Facebook Through The Lens Of Porter s Five Forces

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

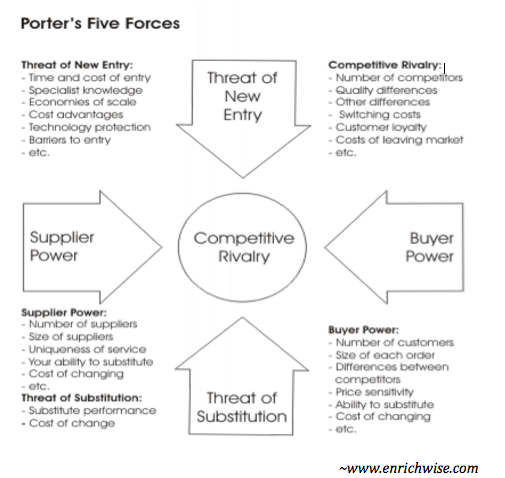

Social networking giant Facebook has shown tremendous growth in the recent past, resulting in almost doubling of its stock price from the IPO level of $38 per share. The market values the company at more than $200 billion, with a P/E ratio of around 70. Its top-line has risen by over 60% during the last nine months, and this impressive growth is expected to continue in the future. In addition to its core platform, Facebook also has other platforms including Messenger, Instagram, WhatsApp and Search, each of which have the potential to become multi-billion dollar businesses. In many respects, the company has not even begun scratching the surface of this opportunity. In this article, we analyze how Facebook stacks up along Porter’s Five Forces to understand whether there are factors which could hamper its growth story and cause its market valuation to drop.

According to our analysis, the social networking market is highly competitive and is prone to rapid change through the introduction of disruptive technologies. Facebook needs to continuously innovative and adapt to changing user trends to keep the engagement levels stable on the platform. The low barriers to entry in the Internet business further intensifies the competition in this market. Moreover, Internet usage is increasingly shifting to mobile devices, where the landscape is quickly evolving; hence we think investors need to keep an eye out for popular mobile apps as they could impact Facebook’s popularity. The switching costs for users are low and hence they could easily shift to newer apps for sharing information and micro-blogging.

Moderate To High

Competitive Rivalry Within The Industry: A wide range of players from full featured platforms (Google +) to niche social networking sites and new mobile apps could hamper Facebook’s user base growth

- Social networking space is prone to innovation, swift change and the introduction of new technologies. Hence, Facebook’s massive user base cannot be taken for granted; the company continuously needs to innovate and to adapt to changing customer trends Any failure to do so could potentially cause its user base to migrate to other social media networks.

- Competition stems not only from social platforms that vie for users, but also from companies that allow marketers with targeted advertising and new development platforms for application developers.

- Facebook commands a loyal user base across several user demographics and geographies. However, competition from Google+ and Twitter can cause a reduction in the average time spent by active users on the FB platform, as these platforms offer unique sets of features.

- Further, a number of social networks are cropping up that target a niche user base. For example, Snapchat appeals to a younger audience and is more popular among females. We expect this trend to persist and hence Facebook could see competition intensifying within different user demographics.

- Apart from this, since desktop usage is being replaced with mobile usage, we believe rapid changes on the mobile landscape pose a potential threat to Facebook. The mobile platform is inherently different, with apps being more targeted towards a specific functionality rather than a broad range of features.

- Currently FB provides a vast range of services such as photo-sharing, messaging, etc. We believe newer innovative apps could emerge providing one of these discrete services. In the event that any such app gains widespread popularity, it could lead to lower engagement on FB-owned platforms. This could also result in Facebook buying out upcoming competitors at steep valuations.

- There are several regional social networks, such as Renren in China, Mixi in Japan, vKontakte in Russia, etc. and these compete with FB for users in their respective geographies. Increased regulation in certain markets such as China is more beneficial to regional players.

Bargaining Power Of Customers: While users of social networking platforms hold high bargaining leverage, the same is limited for marketers

- Users on platforms including Facebook, Whatsapp, Instagram, Messenger, and marketers advertising on these platforms, represent customers for Facebook.

- Given the large-scale competition, the bargaining power of users is high. This means ensuring good user experience is the key to attract and retain customers on social networking platforms.

- The switching costs for users are low, making it easy for them to migrate to other platforms.

- This also places a higher limit on the ad load (the percentage of posts that are ads) on the FB platform; the ad load was previously measured to be around 5 to 10% and we believe this represents an optimal level without compromising on user experience.

- Since customers can choose from a wide array of messaging and other apps, this always restricts the fees Facebook could charge for Whatsapp in the future.

- The wide-spread popularity of Facebook, along with its ad-targeting capabilities, makes it an attractive platform for marketers, raising FB’s bargaining leverage with advertisers.

- Facebook caters to a very large number of marketers across both large and small scale businesses and hence their individual bargaining power is limited.

- However, in the event, Facebook starts increasing ad pricing significantly, we think marketers could start gravitating more towards other social networking platforms. And hence this factor limits Facebook’s ability to dramatically raise ad pricing on the platform.

Threat Of New Entrants: Rapidly evolving mobile landscape could result in newer (more innovative) players enter the market

- The Internet business is characterized by low barriers to entry. It is relatively easy to build new sites and applications. However, significant amount of resources are required for marketing and for gaining brand recognition, and this raises the barriers to entry to an extent.

- The introduction of innovative and niche social networking sites could potentially be a threat to Facebook. Concerns related to falling teen engagement on FB had led to a drop in its stock price in 2013.

- The rapidly evolving mobile landscape is an area to watch out for as Facebook’s usage is increasingly shifting to mobile platform -mobile daily active users (DAUs) comprised for more than 80% of overall Facebook’s DAU in September 2014.

- Hence, we believe investors should closely track the rising popularity of new mobile apps (in areas including social sharing, messaging, micro-blogging) as this market is still emerging with the advent of smart phones.

Threat Of Substitute Products: New social networks and mobile applications could emerge as viable alternatives to Facebook

- There are a large number of social networks that facilitate sharing of information, and hence customers could choose these other platforms over Facebook.

- A number of social networks cater to specific interests such as cooking and gaming, and hence any increase in their popularity could impact engagement levels on FB-owned properties.

- Apart from this, new and innovative mobile applications keep entering the market and they could potentially impact user growth on Facebook in the long-run.

Bargaining Power Of Suppliers: Certain software and hardware providers may hold moderate bargaining power

- Providers of servers, storage, power, software, data center and office equipment, technology etc. represent suppliers for Facebook.

- We expect their bargaining power to be moderate as Facebook is a large scale customer holding significant buying power.

- However, there are only a few reputed suppliers for a large range of hardware and software supplies, and hence this raises their bargaining power to an extent.

Like our charts? Embed them in your own posts using the Trefis WordPress Plugin .