Favorite ETF Positions For 5 Super Investors

Post on: 12 Июль, 2015 No Comment

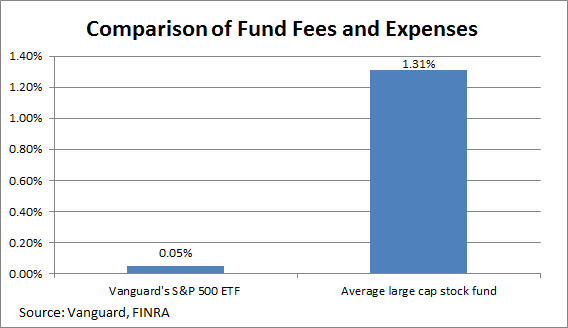

The ETF boom has made it easier for regular retail investors to add various new asset classes, sectors and markets to their portfolios with a single trade. Features like intraday tradability, low expenses and access to foreign issued shares make them a great way for investors to build market beating portfolios. Overall, the use of ETFs continues to rise and a recent survey by INVESCO shows that these products will make up 24% of portfolio allocations over the next 12 months and 33% over the next three years [for more ETF news and analysis subscribe to our free newsletter ].

Those positive factors haven’t been lost on institutional investors either. ETFs are creeping into more hedge fund and professional manager’s portfolios as the security-type continues to gain acceptance. Either as a parking place for excess accumulated cash or a tactical bet on the economy or a sector, the growth in professionals using ETFs is just getting started.

Here’s how some of the biggest investors on the block have added exchanged traded funds to their portfolios over the last few quarters.

John Paulson Paulson & Co.

John Paulson made a huge splash in 2007-08, when he correctly bet against subprime mortgages and the U.S. housing sector. That bet guided his Advantage Plus Hedge Fund to realize returns of 591% in that period and helped propel him into the media spotlight. Since that time, Paulson has made some big bets concerning the health of the global economy by accumulating gold and gold mining stocks at a fevered pace.

Paulsons latest 13F filings from the last few quarters have shown that the soft-spoken fund manager raised his stake in the SPDR Gold Shares ETF (GLD ) by 26% in the second quarter of 2012 to sit at 21.8 million shares. At roughly 66 metric tons of gold, that makes Paulson the single largest holder of the fund. That tonnage also catapults Paulson ahead of Denmark in terms of the countries total gold holdings. Despite the huge amount of GLD that Paulson owns, the fund remains the only ETF in his portfolio.

David Swensen Yale University

Credited with creating the concept of the modern endowment portfolio, Yale University’s David Swensen has long used a mix of stocks, bonds, and alternatives to help achieve record breaking returns and grow the school’s endowment into a $19 billion giant. His investments over the past few years have included a healthy dose of broad and sector ETFs [see also How To Pick The Right ETF Every Time ].

Swensen has been shifting more of Yale’s assets in alternatives like private equity over the last few years, and he currently sold out of big stakes in the Vanguard MSCI Emerging Market ETF (VWO ) and the iShares MSCI EAFE (EFA ). However, Swensen still sees value in a broad index approach and maintains a healthy sized position in S&P 500 SPDR (SPY ).

Paul Tudor Jones Tudor Investment Corp

Paul Tudor Jones founded the $11 billion Tudor Investment Corp. back in 1980 and gained prominence after correctly predicting the 1986 market crash. Tudor Jones’s strategies generally focus on short-term trading rather than long-term calls. This short-term strategy has helped Tudor Jones build a net worth of over $3 billion. One of the main building blocks of Tudor Jones’s strategy has been the use of sector ETFs. His latest 13F is huge and features tons of exchange traded funds. This includes big stakes in the iShares Core Total US Bond Market ETF (AGG ), iPath S&P 500 VIX Short-Term Futures ETN (VXX ), iShares FTSE China 25 Index Fund (FXI ) and SPDR S&P 500 ETF (NYSE: SPY).

Keep in mind that Tudor Jones is a quick-fire trader and many of his positions may already be closed-out by the time the 13F was made public.

George Soros Soros Fund Management

Soros is best known for his unmatched success at his Quantum fund, where he guided the investment partnership to a 32% annual return from 1969 to the year 2000. Since then the fund manager has spent most of his time on humanitarian efforts and charity work. However, he still makes time to invest and manage his family’s vast wealth.

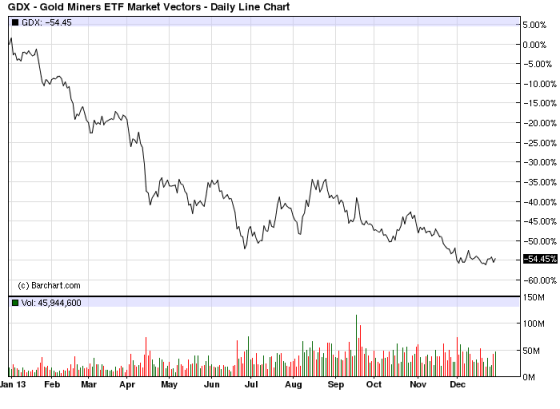

Managing that wealth includes a healthy smattering of ETFs. This includes stakes in the iShares Russell 2000 (IWN ), iShares MSCI Emerging Markets (EEM ) and iShares FTSE China 25 (FXI). Soros has also been bitten by the gold bug lately, as he fears that the U.S. will go over the fiscal cliff and could possibly plunge into a depression. As such, the fund manager has recently loaded up on the SPDR Gold Shares (GLD), SPDR Metals & Mining ETF (XME ) and Market Vectors Gold Miners (GDX ). Soros has even taking a big stake in the junior mining focused Market Vectors Junior Gold Miner ETF (GDXJ ).

David Tepper Appaloosa Management

While the rest of the money managers on this list are pretty well known, value investor David Tepper is generally not on most people’s investing radar. However, the founder and head manager at Appaloosa Management has made investments in distressed and undervalued companies an art form. Focusing on undiversified and concentrated investment positions, Tepper has managed to produce superior returns for his investors.

Tepper’s latest 13F reveals just one exchange traded fund, but it represents a deep value play on the U.S. economic recovery in housing. The manager now owns over 105,000 shares of the iShares DJ US Home Construction Index (ITB ). That’s a pretty serious bet that U.S. consumers will once again return to buying new homes [see also 5 ETF Superstars of 2012 ].

Bottom Line

Exchange traded funds have changed the market place for investors of all sizes. Just like us Average Joe traders, smart-money hedge fund and professional money managers continue to bet heavily on this security type. The previous examples are just some of the superstar investors latest moves using ETFs.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven day trial to ETFdb Pro ]

Disclosure: No positions at time of writing.