ExchangeTraded Notes VIX v

Post on: 23 Май, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

The following commentary comes from an independent investor or market observer as part of TheStreet’s guest contributor program, which is separate from the company’s news coverage.

By David Gillie

NEW YORK ( ETF Digest ) — With the explosion of ETFs (Exchange-Traded Funds) as trading mechanisms, it’s no wonder that ETFs would develop into the realms of the absurd.

Like a bad spin-off from a ’70s sitcom, ETFs spun off into ETNs (Exchange-Traded Notes). The difference between the two is radical.

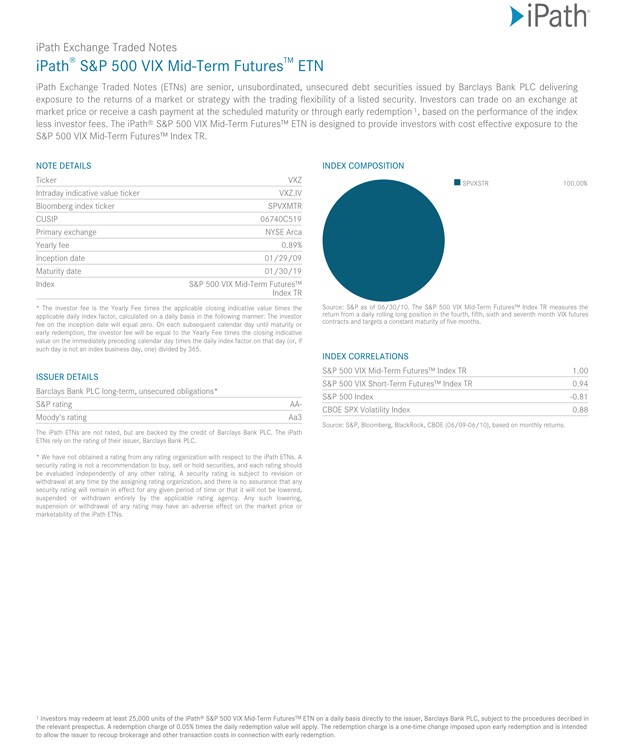

An ETF value is based on the price of its underlying holdings (like a mutual fund). The capital of the fund is secured by the value of the stocks held in the fund. An ETN is an unsecured, unsubordinated debt security with significant basis on the credit rating of the issuer. Although ETNs may be named to indicate tracking certain futures markets or indices, due to the fact that their holdings are credit notes rather than tangible assets, such as ETFs, their price becomes largely supply and demand based rather than based on underlying holdings. ETNs were originally developed to function in bond markets similarly to ETFs in equities markets. Presumably that should work because a bond, although a credit instrument, has an actual tangible monetary value.

Where ETNs went haywire was attempting to track indices not based on a monetary value. The Volatility Index (VIX) is a classic example. The VIX is a measure of options contracts traded on the S&P 500 over a 30-day period. It has no monetary value. It would be like trying to assign a dollar value to the numbers on a thermometer.

Case in point: as of Thursday, the VIX is rising. At the same time (TVIX), supposedly a 2x leveraged ETN tracking the VIX, is in a total collapse. Therefore, it has little correlation to the index it is associated with, and selling (loss of demand) is driving the price dramatically lower. Meanwhile, another 2x leveraged issue (UVXY) associated to the VIX is having a dramatic rise — a pure supply and demand circumstance with virtually no underlying basis of value.

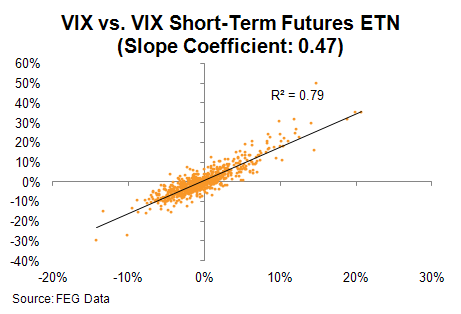

The highest volume ETN associated to the VIX is iPath S&P 500 Short Term Futures (VXX). An overlay of VXX on the VIX chart clearly demonstrated VXX does not track the VIX, but rather follows by supply and demand.

20Digest/gillie_032212/image001.jpg /%

The VXX (purple line) doesn’t even remotely track the Volatility Index (blue line).

The August 2011 selloff triggered a dramatic spike on the VIX, yet VXX didn’t reach its high until three months later. At that high on VXX, the VIX was achieving a lower high. Over the past week at the right of the chart, we see a complete divergence when the VIX was rising and VXX was falling.