ETFs Seek Room in Your 401(k)

Post on: 13 Сентябрь, 2015 No Comment

They are pushing hard for coveted space, but mutual funds aren’t welcoming them

Exchange-traded funds seem to be everywhere these days. But as the industry seeks to maintain its rapid growth, there is one area where the products are struggling to make headway — 401(k) retirement plans.

ETF providers have been waging an uphill battle to persuade the biggest retirement-plan sponsors and administrators to offer their products. Access would provide the ETF industry with a huge new pool of investor money to tap and a steady stream of profits.

The Journal Report

The 401(k) market helped boost the profile and earnings of mutual-fund companies, and some say it could provide the same ride for ETFs — if only someone would hand them a ticket.

What is holding them back? ETF providers blame mutual-fund companies, some which run some of the biggest 401(k) plans, saying their resistance stems from fear of competition. ETFs in general charge lower fees than average mutual funds.

Mutual-fund purveyors see it differently. They say that they already offer plenty of low-cost mutual funds that track stock- and bond-market indexes as most ETFs do, and that some of the most heavily touted features of ETFs, such as tax efficiency and flexible intraday trading, offer few advantages in 401(k) plans, which already are tax-advantaged and geared toward long-term investing.

We’ve had virtually no demand from our plan sponsors for ETFs, says Jennifer Eng le, a spokeswoman at mutual-fund giant Fidelity Investments, which runs about $750 billion in 401(k) accounts. Clients are satisfied with the array of low-cost index mutual funds currently available, she says.

The logistics of offering ETFs also complicate things: ETFs can be bought and sold on exchanges like stocks, but most 401(k) programs aren’t set up to process the trades. And because they trade like stocks, ETFs charge commissions — costs that can diminish the returns of workers who make small, regular contributions to their retirement accounts.

It’s an extremely large and embedded process that they’re trying to crack through, [and] getting into those plans is very cumbersome, says Scott Ebner, senior vice president of the ETF Marketplace at the American Stock Exchange, which lists hundreds of ETFs.

While plan sponsors are thinking about offering ETFs, they move pretty slowly, and don’t make changes that are this fundamental overnight, says David Wray, president of the Profit Sharing/401(k) Council of America, a nonprofit association of companies and retirement-plan participants.

Seeking Traction

The 401(k) angle has been a hot topic at recent ETF conferences; a presentation at an industry gathering this summer, for example, was dubbed ETFs and 401K Plans/Retirement Plans: The Pot at the End of the Rainbow?

To gain a foothold, many ETF providers are either building computerized platforms to support trading of ETFs within 401(k) plans or forming partnerships with companies that are. Some firms are devising solutions to minimize ETF trading commissions — aggregating trades across investor portfolios, for example, to limit the role of stockbrokers and other middlemen.

Because mutual-fund giants such as Fidelity and others generally dominate 401(k) administration at the nation’s biggest companies, ETF providers are taking aim at retirement plans at small to midsize firms, where employees sometimes have more expensive or less efficient investment choices. You can be a hero in such markets, BenefitStreet Inc. a retirement-plan platform maker, says in a marketing presentation. BenefitStreet’s ETF partners include Barclays Global Investors, or BGI, a unit of Britain’s Barclays PLC.

It’s on the agenda in nearly every provider meeting that advisers and retirement-plan record-keepers want to be able to use ETFs for 401(k) portfolios, says Robert Nestor, head of new-business strategy at BGI.

Named after a section of the 1978 Internal Revenue Code, 401(k) plans let investors set aside income for retirement, while deferring taxes on both the contributions and investment earnings until the money is withdrawn. Employers often match workers’ contributions, which helps savings grow faster. The plans held an estimated $2.7 trillion at the end of 2006, representing about 17% of the overall U.S. retirement market, according to the Investment Company Institute, a mutual-fund industry trade group. (About half of retirement money is held in defined-contribution plans, which include 401(k)s, and in individual retirement accounts, according to the ICI. The other half is in government pension and private-sector defined-benefit plans, as well as annuities.)

Funds Scorecard

Mutual-funds performance for August:

Just over half of the money in 401(k) plans was invested in mutual funds as of the end of last year, ICI statistics show, followed by investments in products offered by insurance companies, banks and other institutions.

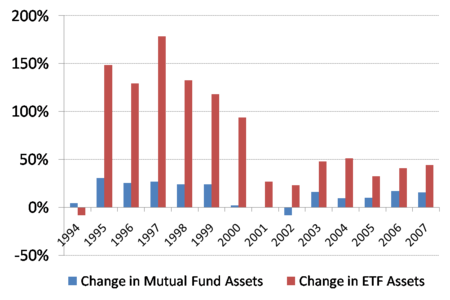

The $1.49 trillion of mutual-fund money in 401(k) accounts represented about 14% of total mutual-fund assets in the U.S. at the end of last year. While assets in ETFs have more than quintupled to about $500 billion since 2002, less than 1% of 401(k) money is estimated to be in the products.

Firms like BenefitStreet are trying to narrow that gap. The San Ramon, Calif. company, which runs about $8 billion in retirement money for more than 7,100 plans, started offering ETFs from Barclays Global Investors and others in June on a 401(k) platform it sells to client companies. Its approach involves aggregating ETF trades among, say, hundreds or thousands of employees, to diffuse commission costs. It eventually aims to send trades directly to stock exchanges, bypassing floor brokers.

Another small firm, Invest n Retire LLC in Portland, Ore. already trades directly with exchanges and has a patent pending on the method. Rather than bundle the trades, Invest n Retire processes them throughout the day with an automated system that executes them for a few cents a share. RPG Consultants of New York offers a system that places orders to brokers in bulk daily to help keep costs low.

ETF firms themselves are developing trading and administrative systems, as well as other approaches to expanding use of their products. State Street Global Advisors, a unit of State Street Corp. has a project under way to figure out the best approach to the 401(k) market for ETFs, says Jill Iacono, director of national accounts. WisdomTree Investments Inc.’s sales force is targeting retirement plans for a 401(k) platform it plans to roll out in October. The ETF provider in April created a division focused on the retirement business.

Some ETF advantages relative to mutual funds line up nicely with a push by the U.S. Labor Department and other federal agencies to improve fund and fee disclosure for individual investors, ETF providers say. The Labor Department’s Employee Benefits Security Administration was recently taking comments on the best ways to improve 401(k)-plan administrative and investment-related fee information. Because ETFs track indexes, data on their holdings are available at all times, while many mutual funds run by managers who pick stocks are required to disclose their holdings only periodically throughout the year. U.S. diversified stock ETFs, on average, charge 0.40% of assets as an annual expense, while comparable mutual funds charge 1.37%.

But even that isn’t enough to win over many employers, says Rick Meigs, president of 401khelpcenter.com LLC, a Web site providing information to sponsors of and participants in 401(k) plans. Most plans don’t see a distinct-enough advantage to them over low-cost mutual funds, which already offer a broad array of choice, he says.

One way ETFs may wind up in more 401(k) programs is through the booming category of target-date funds. These funds automatically shift to more-conservative holdings from more-aggressive ones as the investor nears retirement, the target date of the fund. The Pension Protection Act of 2006 is helping expand 401(k) default investment options to include such funds. In general, these investments are funds of funds, meaning they invest in a range of mutual funds — or ETFs — rather than individual securities.

ETFs are the underlying investments in a growing number of target-date products. Target-date funds offered by Federated Investors Inc. J.&W. Seligman & Co. and others have included broad-market ETFs such as BGI’s iShares S&P 500 or iShares MSCI EAFE.

XTF LP, a New York financial-services firm, developed target-date mutual funds this year that include ETFs. One drawback is that target-date funds may be pricier than individual ETFs since they may include fees for both the underlying funds and the manager who packages them.

Ms. Gullapalli is a staff reporter in New York for The Wall Street Journal.