ETN Credit Risk May Outweigh Benefits For Some

Post on: 11 Май, 2015 No Comment

Exchange-traded notes (ETNs) are similar to exchange-traded funds (ETFs) in that they trade daily on stock exchanges and track the performance of an underlying index (less fees). But one major difference in owning ETNs as compared to ETFs is the risk of default, particularly during economic downturns. For many investors, this sizable risk might overshadow the many benefits that ETNs provide, such as lower taxes and lack of tracking error. Read on to learn more about the default risk associated with ETNs in a bear market and what kind of risk tolerance you will need to invest in these securities.

Differences

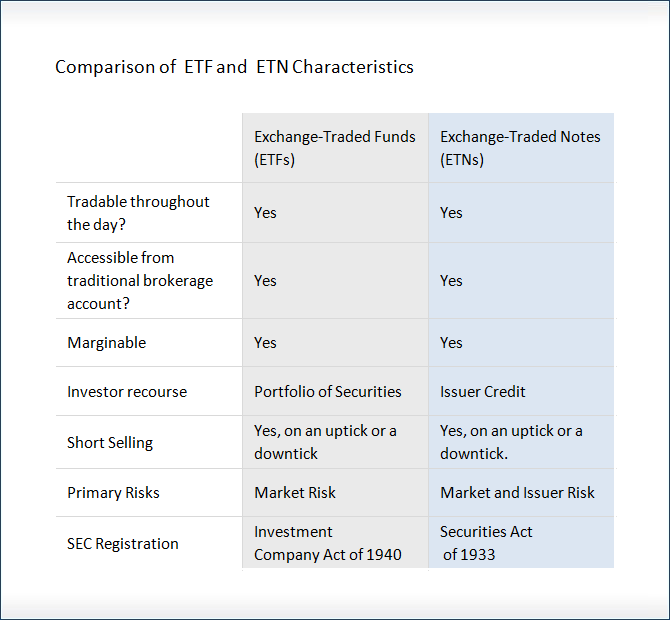

ETNs differ from ETFs in the following four ways:

1. ETNs are structured as unsecured debt. Investors are effectively lending money to the provider in exchange for the commitment to provide a return tied to an index. ETFs and mutual funds hold baskets of stocks or other securities in trust with a custodian.

2. ETNs closely follow their underlying indexes (no tracking error ) while ETFs may not always follow their indexes (tracking error). The ETN provider commits to paying the index return (less fees), whereas ETFs may diverge from the indexes they track due to constraints in managing the underlying baskets of securities.

3. ETNs claim tax advantages. ETFs and mutual funds distribute taxable income and short-term capital gains annually. ETNs are defined as prepaid contracts and investors pay tax only on capital gains received at time of sale. However, as of the fall of 2008, the Internal Revenue Service (IRS) had not issued a final ruling on the taxation of ETNs.

4. ETNs may be the only option available for investors who want exposure to a given market or asset. Their zero tracking error may also have appeal if the ETF covering a market has an unacceptable tracking error. (For more on the differences between ETNs and ETFs, check out Exchange Traded Notes — An Alternative To ETFs .)

As of 2008, there were close to 100 ETNs available to investors. Assets under management were more than $6 billion, compared to $600 billion for ETFs. Barclays PLC (ADR) (NYSE:BCS ) pioneered ETNs in 2006, and according to Morningstar, a leading fund information company, Barclays’ funds claimed the top three positions in terms of assets in 2008: the iPath Dow Jones-AIG Commodity (NYSE:DJP ) ($3.2 billion), iPath MSCIIndia Index (NYSE:INP ) ($694 million), and iPath DJ AIG Livestock (NYSE:COW ) ($327 million) funds.

ETNs and Credit Risk

ETNs offer many advantages, notably absence of tracking error, lower taxes and coverage of markets where no other coverage exists or coverage is inadequate. However, for investors who are concerned about safety of principal, these benefits may be outweighed by the fact ETNs are debt obligations and investors can lose all or most of their investment if the provider goes bankrupt.

Most ETN issuers are large financial institutions with investment-grade credit ratings, so the risk of default is normally negligible. But during the credit crisis of 2008, the risk became quite elevated. In fact, the worst-case scenario unfolded when Lehman Brothers collapsed and its line of Opta ETNs was delisted from the stock exchange. Investors may receive only pennies on the dollar once bankruptcy trustees disburse the dealer’s assets. (For more on the credit crisis, see the Financial Crisis Survival Guide .)

Other providers avoided Lehman Brothers’ fate but still had periods during which their solvency was questioned, causing their ETNs to plunge in price as investors rushed for the exits. Prices rebounded after the fears subsided, but investors who sold during the plunge realized significant capital losses. (As soon as you invest in a company, you face this risk. Find out what it means in An Overview Of Corporate Bankruptcy .)

ETF investors have no credit risk because they own a pro rata interest in a basket of securities held in trust ; these are legally separate from the assets of the provider. If the ETF provider goes bankrupt, the basket of securities will be returned to investors, not creditors.

ETNs Worth Buying?

When the financial sector is functioning normally, credit risk will be less of a concern.

Moreover, investors can minimize default risk by checking the creditworthiness of providers before buying. Conservative investors will want to make sure to buy from providers with credit ratings near the top of the investment-grade category. The websites of many providers display the scores assigned by rating agencies to their long-term debt. (Read about the debate over the value of these ratings agencies in The Debt Ratings Debate .)

Conclusion

The risk of default associated with ETNs is a major drawback, especially during times of financial turmoil. For investors who attach a high priority to return of capital. this risk may outweigh the benefits of zero tracking error, lower taxes (pending IRS ruling) and coverage of markets where none exists or coverage is inadequate. Risk tolerant investors may still be interested in ETNs, particularly when an ETN is the only option for gaining access to a market or asset classes. Furthermore, investors can lower their risk by investing in ETNs from the most creditworthy of providers.

For a wide view on these types of products, check out Understanding Structured Products .