ETNs are Not ETFs

Post on: 12 Май, 2015 No Comment

Asset Class ETFs News:

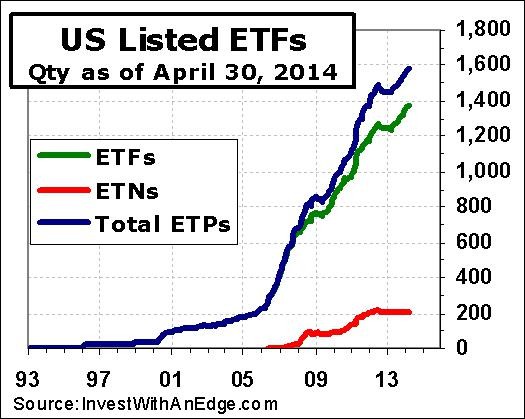

Investors are becoming increasingly familiar with the exchange traded fund investment tool, adding various fund products to bolster their portfolios. Meanwhile, the rapid growth of exchange traded notes has mirrored the wider acceptance of ETFs, but the two should not be used interchangeably.

ETNs, like ETFs, are comprised of a portfolio of bonds, stocks or other securities and can be traded throughout regular market hours. Some financial service firms are even promoting ETNs as a more tax-efficient way to allocate into alternative assets, like futures and commodities, reports Penelope Wang for CNNMoney .

Because they look similar to ETFs, many investors probably own ETNs without realizing the difference, Matt Hougan, editor of IndexUniverse.com, said in the article.

However, ETNs are not ETFs and they come with risks that you might not know about:

- Debt Instruments. When you purchase an ETN, you are actually investing in an unsecured debt obligation, which is reliant on the stability or credit risk of the sponsor, or issuing bank Lehman Brother ETN holders are not too happy. Additionally, since ETNs are not registered under the 1940s investment act, investors do not get the added safeties found in ETFs, like standardized disclosures or a board of directors that have the shareholders backs. [What is an ETF? — Part 12: Exchange Traded Notes ]

- Hidden Fees. ETNs may issue expenses differently or levy more charges on top of their stated expense ratios. ETN fees can be extremely hard to find and calculate, Morningstar ETF analyst Samuel Lee noted. [Morningstar Warns on ETN Fees ]

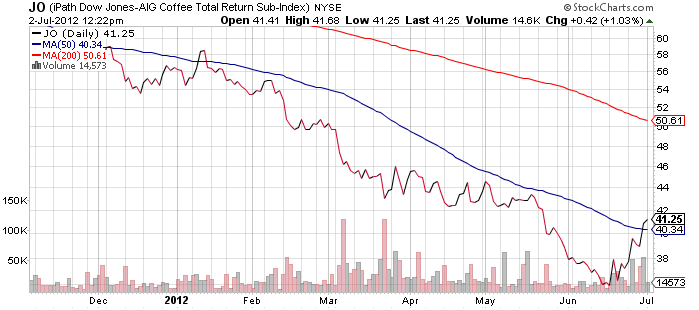

- Potentially Nasty Surprises. The VelocityShares Daily 2x VIX Short-Term ETN (NYSEArca: TVIX ) saw its share price plunge 60% in just a few days. The ETN was designed to offer a leveraged daily performance to that of the VIX; however, the issuer stopped creating shares, essentially letting the the fund act like a closed-end fund and trade at a steep premium to its indicative net asset value.

For more information on exchange traded notes, visit our ETNs category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.