Everything You Need To Know About ConocoPhillips Q3 Earnings Results ConocoPhillips (NYSE COP)

Post on: 11 Май, 2015 No Comment

Summary

- ConocoPhillips Released its third quarter earnings this morning.

- The company saw EPS rise on a GAAP basis, but that isn’t the whole story.

- See the company’s future growth potential and if shareholders can really expect a 10%+ CAGR going forward.

ConocoPhillips (NYSE:COP ) is a large internationally diversified oil corporation with a market cap of $87 billion. When I last analyzed ConocoPhillips I liked their 6% to 10% growth projections from efficiency gains (3% to 5%) and volume growth (3% to 5%). The company hit strong 6% volume growth in the second quarter of 2014. Will ConocoPhillips have a repeat performance or is it stuck in tar? The company’s 3rd quarter results are examined below.

Author’s note: This article includes a few oil specific terms which are described here. MMBOED stands for Million Barrels Oil Equivalent per Day and MBOED stands for Thousand Barrels Oil Equivalent per Day. MMBOED and MBOED allows for the production of both oil and gas to be compared without volatile prices distorting analysis. The term turnaround is used as well and does not mean what a normal business turnaround means. In this article, the term turnaround means temporary shutdowns of production due to inspections, testing, revamps, or other projects.

Third Quarter Results

ConocoPhillips delivered on its volume growth goal for the 3rd quarter of 2014. The company increased volume 4% versus the same quarter a year ago. ConocoPhillips saw adjusted EPS fall from $1.47 in the third quarter of 2013 to $1.29 per share for the third quarter of 2014. The company’s EPS fell due to lower oil prices and higher operating costs. ConocoPhillips saw higher downtime than the same quarter a year ago in its operations. The company has not delivered on its goal of efficiency gains in the third quarter of 2014. This doesn’t mean the company’s future growth is in question, but there is significant room for improvement in operations that management is targeting which has not been fulfilled.

On an unadjusted basis EPS grew from $2.00 per share in the third quarter of 2013 to $2.17 per share in the 3rd quarter of 2014. Generally, adjusted EPS paints a more accurate picture of company growth as it better tracks underlying business results and excludes special events. ConocoPhillips unadjusted EPS growth comes primarily from the sale of its Nigerian Business. ConocoPhillips is a global company and operates around the world. The company’s most important operations over several locations are analyzed below.

North American Operations

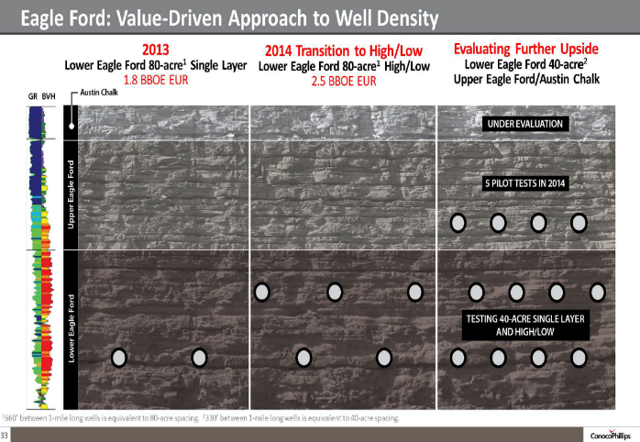

The company’s operations in the lower 48 US states were positive in the most recent quarter. The company’s assets in the Eagle Ford and Bakken fields increased 33% versus the same quarter a year ago. Much of ConocoPhillips growth is centered around North American oil and gas plays, both conventional and unconventional.

In Canada, volume was flat for ConocoPhillips. The company is expected to ramp up Foster Creek volume after finding first oil in September. ConocoPhillips saw production decline about 13% in Alaska as downtime increased due to turnarounds in the Prudhoe Bay field.

Europe

ConocoPhillips production Europe increased 10% from 176 MBOED (Million Barrels Oil Equivalent Per Day) in the third quarter a year ago to 194 MBOED for the third quarter of 2014. The company has significant operations in and around the North Sea in Europe.

Asia Pacific & The Middle East

ConocoPhillips saw production decline from 317 MBOED in the third quarter of 2013 to 301 MBOED in the third quarter of 2014 for its Asia Pacific & Middle East operations. The company credits major turnarounds in and around Australia for the volume declines. The company has several new projects in Australia and Malaysia expected to come on line within the next 12 months that will help drive volume growth going forward.

Outlook & Future Growth Prospects

ConocoPhillips management says it is on track to deliver 3% to 5% production growth coupled with margin growth. The company has certainly managed to put itself in position to hit its production growth goals. ConocoPhillips saw margins decline this quarter. This is to be expected as oil prices decline. What is not to be expected is the increase in downtime and lower efficiency in general. Going forward, I believe ConocoPhillips will hit its expected 3% to 5% production growth. I think they will see only modest efficiency gains of 0% to 2% per year going forward as management does not have an excellent record of fast growth. ConocoPhillips has only grown revenue per share at about 3.7% per year over the last decade.

In total, shareholders can expect a strong CAGR of 8% to 12% over the next several years from dividends (

4%), share count reductions from share repurchases (1%), production growth (3% to 5%), and efficiency gains (0% to 2%). The company’s strong CAGR and high current yield should appeal to investors looking for growth and income.

Valuation

Over the last 5 years, ConocoPhillips has traded at a discount of around 0.6x the S&P500’s PE ratio. The S&P500 currently has a PE ratio of close to 19, implying a fair PE multiple for ConocoPhillips of about 11.5. The company currently trades at a PE multiple of 13.1. Despite this, I don’t believe ConocoPhillips to be significantly overvalued as its strong projected CAGR and future production growth should give it a higher PE multiple than its history suggests.

Final Thoughts

ConocoPhillips has only an average rank based on The 8 Rules of Dividend Investing. This is because of ConocoPhillips unimpressive historical revenue per share growth rate and relatively high stock price volatility. The company’s stock has a price volatility of about 30%, which is high for an individual stocks (especially a dividend paying company). The company’s stock price volatility is likely due to its earnings exposure to volatile oil prices. If the company is able to grow revenue per share at 6% per year (which is the high end of production growth + share repurchases), it would rank in the Top 35 based on The 8 Rules of Dividend Investing. All in all, ConocoPhillips’ high dividend yield and future growth prospects should appeal to investors who are looking for current income and potential growth in the future.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.