Extending the Black Scholes formula

Post on: 1 Июнь, 2015 No Comment

For options on other financial instruments than stocks, we have to allow for the fact that the underlying may have payouts during the life of the option. For example, in working with commodity options, there is often some storage costs if one wanted to hedge the option by buying the underlying.

Continous Payouts from underlying.

The simplest case is when the payouts are done continuously. To value an European option, a simple adjustment to the Black Scholes formula is all that is needed. Let be the continuous payout of the underlying commodity.

Call and put prices for European options are then given by formula 8.1. which are implemented in code 8.1 .

Dividends.

A special case of payouts for the underlying is dividends. When the underlying pays dividends, the pricing formula is adjusted, because the dividend changes the value of the underlying.

The case of continuous dividends is easiest to deal with. It corresponds to the continuous payouts we have looked at previously. The problem is the fact that most dividends are paid at discrete dates.

European Options on dividend-paying stock.

To adjust the price of an European option for known dividends, we merely subtract the present value of the dividends from the current price of the underlying asset in calculating the Black Scholes value.

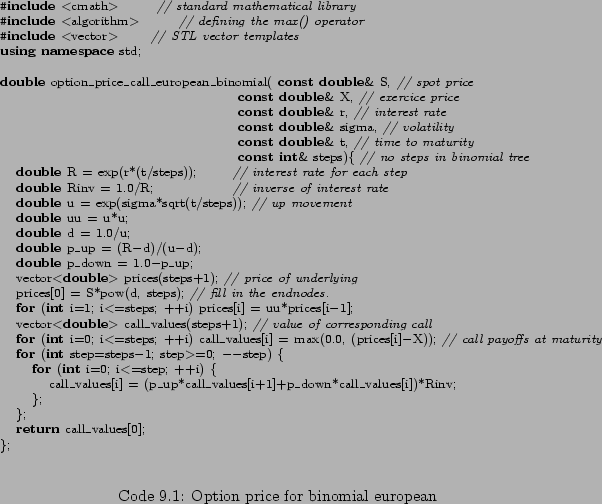

American options are much harder to deal with than European ones. The problem is that it may be optimal to use (exercise) the option before the final expiry date. This optimal exercise policy will affect the value of the option, and the exercise policy needs to be known when solving the pde. There is therefore no general analytical solutions for American call and put options. There is some special cases. For American call options on assets that do not have any payouts, the American call price is the same as the European one, since the optimal exercise policy is to not exercise. For American Put is this not the case, it may pay to exercise them early. When the underlying asset has payouts, it may also pay to exercise the option early. There is one known known analytical price for American call options, which is the case of a call on a stock that pays a known dividend, which is discussed next. In all other cases the American price has to be approximated using one of the techniques discussed in later chapters: Binomial approximation, numerical solution of the partial differential equation, or another numerical approximation.

Exact american call formula when stock is paying one dividend.

When a stock pays dividend, a call option on the stock may be optimally exercised just before the stock goes ex-dividend. While the general dividend problem is usually approximated somehow, for the special case of one dividend payment during the life of an option an analytical solution is available, due to Roll-Geske-Whaley.

If we let be the stock price, the exercise price, the amount of dividend paid, the time of dividend payment, the maturity date of option, we find

The time to dividend payment and the time to maturity .

A first check of early exercise is:

If this inequality is fulfilled, early exercise is not optimal, and the value of the option is