Euronav New Kid In Town Becoming Analysts Best Pick Among Crude Tanker Plays Euronav (NYSE EURN)

Post on: 17 Апрель, 2015 No Comment

Summary

- Belgian oil tanker company Euronav completed its IPO on New York Stock Exchange few weeks ago and has since become a favorite pick among US investment bankers.

- The company operates and owns 53 crude tankers — one of the largest fleets in the world — made a timely strategic investment in early 2014.

- Analysts predict a target price range of $15.5-$18 in 12 months.

- Independent shipping consultancy Drewry warns the good times would be short because the excellent return on investment has led to a deluge of new vessel orders.

Three US investment banks are betting big on a Belgian crude tanker company just listed on the New York Stock Exchange less than a month ago. Euronav (NYSE: EURN ) owns and operates the sixth largest VLCC fleet in the world. I have published a PRO article on this company about a week ago suggesting that this could be a high flyer in 2015 because of the company’s timely strategic investments. I predicted an upside potential of 30% to around $15 in 12 months.

Source: Clarksons

Favorable consensus from leading analysts

The three firms gave the new comer favorable coverage with Morgan Stanley (NYSE: MS ) naming Euronav their top pick among shipping stocks operating in crude oil transports with a target price of $15.5. The most aggressive target price was $18 by Deutsche Bank (NYSE: DB ). Credit Suisse (NYSE: CS ) has also pinpointed Euronav as the strongest crude oil stock after the company reported a loss of $3.9 million or $0.03 per share in the latest quarterly earnings last week. The reasons the analysts gave included strong cargo demand, lower bunker fuel costs, marginal growth in vessel supply and a favorable market price structure known as contango.

Euronav delivered a stellar Q4/2014 earnings report with $67.6 million EBITDA — more than three times of $20.7 million recorded a year ago. Despite the timely addition of 19 VLCC and a substantial upswing in spot market rates in 2014, the company reported a loss of $45.8 million for the entire financial year — about half of the losses recorded in 2013. The company has reported consecutive yearly losses since 2011 because of the persistent imbalance in global demand and supply in the crude tanker market.

Promising corporate earnings in 2015

At the company’s earnings call, the management was confident they would have a bumper harvest in 2015. Besides increasing floating storage requests from oil traders, a fast roll out by China to increase its Strategic Petroleum Reserve would increase the eastbound ton-mile demand tremendously. A Norwegian shipping investment bank RS Platou Markets estimated that the average day rate of VLCC in 2015 could reach $40,000 whereas the UK-based maritime consultancy Lloyd’s List said VLCC spot rates could go up to as much as $90,000. Consequently, the company has placed almost its entire fleet in the spot market where the vessels could capture the best possible rates the market could offer. In the past quarter, almost 83% of the vessel days were available at spot market rates. The remaining were at fixed or time charter rates.

Source: Euronav Q4/2014 earnings presentation

Euronav profited from rising asset prices

There are two recent developments in the dirty tanker industry investors must take note. First, owing to the increased tanker rates across the board, the return on investment in new or pre-owned tankers has jumped considerably. According to US-based McQuilling Research Services, the asset price of a 10-year old VLCC has increased by 21.2% in the past 12 months. Given the prevailing spot rates, the Internal Rate of Return was over 44% — an extremely high yield by any standard regardless of asset class.

When Euronav announced the deal to acquire 15 VLCC at $980 million from Maersk Tankers in early January 2014, the average vessel price is $65.3 million. The average fleet was about 4 year old. As of today, the asset prices have increased to over $80 million per vessel. The timely acquisition at the trough of the market has enabled Euronav to make an unrealized profit of $220 million on its ledger. The four newer VLCC that the company acquired from Maersk Tankers last September cost much more (average $85 million) and hence had no significant capital gain.

Source: Euronav Q4 Earnings Presentation

Newbuilds threaten to spoil the party in 2016

Whenever any investment vehicle offers a return exceeding 40%, it can hardly escape the attention of shrewd investors, particularly at a time when costs of borrowing are so low. The lucrative opportunities currently available in the crude tanker market have already drawn the attention of Euronav’s peers and other investors. According to British maritime consultancy Drewry, 2014 saw a meager 0.6% growth in the global fleet size. The sudden surge in cargo demand in late 2014 drove up the spot market rates rapidly. The Drewry’s Tanker Earnings Index rose to 323.5 — the highest since 2009.

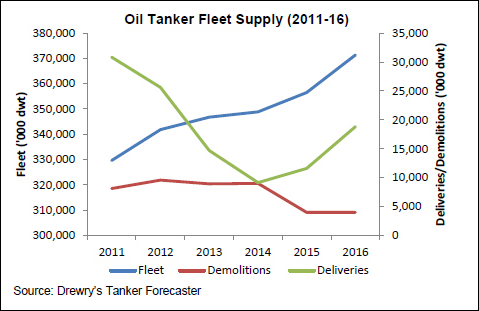

The long awaited turnaround in the tanker industry has prompted a deluge of new vessel orders at the shipyards. The firm noted that capacity expansion has been gathering momentum in recent months and forecast the total deadweight (dwt) would climb to 371 million in 2016.

Source: Drewry (9 February 2015)

The estimated annual growth in that year would be over 4%. The tanker lead analyst at Drewry, Rajesh Verma said the rapid increase in new orders would quickly upset the hard-earned demand-supply balance and could spoil the party in two years.

Notwithstanding the recent spike in demand, the primary driver of freight rate and earnings recovery in tanker shipping has been the decline in fleet growth. If current ordering persists, it will prove the sector’s ruin.

However, Verma confirmed the industry’s short-term positive outlook.

With bunker prices projected to remain low we expect tanker operators to make the most of a buoyant market, for the moment at least.

Set a target price and time your exit

The stock’s share price closed at $12.12 last Wednesday. Barring unforeseen circumstances, the rising operating income would translate into decent dividend and price appreciation in 2015. Nonetheless, investors must take note of the highly cyclical nature of this business. When future earnings look too good to be true, the good times would be short too. When the new vessels join the market gradually in 2016 and thereafter, the market would surely go through the boom and bust cycle once again. Make sure to take profits when the stock price reaches the upside target range of $15.5 — $18 as recommended by the analysts. Be contented with a 30% capital gain before the party is over.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.