ETFs The Of Sector Rotation

Post on: 10 Май, 2015 No Comment

This article is part of a regular series of thought leadership pieces from some of the more influential ETF asset managers in the money management industry. Today’s article is by Hafeez Esmail, San Francisco-based Main Management’s director of compliance.

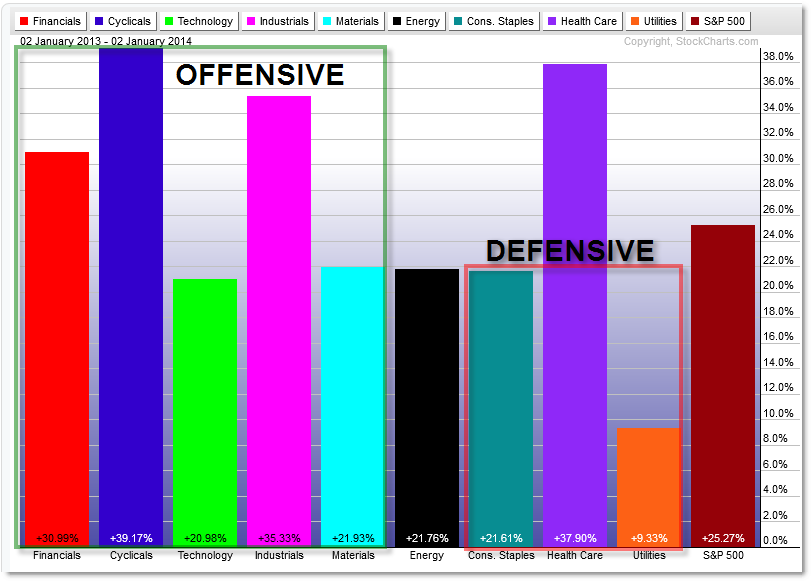

In investment management circles, it’s a well-known adage that it’s better to own the worst stock in the best-performing sector than the best stock in the worst-performing sector. In most cases, this holds true, and it underscores the fact that identifying the correct segment of the market at the right point in the investment cycle is of critical importance.

Prior to the advent and proliferation of ETFs, sector rotation strategies were populated using single stocks. Executing the strategy with individual positions was challenging, as you have to get two decisions right:

- Correctly identify the right sector Select the right handful of stocks that best replicate the capital-weighted performance of that particular GIC sector

Given that the challenge involved mastering multiple disciplines, there were precious few managers that could consistently execute on both fronts.

ETFs Make It Easier

The onset of ETFs did simplify the process in that pinpointing the right sector was the key exercise. State Street was first to market with the S&P GICS Sectors, all of which currently have sizable trading volumes. iShares and Vanguard have built out sector suites as well, expanding the tool kit beyond U.S. markets.

However, there are some new wrinkles to consider. First Trust has a proprietary methodology—incorporating fundamental factors—to construct sector ETFs, many of which have outperformed the standard capital-weighted GICS sectors.

Moreover, there are technology subsectors such as software or semiconductors, and health care subsectors such as biotechnology. All of these fund sponsors have ETFs with deep and liquid trading, and provide an efficient way to overweight particular segments of a given sector that may have greater price appreciation than the overall sector.

ETF asset managers are essentially active managers of passive index ETFs. The goal of each is to generate outperformance over a given benchmark. For sector rotation strategies predominantly focused on U.S. large-cap stocks, the benchmark that most managers seek to outperform is the S&P 500 Index.