ExchangeTraded Funds 2012 ETF Trend Trading & Real Wealth Income Generator

Post on: 11 Апрель, 2015 No Comment

Although a period of market ‘craziness’ where stocks went up one day and down the next due to Washington politics during 2011, many investors were afraid of ETFs, but in 2014 they are just another form of stock trading as are Binary Options. See also Forex & Options Profits Daily .

An ETF (Exchange-Traded Fund) is a securities fund which tracks a certain sector of a stock market index. Indices such as the S&P 500 and FTSE are examples of funds which can be traded on an exchange like a stock or share.

ETFs can be chosen by market sector or country or include broad-market indexes. This diversification offers protection in volatile markets, such as commodities. There are ETFs for gold, silver, platinum, copper as well as the agricultural and energy markets.

Exchange Traded Funds (ETFs) represent a basket of securities that are traded on an exchange. They are similar to index mutual funds but are traded as stock. As with all investment products, exchange traded funds have some advantages as well as disadvantages.

Definition of an Exchange-Traded Fund

An ETF is rather like a mutual fund in that it can be traded as a single stock. Like an index fund. such as the S&P500, an ETF also represents a ‘basket’ of stocks. However, an ETF isn’t a mutual fund which has its NAV or net-asset value calculated at the end of each trading day. An ETF’s value fluctuates during the trading day like any other stock, reacting to supply and demand.

While ETFs attempt to mirror the return on indexes. they do not follow them exactly. There is typically a 1% or more disparity between the return of an ETF compared to year-end return of the actual index, and in some cases it can be a lot more.

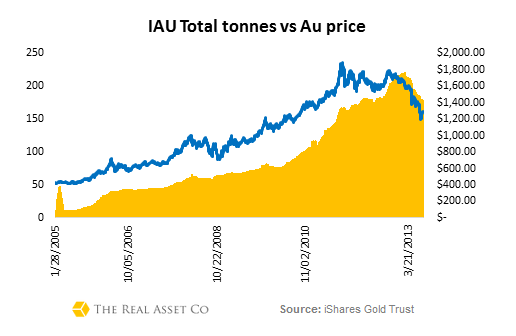

For example, here is a chart showing the past performance of two Gold ETF’s (GDX and GLD), compared to the S&P 500 index (^GSPC) for the same period. Some ETFs pay dividends too. The spot gold price rose dramatically in 2008 to over $1,000 per ounce before fluctuating with the current financial turmoil affecting markets world wide. Note that gold bullion ownership is possible with a company like BullionVault . Learn more on our Bullion Page. However, while GLD and SLV are within the scope of a 401(k) or IRA. purchasing and storing physical metals are not.

Costs of Trading Exchange-Traded or Mutual Funds

ETF investors receive the benefits of both diversification of an index fund together with the flexibility of a stock. For example ETFs can be bought on margin in single ‘share’ quantities and also short sold. Also, the expense ratios of most ETFs are lower than those of a typical mutual fund. as the broker commission on trading ETFs is the same as for buying and selling regular stocks.

Types of ETF

Exchange-traded fund trading began in 1993 with the introduction to the American Stock Exchange (AMEX) of the S&P 500 Index Fund. The SPDR ticker symbol gave rise to the nickname of Spider. Today — tracking a wide variety of sector-specific, country-specific and broad-market indexes — there are hundreds of ETFs trading on the open market.

Regular stock traders have a daunting task in choosing and analysing which sectors are performing and which stocks to buy. This is one reason that Exchange-Traded Funds suits some traders more, but as with other types of investment, some ETF training is required to get the best out of this market.

For example, if the Austrian market sector is your thing, there is the iShares (Barclays) MSCI Austrian Index fund (EWO ). Someone interested in the healthcare sector might buy into Vanguard’s Health Care Viper (VHT ) and Merrill Lynch’s HOLDRs (IIH0 ) could be the instrument for a potential investor in the internet infrastructure sector.

Popular ETFs have nicknames like cubes (QQQQ), vipers (VIPERs) and diamonds (DIAs). All funds are ‘passively managed ‘ which means that investors pay much less management fees than say for mutual funds.

Some Popular Exchange-Traded Funds

SPDRs , usually referred to as Spiders. allow an investor own shares in the famous S&P (Standard & Poor’s ) 500. This is the ‘benchmark’ index of the 500 most widely held and traded stocks on the New York Stock Exchange. Buying Spiders allows an individual trader to invest in a selection of these stocks, according to personal preference, choosing groups such as Technology, Financials, Healthcare, Industrials, Energy, Materials, Utilities, Consumer Staples and more.

QQQQs are known as Cubes. This is an ETF which tracks stocks represented on the Nasdaq-100 Index, the 100 largest and most actively traded non-financial stocks on the Nasdaq. Cubes offer broad exposure to the long term prospects of the technical sector. If one tech company falls short of projected earnings, its shares may be hit hard, but the sector’s performance as a whole may absorb this.

iShares is Barclays ‘ ETF (Barclay’s Global Investors or BGI). There are over 120 iShares trading on ten or more stock exchanges. Barclays has introduced technology-oriented iShares that follow the Goldman Sachs indexes. These ETFs trade on the AMEX.

DIAMONDs (DIA ) are Diamonds Trust Series I, and track the Dow Jones Industrial Average (DJIA ). This fund is structured as a unit investment trust which trades on the AMEX.

There are of course many more US, UK, Europe and other regions with Exchange-Traded Funds open to the private investor and the whole topic of ETFs needs to be studied and understood.