Exempt supplies (GST on exempt zerorated and special supplies)

Post on: 12 Май, 2015 No Comment

Additional information and help

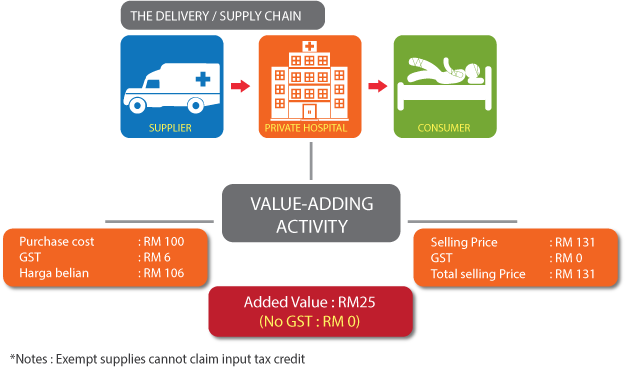

Exempt supplies

Exempt supplies are goods and services which are not subject to GST and not included in your GST return.

Exempt supplies include:

Donated goods and services sold by non-profit bodies

A charity that runs an opportunity shop selling only donated clothing can’t claim GST credits on the shop expenses, such as rates, electricity or maintenance. In this case, if this was the charity’s only activity, it would not even register for GST. However, if it also sells purchased goods, a GST credit may be claimed on the expenses that directly relate to those goods. All other expenses must be apportioned between the exempt and taxable supply use.

Financial services

Financial services include the following:

- paying or collecting any amount of interest

- mortgages and other loans

- bank fees

- securities such as stocks and shares

- providing credit under a credit contract

- exchanging currency (for example, changing US$ into NZ$)

- arranging or agreeing to do any of the above (for example, mortgage broking)

- financial options

- deliverable future contracts

- non-deliverable contracts.

Financial planning fees cover the various types of fees charged by financial advisers for financial planning services they provide. These are initial planning fees, implementation fees, administration fees, monitoring fees, evaluation fees, replanning fees and switching fees.

- Services relating to initial planning fees, monitoring fees, evaluation fees and replanning fees are subject to GST.

- Services relating to implementation fees, administration fees and switching fees are financial services and exempt from GST.

Additional information

Renting a residential dwelling

GST can’t be charged on the rent for a residential dwelling. A landlord can’t claim any GST on dwelling expenses, such as maintenance, rates and insurance.

If a residential dwelling is sold as part of a taxable activity, and it was rented for at least five years beforehand, the sale is an exempt supply.

If a property developer acquires a property for the principal purpose of making a taxable supply and then subsequently rents the property out, a change of use adjustment may be required.

Residential accommodation under a head lease

One tenant, the head lessee, has overall responsibility as set out in the lease with the landlord. This type of lease would most likely exist for a large multi-tenanted building.

The supply of residential property for lease under a head lease is an exempt supply, if the property is to be used for the principal purpose of residential accommodation, unless all of the following apply:

- the supplier and the recipient agree that the exemption does not apply

- the supply was made under a lease entered into before 16 May 2000, and

- previous supplies were treated as taxable.

Supply of fine metals

Fine metal is any form of:

- gold with a fineness of not less than 99.5%

- silver with a fineness of not less than 99.9%

- platinum with a fineness of not less than 99%.

The supply of fine metal is an exempt supply, such as any sale of fine metal by a dealer, or anyone importing fine metal.

Exception. When newly-refined fine metal is supplied by a refiner to a dealer as an investment item, it is a zero-rated supply.