Etfs vs Mutual Funds And the Winner Is

Post on: 3 Июнь, 2015 No Comment

In its most simple terms, ETFs are very inexpensive mutual funds. They have exploded in popularity especially commission free Exchange Traded Funds. Does that mean you should invest in ETFs and forget about mutual funds? Not so fast.

What Is An ETF?

ETFs are quasi-index funds and as I said they are extremely inexpensive. An index fund just buys the stocks that are held in an index and doesn’t do much trading. That’s one reason why the costs are so low. They are almost identical to index funds. The main difference between an index fund and an ETF (exchange traded fund) is that the ETF trades like a stock.

You can buy an ETF during the day and know what price you’ll pay for it before you buy it unlike a mutual fund or index fund. You can sell it short and you can use limit orders to protect your investments. Oh…and one more thing…ETFs are typically even less expensive than index funds. Ohand one more, one more thing. Because the ETF managers trade so infrequently, investors have less potential exposure to capital gains tax.

With so much going for ETFs, why would anyone want to buy a mutual fund? There is really only one reason..Performance.

ETF Performance Issues

There are a few concerns I have about ETF performance. First, some experts suggest that the performance of the biggest ETFs is going to suffer because as more and more people shovel their money towards the largest ETFs it concentrates investment dollars in fewer and fewer places. And as money gets more concentrated, the investments are subject to greater volatility.

Keep in mind that if you (and everyone else) buy the ETF that owns all 500 stocks that are part of the S&P 500 you ignore the other 8,000 companies that are available. So the success of the ETF is the very thing that may hurt them going forward.

You could buy smaller, more esoteric ETFs to increase diversification. But you have to consider that smaller funds have less liquidity and possibly higher spreads between the buy and sell prices. If that’s the case, you’re right back where you started. High volatility (and possibly higher costs because of this price spread).

And this isnt the only performance concern. An index fund or ETF will often mimic the performance of its underlying broad market index. Thats great if the market is headed up. But if the market drops 30% your ETF might do the same thing. Sometimes its nice to have a defensive investment strategy too and most ETFs dont provide that.

Also, while indexes often beat most actively managed funds, they dont beat all of them . As a result, by excluding mutual funds from your universe of potential investments you unnecessarily limit your options. There is no good reason to do this.

The solution?

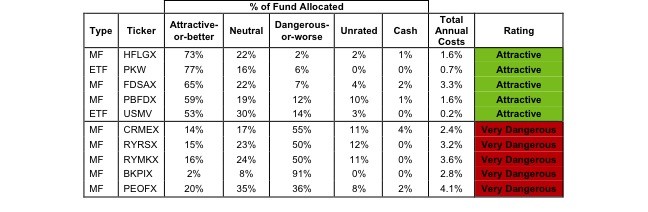

If you are a buy and hold investor, ETFs can be a good option. Im the first one to admit it. But if you buy funds based on performance, your selection method will tell you what to do. For example, one investment strategy I’ve written about before evaluates mutual funds and compares them to ETFs. It then ranks funds and ETFs by performance and buys the strongest of the lot. If (as people argue) ETFs perform better because their expenses are lower, you’d expect the ETFs to hold all the top spots. Right?

Well…they don’t. Sometimes they are in the top, but often they are not. That’s because while most funds don’t outperform the indexes, some do. Bottom line? The most important determinant of your investment success is your investment strategy not low cost. If you have a system that only buys top-performing funds and then rebalances your portfolio periodically, you’ll buy ETFs when they are doing well and you’ll ignore them when they aren’t.

Performance is reported net of all fees. This argument of only buying the cheapest funds can actually be very expensive because it completely ignores funds that might be doing far better. By doing so, you might give up a dollar to save a nickel. Yuk.

Given the direction that investors’ dollars are flowing, it makes even more sense to consider performance, cost and volatility rather than just cost.

How do you side on the mutual funds vs. ETFs argument?