6% by the end of 2015. Based on those projections, Fed Chairman Ben Bernanke said in his press conference that the Fed’s new guidance was consistent with its previous plan to keep its key interest rate unchanged until at least mid-2015.

Still, Bernanke said that the thresholds would be more transparent to financial markets than setting a date that could be modified anyway if economic conditions change. We think it’s a better form of communication, he said.

Rather than revising the projected date for interest rate increases, investors could automatically adjust their expectations based on the state of the economy. It acts as an automatic stabilizer, he said.

At the same time, he cautioned that 6.5% unemployment and 2.5% inflation would not automatically trigger a rate increase but would simply set a minimum threshold for when the Fed could consider raising rates. Calling the thresholds a guidepost, he said policymakers also would consider other economic data as well, such as whether Americans are dropping out of the labor force, before raising rates.

It by no means puts monetary policy on autopilot, he said.

Fed policymakers also lowered their economic growth forecast. They expect economic growth of 1.7% to 1.8% this year, down from their September projection of 1.7% to 2%. And they expect growth of 2.3% to 3% in 2013, down from 2.5% to 3% previously.

The jobless rate, however, has fallen more sharply recently, leading the Fed to slightly revise down its forecast. The Fed expects the rate to drop to 7.4% to 7.7% by the end of next year compared with its September forecast of 7.6% to 7.9%.

The Fed also said Wednesday it will continue buying $40 billion a month in mortgage-backed securities. The moves are aimed at holding down long-term interest rates for assets such as mortgages and corporate bonds, theoretically spurring consumers and businesses to buy more homes and factory gear.

The bond-buying initiative is intended to prod investors to shift money from low-yielding bonds to stocks, lifting stock prices and making consumers feel wealthier so they’ll spend more.

Many economists say the Fed’s efforts won’t help that much because interest rates are already near historic lows. And borrowing may not increase much because many consumers and small businesses don’t qualify for loans while bank lending standards remain tight.

The new bond-buying program replaces the 15-month-old Operation Twist. Under that initiative, the Fed had been buying $45 billion a month in long-term Treasury bonds and selling a similar amount of short-term Treasuries. The program ends this month and the Fed doesn’t have enough short-term bonds to continue the swaps.

The outright purchases, by contrast, will increase the size of the Fed’s bond holdings and the total amount of money it’s pumping into the banking system. That could lead banks to lend more, but it also could make it more difficult for the Fed to sell the bonds to head off inflation once the economy heats up.

The Treasury purchases supplement a separate program the Fed announced in September to buy $40 billion a month in mortgage-backed securities to more directly bring down mortgage rates. Fed policymakers made no changes to that initiative on Wednesday.

Unlike the Fed’s previous $2.3 trillion in government bond purchases since the financial crisis began in 2008, the Fed said the mortgage bond purchases would be open-ended, signaling a stronger commitment to support the economy as long as necessary.

If the labor market doesn’t improve substantially, the Fed vowed, it would continue the purchases and buy other assets. The latest Treasury bond purchases are also open-ended.

Richmond Fed Bank President Jeffrey Lacker was the lone dissenter, saying he opposed the additional asset purchases and the Fed’s description for how long it will continue to keep rates low and pump money into the economy.

For the past three months, monthly job growth has averaged 139,000, lower than this year’s 151,000 monthly average and the 200,000 needed to more quickly lower the unemployment rate. In that period, the jobless rate has dipped to 7.7% in November from 7.8% in September.

Citing high long-term unemployment and the decline in the portion of Americans working or looking for work, Bernanke recently said, We have some way to go before the labor market can be deemed healthy again.

Other economic data have been mixed lately. The housing market has improved, helping lift consumer confidence and bolster holiday sales. But businesses have reined in hiring and investment because of uncertainty over the fiscal cliff — a package of tax hikes and spending cuts that could topple the nation back into recession if Washington doesn’t avert them.