ETFs vs Indexes Is an Index Better than an ETF Index vs ETF

Post on: 11 Май, 2015 No Comment

Are ETFs Better than Indexes?

You can opt-out at any time.

Please refer to our privacy policy for contact information.

I write a lot of articles about ETFs vs. mutual funds. but how does an ETF stack up against an index. As we know, a lot of ETFs are designed to track an index, but are you better off buying an index basket or the exchange traded fund?

I’m here to help. Every investing situation is different and a lot of factors can affect your trading strategy. However, if you’re armed with the facts, you have the best chance of making the right decision.

Why You Should Consider Buying an Index Basket

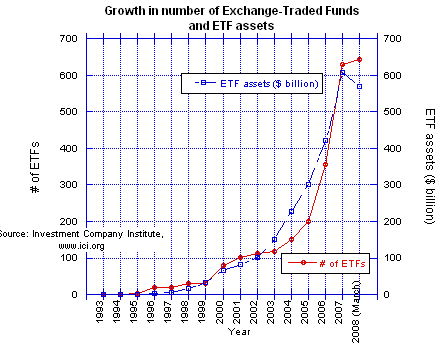

Liquidity. Certain indexes are tracked by multiple ETFs. In fact, there are more ETFs than indexes. And most indexes have multiple ETF followers. Why? Because indexes are more popular (for now). They have more investors and traders watching their every move. Therefore they are more liquid and sometime easier to trade.

Not that there aren’t ETFs that are just as popular or liquid. But since there are multiple ETFs tracking an index, some of those funds just won’t be popular or liquid. Call it survival of the fittest or supply and demand, but the bottom line is that ETFs open with high expectations and sometimes don’t make it through the year.

Control & Flexibility. When you purchase an ETF, you buy a pre-packaged asset that combines proportions of equities and sometimes derivatives to track an index. You get whatever is in the ETF. You can’t trade in and out of stocks as you please.

With an index basket you can. If you’d like to tweak your basket to skew to a certain company or sector, you have that ability. And while this may affect your basket price as well as annoy your clearing firm, it can be done. You can customize your basket if need be, not your ETF. This flexibility and control is a nice feature for traders to utilize in their portfolios and one I’ve used myself.

Tracking Error. This is more of a ETF disadvantage than an index advantage, but it’s one worth mentioning. ETFs have been accused of large tracking errors, especially commodity ETFs. However, with a basket there’s not truly a tracking error since an index is a benchmark that represents a sector or market. However, there are some that can argue an index isn’t truly representative either at times (and they wouldn’t be wrong).

Why You Should Consider Buying an ETF

Lower Transaction Costs. When you buy an index you have to fill a basket with multiple trades…and multiple commissions. When you buy an ETF, it’s one trade and one commission. So an ETF can really help save you money when it comes to investing fees .

Pricing. Simply said it’s easier to hit a target price with an ETF. If you buy an ETF. it’s one trade, one price. This includes market orders (depending on the spread). However, attaining an index price is not such an easy feat, even with market orders. You are at the mercy of multiple specialists and markets, since you are buying multiple stocks. And if you’re using limit orders, you may have to wait a while to finally fill your basket.

Taxes. It’s no secret that ETFs have a huge tax advantage over other investments like mutual funds, and indexes are no exception. When you make any profitable trade while buying or selling the securities in an index basket, you’re going to have to pay Uncle Sam for all of those capital gains. And they go on record as soon as you make them, whether you fill your basket or not.

With an ETF, the capital gain taxes are only in effect when you buy or sell the entire ETF. Since an ETF is one asset, the gains on the securities in the fund only count when the ETF transaction is made, unlike mutual funds or indexes.

Inverse ETFs. If you’re bearish on a certain index, shorting multiple stocks may cause havoc with your margins and your clearing firm. However, inverse ETFs allow you to create a short position without actually selling any shares. With inverse funds, you are actually buying an asset.

Selection. As we said, there are multiple ETFs that track an index, so you have the advantage of selection. If there are two or more funds that track the same index, you can choose which ETF is the best fit for your investing strategy. It’s nice to have options.

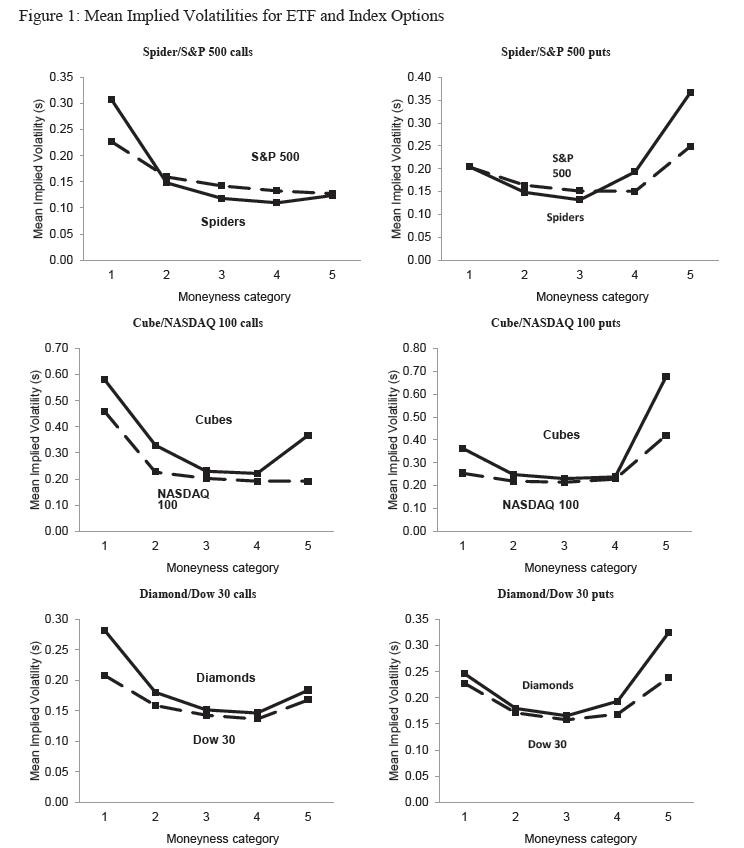

Options. Speaking of options, this last benefit is more of an ETF advantage than an index disadvantage, but another one worth discussing.

In some cases, hedging index options with a correlating ETF might work better than using the index itself. This is an advanced trading strategy and one that might create clearing firm issues, but if utilized correctly, may help you create a hedged position faster and with better target pricing than using the underlying index. And as we know, speed and price are big concerns when day-trading. However, I stress the importance of thoroughly researching this strategy before actually utilizing it, it’s not for the meek.

So is an index better than an ETF (or vice versa)? I know you hate when I say this, but…there is no clear cut answer. It really depends on the situation. However, the above reasons can really impact your decision and hopefully help you make the right one.