Evaluating Stocks using Dividend Discount Model

Post on: 16 Март, 2015 No Comment

Dividend discount model is a widely accepted financial tool used to evaluate stocks based on the net present value of the future dividends. It works by analyzing and making assumptions related to growth in dividends and interest rates. Its a tool that is heavily based on speculation but what sets it apart from other financial tools is its ability to compare specific numbers based on the given data with accuracy.

Dividend discount model can only be applied to stocks that pay dividends. Dividends are portion of earnings that a company decides to give out as cash or stock to its shareholders. Companies that offer dividends, like Microsoft, are usually very stable and secure and have financial strength to continue paying dividends.

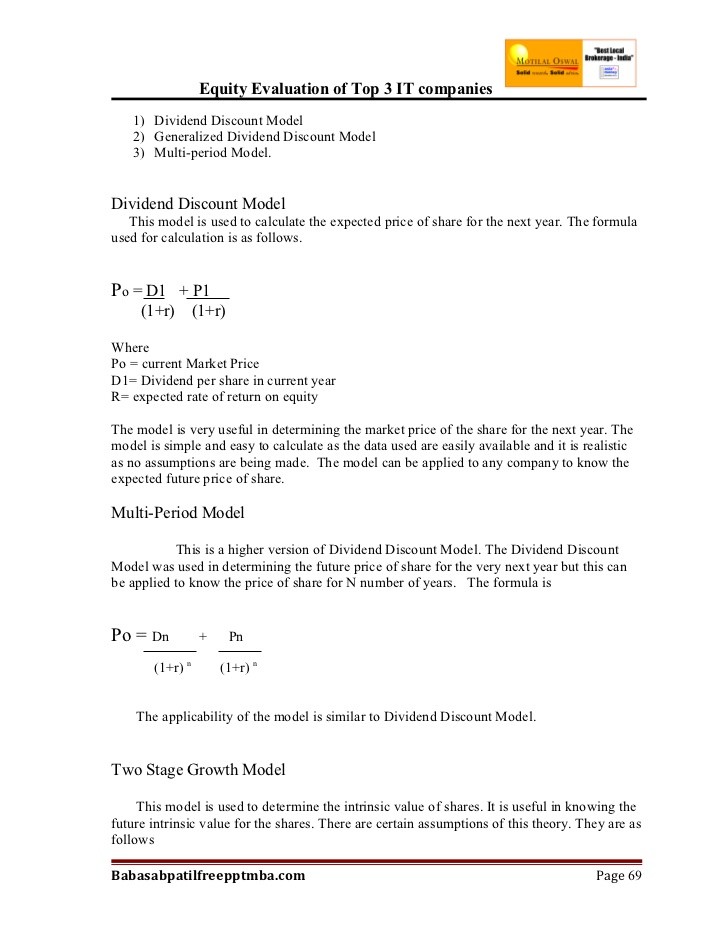

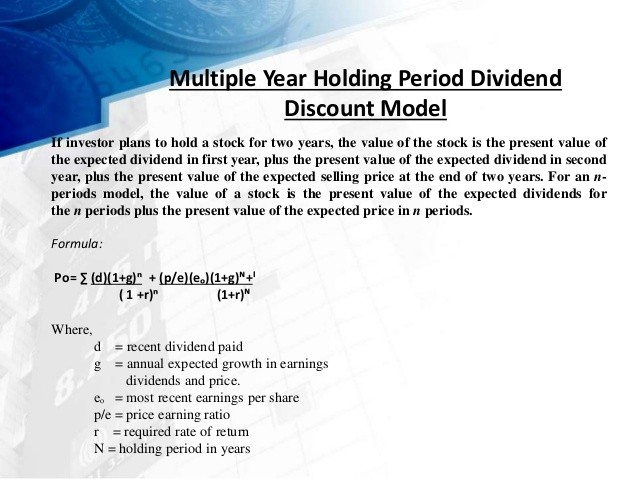

Dividend discount model can also help investors decide if the future growth in dividends is worth the investment today. The concept of time value of money is crucial in calculations related to dividend discount model. Future growth in dividend payments is discounted to present value of the stock to see if the stock is undervalued or overvalued. Basic dividend discount model formula states that:

There are no two stocks alike so dividend discount model is available both for companies where growth is imminent and companies with no growth. No growth dividend discount model assumes that a company will pay the same amount of dividend until infinity. Constant growth dividend discount model assumes that the company will grow and so the dividends will also grow.

No growth dividend discount model dictates the formula:

Where P is the current price, Div is the dividend the company currently pays and r is the discount rate. Formula for constant growth dividend discount model is:

g is the growth rate which is assumed in most cases.

Lets say that a company is paying $.60 in dividends and the required rate of return in other securities is equal to 6%. Looking at other growth stocks, assume 2% growth rate.

Using dividend discount model, we just figured out the current price of the stock which is $15. Now lets say that the stock is currently selling for $12, which makes the stock undervalued. If the stock were to be $18, we can assume that it is overvalued.

Its a good idea to buy a stock that is undervalued because the amount of future cash flows it is able to generate. Using dividend discount model, it is very easy to identify growth or income stocks that can prove to be profitable if the investment is made in the present.

On the other hand, one has to keep in mind that dividend discount model is highly speculative and is based on variety of assumptions. In theory it is one of the best financial tools available to investors but in the real world it is better to use wide range of tools to evaluate stocks.

In future if I am trying to make a decision and evaluating stocks, I will definitely use dividend discount model to identify undervalued stocks. Risk in stock market will always be there but financial tools like dividend discount model help us make an intelligent decision based on the information provided to us.